Students can Download Accountancy Chapter 2 Conceptual Framework of Accounting Questions and Answers, Notes Pdf, Samacheer Kalvi 11th Accountancy Book Solutions Guide Pdf helps you to revise the complete Tamilnadu State Board New Syllabus and score more marks in your examinations.

Tamilnadu Samacheer Kalvi 11th Accountancy Solutions Chapter 2 Conceptual Framework of Accounting

Samacheer Kalvi 11th Accountancy Conceptual Framework of Accounting Text Book Back Questions and Answers

I. Multiple Choice Questions

Choose the Correct Answer

Question 1.

The business is liable to the proprietor of the business in respect of capital introduced by the person according to ………………

(a) Money measurement concept

(b) Cost concept

(c) Business entity concept

(d) Dual aspect concept

Answer:

(c) Business entity concept

Question 2.

The concept which assumes that a business will last indefinitely is ………………

(a) Business Entity

(b) Going concern

(c) Periodicity

(d) Conservatism

Answer:

(b) Going concern

![]()

Question 3.

GAAPs are:

(a) Generally Accepted Accounting Policies

(b) Generally Accepted Accounting Principles

(c) Generally Accepted Accounting Provisions

(d) None of these

Answer:

(c) Generally Accepted Accounting Provisions

Question 4.

The rule of stock valuation ‘cost price or realisable value’ whichever is lower is based on the accounting principle of ………………

(a) Materiality

(b) Money measurement

(c) Conservatism

(d) Accrual

Answer:

(c) Conservatism

Question 5.

In India, Accounting Standards are issued by ………………

(a) Reserve Bank of India

(b) The Cost and Management Accountants of India

(c) Supreme Court of India

(d) The Institute of Chartered Accountants of India

Answer:

(d) The Institute of Chartered Accountants of India

II. Very Short Answer Questions

Question 1.

Define book-keeping.

Answer:

According to R.N. Carter, “Book-keeping is the science and art of recording correctly in the books of account all those business transactions of money or money’s worth”.

Question 2.

What is meant by accounting concepts?

Answer:

Accounting concepts are the basic assumptions or conditions upon which accounting has been laid. Accounting concepts are the results of broad consensus. The word concept means a notion or abstraction which is generally accepted. Accounting concepts provide a unifying structure to the accounting process and accounting reports.

![]()

Question 3.

Briefly explain about revenue recognition concept.

Answer:

According to the accrual concept, the effects of the transactions are recognized on a mercantile basis, i.e., when they occur and not when cash is paid or received. Revenue is recognized when it is earned and expenses are recognized when they are incurred.

All expenses and revenues related to the accounting period are to be considered irrespective of the fact that whether revenues are received in cash or not and whether expenses are paid in cash or not.

For example, a Credit sale is recognized as a sale though the amount has not been received immediately.

Question 4.

What is the “Full Disclosure Principle” of accounting?

Answer:

It implies that the accounts must be prepared honestly and all material information should be disclosed in the accounting statement. This is important because the management is different from the owners in most organizations.

Question 5.

Write a brief note on the ‘Consistency’ assumption.

Answer:

- It indicates that the accounting policies must be followed consistently from one accounting period to another.

- The results of different years will be comparable only when the same accounting policies are followed from year to year.

- The changes in accounting policy can be incorporated when it complies with the provision of law.

- It complies with the accounting standards issued.

- It helps to reflect a true and fair view of the state of affairs of the business.

III. Short Answer Questions

Question 1.

What is the matching concept? Why should a business concern follow this concept?

Answer:

Matching concept: According to this concept, revenues during an accounting period are matched with expenses incurred during that period to earn the revenue during that period. This concept is based on the accrual concept and periodicity concept. The periodicity concept fixes the time frame for measuring performance and determining financial status. All expenses paid during the period are not considered, but only the expenses related to the accounting period are considered.

On the basis of this concept, adjustments are made for outstanding and prepaid expenses and accrued and unearned revenues. Also, due provisions are made for depreciation of the fixed assets, bad debts, etc., relating to the accounting period. Thus, it matches the revenues earned during an accounting period with the expenses incurred during that period to earn the revenues before sharing any profit or loss.

![]()

Question 2.

“Only monetary transactions are recorded in accounting”. Explain the statement.

Answer:

Money serves as the medium of exchange:

The Money Measuring Concept implies that only those transactions, which can be expressed in terms of money.

Transactions which do not involve money will not be recorded in the books of accounts.

E.g: Working conditions in the workplace, a strike by employees, the efficiency of the management, etc. will not be recorded in the books, as they cannot be expressed in terms of money.

Question 3.

“Business units last indefinitely”. Mention and explain the concept on which the statement is based.

Answer:

This concept implies that a business unit is separate and distinct from the owner or owners, that is, the persons who supply the capital to it. Based on this concept, accounts are prepared from the point of view of the business and not from the owner’s point of view. Hence, the business is liable to the owner for the capital contributed by him/her.

According to this concept, only business transactions are recorded in the books of accounts. Personal transactions of the owners are not recorded. But, their transactions with the business such as capital contributed to the business or cash withdrawn from the business for personal use will be recorded in the books of accounts. It implies that the business itself owns assets and owes liabilities.

Question 4.

Write a brief note on Accounting Standards.

Answer:

- In India, Standards of Accounting are issued by the Institute of Chartered Accountants of India (ICAI).

- The Council of the Institute of Chartered Accountants of India constituted Accounting Standards Board (AS(b) on 21st April 1977 recognizing the need for Accounting Standards in India.

- ASB formulates Accounting Standards so that such standards may be established by the Council of the Institute in India.

- The ASB will consider the applicable law, custom, usage, business environment, and the International Accounting Standards while framing Accounting Standards (AS) in India.

Textbook Case Study Solved

Magesh started a new trading business. He buys and sells packing materials. He wants to be honest in doing his business. He has plans to establish his business in the future. He has little accounting knowledge but has excellent business skills. At the end of his first year of trading, he wanted to value his closing stock. He finds some of the goods are damaged. If he wants to sell them, then he has to spend some amount for making them in a saleable condition. He also takes some money from his business bank account for his personal use. But, he forgot to record that.

Now, discuss the following points:

Question 1.

Does every businessman need accounting knowledge?

Answer:

No, Every businessman does not need accounting knowledge. The businessman is called sole trader. If he has little accounting knowledge, is enough, but he should have business skill.

Question 2.

Identify some of the accounting concepts in this case study.

Answer:

- Money measurement concept.

- Going concern concept.

- Matching concept.

- Realization concept

- Accrual concept

![]()

Question 3.

How should his closing stock be valued?

Answer:

Convention of conservation or prudence concept. The closing stock will be valued at market price or cost price whichever is lower.

Question 4.

Is it possible for him to compare his business results with that of his competitors?

Answer:

Yes, it is possible for him to compare his business results with that of his competitors, but the method is not accurate. It may be approximated i.e., the capital comparison method followed.

Samacheer Kalvi 11th Accountancy Conceptual Framework of Accounting Additional Questions and Answers

I. Multiple Choice Questions

Choose the correct answer

Question 1.

The practice of transferring closing stock into trading accounting is the ……………

(a) Going Concern Concept

(b) Matching Concept

(c) Money measurement Concept

(d) Revenue Realization Concept

Answer:

(a) Going Concern Concept

Question 2.

……………… is the primary stage in accounting.

(a) Journal

(b) Book-keeping

(c) ledger

(d) Transactions

Answer:

(b) Book-keeping

![]()

Question 3.

The incomplete system of accounting …………….

(a) Double Entry System

(b) Single Entry System

(c) Double Account system

(d) None of the above

Answer:

(b) Single Entry System

Question 4.

……………… is routine and clerical in nature.

(a) Book-keeping

(b) Accounting

(c) Ledger

(d) Journal

Answer:

(a) Book-keeping

Question 5.

The matching concept means ………………

(a) Transactions recorded at accrual concept

(b) Anticipate no profit but recognize all losses

(c) Assets = Capital + Liabilities

(d) Expenses = Revenue

Answer:

(d) Expenses = Revenue

Question 6.

The word convention refers ………………

(a) traditions

(b) trade

(c) business

(d) accounting

Answer:

(a) traditions

Question 7.

Which of the following provide framework and accounting policies so that the financial statements of different enterprises become comparable?

(a) Business Standards

(b) Accounting Standards

(c) Market Standards

(d) None

Answer:

(b) Accounting Standards

Question 8.

requires that all accounting transactions recorded should be based on objective evidence.

(a) Matching concept

(b) Cost concept

(c) Dual aspect concept

(d) Objective evidence concept

Answer:

(d) Objective evidence concept

II. Very Short Answer Questions

Question 1.

What are the features of book-keeping?

Answer:

Following are the features of book-keeping:

- It is the process of recording transactions in the books of accounts

- Monetary transactions only are recorded in the accounts.

- Book-keeping is the primary stage in the accounting process.

- Book-keeping includes journalizing and ledger processing.

Question 2.

Write any two limitations of book-keeping.

Answer:

The limitations of Book-keeping are:

- Only monetary transactions are recorded in the book accounts.

- Effects of price level changes are not considered.

![]()

Question 3.

Define Accounting Standards.

Answer:

According to Kohler, “Accounting standards are codes of conduct imposed by customs, law or professional bodies for the benefit of public accountants and accountants generally”.

Question 4.

What is the dual aspect concept?

Answer:

According to this concept, every transaction or event has two aspects, i.e., dual effect. This is the concept that recognizes the fact that for every debit, there is a corresponding and equal credit. This is the basis of the entire system of double-entry book-keeping.

Question 5.

Write any two needs for accounting standards.

Answer:

The need for accounting standards is:

- To promote a better understanding of financial statements.

- To help accountants to follow uniform procedures and practices.

III. Short Answer Questions

Question 1.

Explain the Objectives of book-keeping.

Answer:

Following are the objectives of book-keeping:

- To have a complete and permanent record of all business transactions in chronological order and under appropriate headings.

- To facilitate ascertainment of the profit or loss of the business during a specific period.

- To facilitate ascertainment of financial position.

- To know the progress of the business.

- To find out the tax liabilities.

- To fulfill the legal requirements.

Question 2.

What are the features of book-keeping?

Answer:

The main features of book-keeping are:

- It is the process of recording transactions in the books of accounts.

- Monetary transactions only are recorded in the accounts.

- Bookkeeping is the primary stage in the accounting process.

- Bookkeeping includes journaling and ledger processing.

![]()

Question 3.

What is the need for accounting standards?

Answer:

The need for accounting standards is as follows:

- To promote a better understanding of financial statements.

- To help accountants to follow uniform procedures and practices.

- To facilitate meaningful comparison of financial statements of two or more entities.

- To enhance the reliability of financial statements.

- To meet the legal requirements effectively.

Question 4.

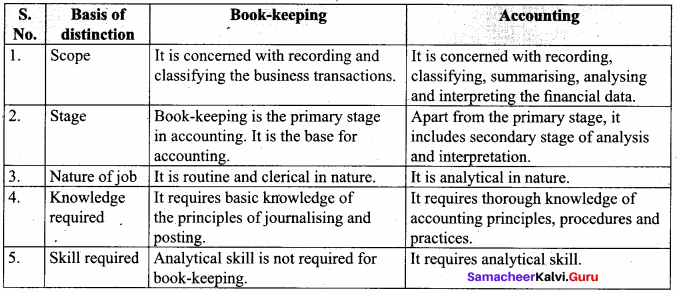

What are the differences between bookkeeping and accounting?

Answer: