Students can Download Tamil Nadu 11th Commerce Previous Year Question Paper March 2019 English Medium Pdf, Tamil Nadu 11th commerce Model Question Papers helps you to revise the complete Tamilnadu State Board New Syllabus and score more marks in your examinations.

TN State Board 11th Commerce Previous Year Question Paper March 2019 English Medium

Instructions:

- The question paper comprises of four parts.

- You are to attempt all the parts. An internal choice of questions is provided wherever applicable.

- questions of Part A, B. C and IV are to be attempted separately

- Question numbers 1 to 20 in Part A are objective type questions of one -mark each. These are to be answered by choosing the most suitable answer from the given four alternatives and writing the option code and the corresponding answer

- Question numbers 21 to 30 in Part B are two-marks questions. These are to be answered in about one or two sentences.

- Question numbers 31 to 40 in Parr C are three-marks questions, These are to be answered in about three to five short sentences.

- Question numbers 41 to 47 in Part D are five-marks questions. These are to be answered) in detail. Draw diagrams wherever necessary.

Time: 2\(\frac{1}{2}\) Hours

Maximum Marks: 90

Part – A

Choose the correct answer. Answer all the questions: [20 × 1 = 20]

Question 1.

Which one of the following comes under Non-economic Activities?

(a) Working as a Lawyer

(b) Doctor Charges Consultation Fees

(c) Fruit Seller Selling Fruits

(d) Visit to a Temple

Answer:

(d) Visit to a Temple

Question 2.

Which is the oldest form of business organisation?

(a) Co-operative Society

(b) Company

(c) Sole proprietorship

(d) Partnership

Answer:

(c) Sole proprietorship

Question 3.

…………. is the partner who neither contribute any capital nor manages the affairs of the business.

(a) Sleeping partner

(b) Nominal partner

(c) Partner by estoppel

(d) Secret partner

Answer:

(b) Nominal partner

Question 4.

The Board of Directors of a company is elected by ……………..

(a) Debenture holders

(b) Shareholders

(c) Creditors

(d) Debtors

Answer:

(b) Shareholders

![]()

Question 5.

A ………… is run on the principle of ‘one man one vote’.

(a) Partnership

(b) Government Company

(c) Joint Stock Company

(d) Co-operative Society

Answer:

(d) Co-operative Society

Question 6.

The largest commercial Bank of India:

(a) PNB

(b) RBI

(c) ICICI

(d) SBI

Answer:

(d) SBI

Question 7.

Commodities like tobacco and cotton are stored in ………………

(a) Automated warehouse

(b) General warehouse

(c) Cold storages

(d) Special commodity warehouses

Answer:

(d) Special commodity warehouses

Question 8.

Which is the fastest means of transport?

(a) Sea

(b) Air

(c) Rail

(d) Road

Answer:

(b) Air

Question 9

………….. is taken up jointly on the lives of two or more persons.

(a) Joint Life Policy

(b) Endowment Life Assurance Policy

(c) Whole Life Policy

(d) Annuity Policy

Answer:

(a) Joint Life Policy

Question 10.

Buying and selling of goods through electronic network is known as ……………….

(a) Website

(b) Trade

(c) E-commerce

(d) Internet

Answer:

(c) E-commerce

![]()

Question 11.

Ethics is important for:

(a) Non-managerial employees

(b) Top management

(c) Middle level managers

(d) All of them

Answer:

(d) All of them

Question 12.

Debenture holders are entitled to a fixed rate of …………….

(a) Interest

(b) Ratios

(c) Dividend

(d) Profits

Answer:

(a) Interest

Question 13.

MSMEs Act for Micro, Small and Medium Enterprises was enacted in the year:

(a) 2006

(b) 2008

(c) 2004

(d) 2007

Answer:

(a) 2006

Question 14

………….. is a special type of bond issued in the currency other than the home currency.

(a) Corporate Bond

(b) Investment Bond

(c) Government Bond

(d) Foreign Currency Convertible Bond

Answer:

(b) Investment Bond

Question 15.

Internal trade can be classified into ? categories.

(a) Two

(b) Five

(c) Three

Answer:

(a) Two

Question 16.

Retailers deal in quantity of goods.

(a) Medium

(b) Limited

(c) Small

(d) Large

Answer:

(c) Small

Question 17.

WTO meets almost once in every years.

(a) Five

(b) Two

(c) Four

(d) three

Answer:

(d) three

Question 18.

Exception to “stranger to a contract” is ………………

(a) Third party

(b) Promisee

(c) Legal Representative

(d) Agent

Answer:

(a) Third party

Question 19.

Income Tax is ……………..

(a) an indirect tax

(b) service tax

(c) a business tax

(d) a direct tax

Answer:

(d) a direct tax

![]()

Question 20.

In India Goods and Services Tax (GST) became effective from:

(a) 1st July, 2017

(b) 1st March, 2017

(c) 1st April, 2017

(d) 1st January, 2017

Answer:

(d) 1st January, 2017

Part-B

Answer any seven questions in which Question No. 30 is compulsory. [7 x 2 = 14]

Question 21.

What is meant by Nalangadi?

Answer:

The place where the goods were sold was called ‘Angadi’ in the Pandiya period. Day market was called as Nalangadi.

Question 22.

What are the two schools of Hindu Law? ‘

Answer:

- Dayabhaga

- Mitakshara

Question 23.

What are Foreign Banks?

Answer:

Banks which have registered office in a foreign country and branches in India are called foreign banks.

![]()

Question 24.

Define contract.

Answer:

Contract [section 2(h)] An agreement enforceable by Law is a Contract.

Question 25.

Who is a Franchisee?

Answer:

The individual who acquires the right to operate the business or use the trademark of the seller is known as the franchisee.

Question 26.

What are Multi-national Companies (MNCs)

Answer:

Multinational company is one which is incorporated in one country, but operates in other countries. It is also called as global enterprise, world enterprise, and international enterprise.

![]()

Question 27.

Give some examples for micro-enterprises.

Answer:

Micro enterprises are engaged in low scale activities such as clay pot making, fruits and vegetable vendors, transport (three wheeler tempos and autos), repair shops, cottage industries, small industries, hand looms, handicraft works etc.

Question 28.

What are specialty stores?

Answer:

Specialty Stores deal in a particular type of product under one product line only. For example, Sweets shop specialised in Tirunelveli Halwa, Bengali Sweets, etc.

Question 29.

What is meant by indent?

Answer:

An indent actually points to an order received from abroad for export of goods, i.e. sale of goods. The indent contains the details in the box.

![]()

Question 30.

Name any two suitable form of transport found in hilly areas, forest areas and in remote places.

Answer:

Pack animals (horse, donkey, camel and elephant) are used to carry small loads in hilly areas and forest areas.

Bullock cart is also used in rural areas and forest areas.

Part-C

Answer any seven questions in which Question No. 40 is compulsory. [7 x 3 = 21]

Question 31.

Write short notes on:

(a) Extractive Industry

(b) Genetic Industry.

Answer:

(a) Extractive Industry:

The industry which extracts or draws out products from natural resources is known as extractive industry, eg., farming, mining.

(b) Genetic Industry:

The industries which are engaged in breeding plants and animals for their use is called genetic industry, eg.,diary, fishery, poultry.

![]()

Question 32.

What is unlimited liability?

Answer:

The liability of the proprietor for the debts of the business is unlimited. The creditors have the right to recover their dues even from the personal property of the proprietor in case the business assets are not sufficient to pay their debts.

Question 33.

Give the meaning of crop insurance.

Answer:

This policy is to provide financial support to farmers in case of a crop failure due to drought or flood. It generally covers all risks of loss or damages relating to production of rice, wheat, millets, oil seeds and pulses etc.

Question 34.

What is the impact of E-commerce on buyers?

Answer:

- Buyers could have a global access to information about variety of products and services available in the market.

- They could buy the products / services round the clock from anywhere in world.

- The prices of products bought through e – commerce tend to be relatively lower than those purchased physically in the conventional shops due to offers, discount etc.

![]()

Question 35.

Write the characteristics of wholesalers, (any six)

Answer:

- Wholesalers buy goods directly from producers.

- Wholesalers buy goods in large quantities and sell in small quantities.

- Wholesalers sell different varieties of a particular product.

- They need large amount of capital.

- They provide credit facility to retailers.

- They also provide financial assistance to producers.

Question 36.

Explain the characteristics of super marker

Answer:

- Super market are gernally situated at the main shopping centres.

- the goods kept on rocks with clearly labelled price and quality tags in such stones

- the customers move into the store to pick up goods of their requirement bring them to the cash counter make and take home delavary

Question 37.

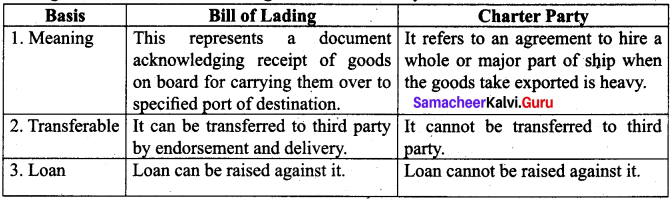

distinguish between Bill of Landing and Charter Party

Answer:

Question 38.

Who can demand performance?

Answer:

- Promisee:

only a promisee can demand performance and not a stranger demand performance of the contract. - Legal Representative:

legal representative can demand Exception performance. Contrary intention appears from the contract. Contract is of a personal nature. - Third party:

Exception to “stranger to a contract”.

![]()

Question 39.

List out the five heads of income.

The five heads of income are:

Answer:

- Income from ‘Salaries’ [Sections 15-17];

- Income from ‘House Property’ [Sections 22-27];

- Income from ‘Profits and Gains of Business or Profession’ [Sections 28-44];

- Income from ‘Capital Gains’ [Sections 45-55]; and

- Income from ‘Other Sources’ [Sections 56-59],

Question 40.

Govind started a business on his own. His father helped him with the accounts and his brother looked after customers in the evening. He pays monthly salary to his father and brother. Identify the form of business and mention any two disadvantages of it.

Answer:

The form of organisation is partnership. His father and brother are working partners. And they are paid salary.

Disadvantages:

- Limited resources:

The number of members is 10 or 20. So the resources available is limited. - Risk of implied authority:

Every partner can find the firm and his other partners by his acts. Therefore all other partners become liable for the fraud done by the other partners.

Part – D

Answer all the questions. [7 x 5 = 35]

Question 41(a).

What are the hindrances of business? (Any five)

Answer:

(1) Hindrance of Person:

Manufacturers do not know the place and face of the consumers. It is the retailer who knows the taste, preference and location of the consumers. The chain of middlemen consisting of wholesalers, agents and retailers establish the link between the producers and consumers.

(2) Hindrance of Place:

Production takes place in one center and consumers are spread throughout the country and world. Rail, air, sea and land transports bring the products

to the place of consumer.

(3) Hindrance of Time:

Consumers want products whenever they have money, time and willingness to buy. Goods are produced in anticipation of such demands.

(4) Hindrance of risk of deterioration in quality:

Proper packaging and modem air conditioned storage houses ensure that there is no deterioration in quality of products.

(5) Hindrance of risk of loss:

Fire, theft, floods and accidents may bring huge loss to the business.

[OR]

Question 41.(b)

Write short notes on:

- Retained Earnings

- Lease Financing

Answer:

1. Retained Earnings:

Retained earnings refer to the process of retaining a part of net profit year after year and reinvesting them in the business. It is also termed as ploughing back of profit. An individual would like to save a portion of his/her income -for meeting the contingencies and growth needs. Similarly profit making company would retain a portion of the net profit in order to finance its growth and expansion in near future. It is described to be the most convenient and economical method of finance.

2. Lease Financing:

Lease financing denotes procurement of assets through lease. For many small and medium enterprises, acquisition of plant and equipment and other permanent assets will be difficult in the initial stages. In such a situation Leasing is helping them to a greater extent.

Leasing here refers to the owning of an asset by any individual or a corporate body which will be given for use to another needy business enterprise on a rental basis. The firm which owns the asset is called ‘Lessor’ and the business enterprise which hires the asset is called ‘Lessee’.

The contract is called ‘Lease’. The lessee pays a fixed rent on agreed basis to the lessor for the use of the asset. The terms and conditions like lease period, rent fixed, mode of payment and allocation of maintenance, are mentioned in the lease contract.

At the end of the lease period, the asset goes back to the lessor. Alternatively lessee can own the asset taken on lease by paying the balance of price of asset concerned to lessor. Hence lease finance is a popular method of medium term business finance.

![]()

Question 42(a).

What are the contents of partnership deed?

Answer:

(1) Name:

Name of the Firm.

(2) Nature of Business:

Nature of the proposed business to be carried on by the partners.

(3) Duration of Partnership:

Duration of the partnership business whether it is to be run for a fixed period of time or whether it is to be dissolved after completing a particular venture.

(4) Capital Contribution:

The capital is to be contributed by the partners. It must be remembered that capital contribution is not necessary to

(5) Withdrawal from the Firm:

The amount that can be withdrawn from the firm by each partner.

(6) Profit / Loss Sharing:

The ratio in which the profits or losses are to be shared. If the profit sharing ratio is not specified in the deed, all the partners must share the profits and bear the losses equally.

(7) Interest on Capital:

Whether any interest is to be allowed on capital and if so, the rate of interest.

(8) Rate of Interest on Drawing:

Rate of interest on drawings, if any.

(9) Loan from Partners:

Whether loans can be accepted from the partners and if so the rate of interest payable thereon.

(10) Account Keeping:

Maintenance of accounts and audit.

(11) Salary and Commission to Partners: Amount of salary or commission payable to partners for their services. (Unless this is specifically provided, no partner is entitled to any salary).

(12) Retirement:

Matters relating to retirement of a partner. The arrangement to be made for paying out the amount due to a retired or deceased partner must also be stated.

(13) Goodwill Valuation:

Method of valuing goodwill on the admission, death or retirement of a partner.

(14) Distribution of Responsibility:

Distribution of managerial responsibilities. The work that is entrusted to each partner is better stated in the deed itself.

(15) Dissolution Procedure:

Procedure for dissolution of the firm and the mode of settlement of accounts thereafter.

(16) Arbitration of Dispute:

Arbitration in case of disputes among partners. The deed should provide the method for settling disputes or difference of opinion. This clause will avoid costly litigations.

[OR]

Question 42 (b).

Elucidate the features of Factoring.

Answer:

- Maintenance of book-debts:

A factor takes the responsibility of maintaining the accounts of debtors of a business institution. - Credit coverage:

The factor accepts the risk burden of loss of bad debts leaving the seller to concentrate on his core business. - Cash advances:

Around eighty percent of the total amount of accounts receivables is paid as advance cash to the client. - Collection service:

Issuing reminders, receiving part payments, collection of cheques from part of the factoring service. - Advice to clients:

From the past history of debtors, the factor is able to provide advises regarding the credit worthiness of customers, perception of customers about the products of the client, etc.

![]()

Question 43(a).

State the features of Departmental stores.

Answer:

- Large Size:

Adepartment is a large scale retail showroom requiring a large capital investment by forming a joint stock company managed by a board of directors. - Wide Choice:

It acts as a universal provider of a wide range of products from low priced to very expensive goods (Pin to Car) to satisfy all the expected human needs under one roof. - Departmentally organised:

Goods offered for sale are classified into various departments. - Facilities provided:

It provides a number of facilities and services to the customers such as restaurant, rest rooms, recreation, packing, free home delivery, parking, etc. - Centralised purchasing:

All the purchases are made centrally and directly from the manufacturers and operate separate warehouses whereas sales are decentralised in different departments.

![]()

[OR]

Question 43 (b).

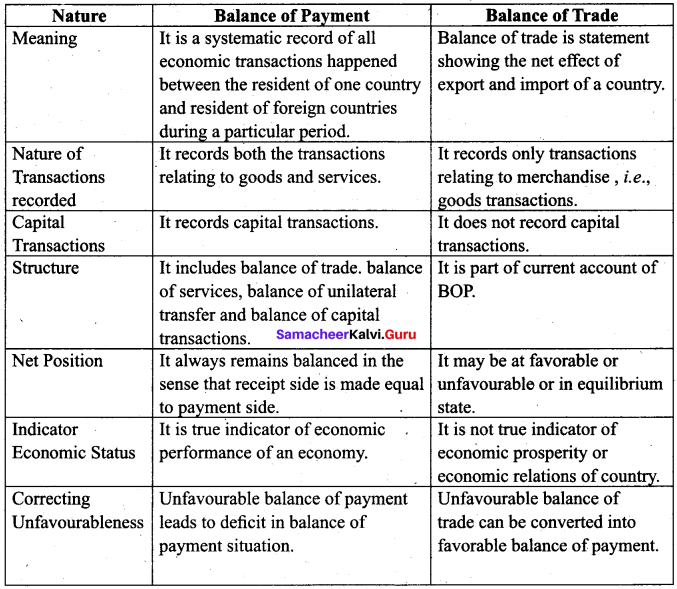

Distinguish between balance of payment and balance of trade.

Answer:

Question 44(a).

Explain different types of transport. (Any five)

Answer:

Types of transport:

(a) Land Transport

(b) Water transport

(c) Air Transport

(a) Land Transport:

Transport of people and goods by land vehicles is known as Land transport. It is also called as‘Surface Transport’.

1. Pack Animals : Animals like horse, mule, donkey, camel, elephant etc., are used for carrying small loads in backward areas, hilly tracks, forest regions and deserts known as pack animals.

2. Bullock Carts : It constitutes the predominant form of rural road transport in India for goods traffic and to some extent for passengers’ traffic.

3. Road Transport : Road Transport is one of the most promising and potent means suitable for short and medium distances.

4. Motor lorries and Buses : From the dawn of civilization, people have been endeavoring to form roads and use wheeled vehicles to facilitate transport of men and materials.

5. Tramways : It made their appearance in the 19th century as a form of transport suitable for big cities. Tramways were initially horse drawn later steam-power and now electrically operated.

6. Railway Transport : The invention of steam engine by James Watt, revolutionized the mode of transport all over the world.

7. Recent Trends in Transport : Metro Rail, Monorail, Bullet train, Pipeline Transport, Conveyor Transport, Ropeway transport and Hyper loop transport.

(b). Water Transport:

“Water is a free gift of nature’. Human civilization through gradual application of science and technology, have utilized water resources for economic, political and military activities.

- Inland Waterways: Inland Waterways comprise of rivers, canals and lakes. It is also known as internal water transport.

- Ocean or Sea Transport: Ocean transport has been playing a significant role in development of economic, social and cultural relations among countries of the world.

(a) Coastal shipping

(b) Overseas shipping

- Liner

- Tramps

(c) Air Transport:

Air transport is the fastest and the costliest mode of transport. Commercial air transport is now one of the most prominent modes of overseas transport. Domestic and International flights are the air travels.

![]()

[OR]

Question 44 (b).

Explain the classification of contract on the basis of performance.

Answer:

(1) Executed Contract:

A contract in which both the parties have fulfilled their obligations under the contract. For example X contracts to buy a car from Y by paying cash, Y instantly delivers his car.

(2) Executory Contract:

A contract in which both the parties are yet to fulfil their obligations, it is said to be an executory contract. For example A agrees to buy B’s cycle by promising to pay cash on 15th June. B agrees to deliver the cycle on 20th June.

(3) Unilateral Contract:

A unilateral contract is a one sided contract in which only one party has performed his promise or obligation, the other party has to perform his promise or obligation. For example X promises to pay Y a sum of Rs. 10,000 for the goods to be delivered by Y. X paid the money and Y is yet to deliver the goods.

(4) Bilateral Contract:

A contract in which both the parties commit to perform their respective promises is called a bilateral contract. For example R offers to sell his fiat car to S for Rs. 10,00,000 on acceptance of R’s offer by S, there is a promise by R to Sell the car and there is a promise by S to purchase the car, there are two promises.

![]()

Question 45(a).

Discuss the causes of risk.

Answer:

Business risk arises due to a variety of causes which are classified as follows:

(1) Natural Causes:

Human beings have little control over natural calamities like flood, earthquake, lightning, heavy rains, famine, etc. These result in heavy loss of life, property, and income in business.

(2) Human Causes:

Human causes include such unexpected events like dishonesty, carelessness or negligence of employees, stoppage of work due to power failure, strikes, riots, management inefficiency, etc.

(3) Economic Causes:

These include uncertainties relating to demand for goods, competition, price, collection of dues from customers, change of technology or method of production, etc. Financial problems like rise in interest rate for borrowing, levy of higher taxes, etc., also come under this type of causes as they result in higher unexpected cost of operation of business.

(4) Other Causes:

These are unforeseen events like political disturbances, mechanical failures such as the bursting of boiler, fluctuations in exchange rates, etc. which lead to the possibility of business risks.

![]()

[OR]

Question 45 (b)

How do you classify Social Responsibility?

Answer:

(1) Economic responsibility:

A business enterprise is basically an economic entity and, therefore, its primary social responsibility is economic i.e., produce goods and services that society wants and sell them at a profit.

(2) Legal responsibility:

Every business has a responsibility to operate within the laws of the land. Since these laws are meant for the good of the society, a law abiding enterprise is a socially responsible enterprise as well.

(3) Ethical responsibility:

This includes the behaviour of the firm that is expected by society but not codified in law. For example, respecting the religious sentiments and dignity of people while advertising for a product. There is an element of voluntary action in performing this responsibility.

(4) Discretionary responsibility:

This refers to purely voluntary obligation that an enterprise assumes, for instance, providing charitable contributions to educational institutions or helping the affected people during floods or earthquakes. It is the responsibility of the company management to safeguard the capital investment by avoiding speculative activity and undertaking only healthy business ventures which give good returns on investment.

Question 46(a).

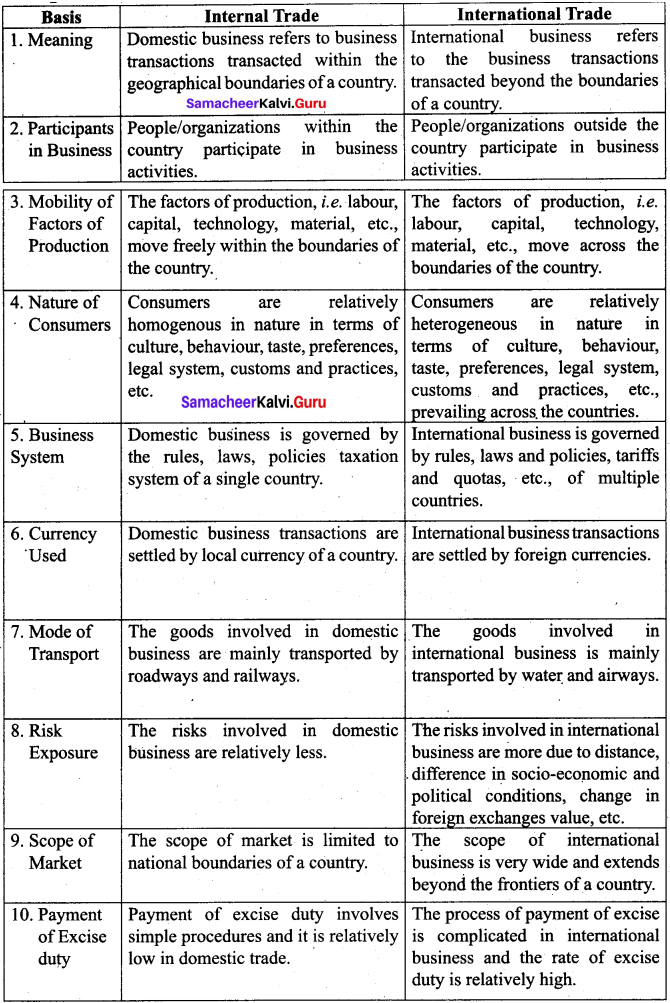

Distinguish between Internal and International trade.

Answer:

Question 46(b).

Explain briefly the different types of Foreign trade.

Answer:

A. Import Trade:

Import trade jneans buying goods from a foreign country for domestic use. Example. India imports petroleum products from Gulf Countries. India imports machinery, equipment, materials etc. It is necessary to speed-up industrialization, to meet consumer demands and to improve standard of living.

B. Export Trade:

Export trade means the sale of domestic goods to foreign countries.

Examples:

- Export of Iron ore from India to Japan

- Selling of Tea from India to England.

- Export of jasmine flowers from Madurai to Singapore

Export trade is necessary to sell domestic surplus goods, to make better utilization of resources, to earn foreign exchange, to increase national income, to generate employment and to increase Government revenue

C. Entrepot Trade:

Entrepot trade means importing of goods from one country and exporting the same to foreign countries. It is also known as‘Re-export trade’ E.g. Indian diamond merchants in Surat import uncut raw diamonds from South Africa. They cut and polish die diamonds in their units in India and re-export them to the International Diamond Market in Amsterdam.

![]()

Question 47(a).

Classify the companies on the basis of incorporation.

Answer:

Companies on the basis of incorporation

(a) Chartered Companies:

Companies which are established by the king or queen of a countries are called as chartered companies. Powers and privileges are given in the charter, e.g., East Indian company, Bank of England. ‘

(b) Statutory Companies:

Companies which are established by a Special Act of Parliament or state Assembly. Constitution of the company is specified in the memorandum of Association. Rules and regulations of the company are given in the Articles of Association.

Examples:

Food Corporation of India, LIC, RBI .

(c) Association Not for profit:

According to Section 25, the Central Government may, by license, grant that an association may be registered, as a company. It should use the words ‘limited’, or ‘private limited’ as part of its name.

![]()

[OR]

Question 47(b).

Write short notes on:

- Bank over draft

- Housing loan

Answer:

(1) Bank over draft:

It is a credit facility given mostly to current account holders. It is an arrangement between banker and credit worthy customers. Such customers are allowed to overdraw up to a certain amount usually for 3 months period. The withdrawn amount is charged with interest.

(2) Housing loan:

The banks can grant medium and long term loans to the customers, by accepting the title deeds of the house, is called housing loan. The loan is repaid in equated monthly installments. It is a boon to middle class and salaried employees.