Download Samacheer Kalvi Class 11th Commerce Solutions Chapter 10 Reserve Bank of India Questions and Answers from this page for free of cost. We have compiled the Samacheer Kalvi 11th Commerce Book Solutions Chapter 10 Reserve Bank of India solutions for all topics in a comprehensive way to support students who are preparing effectively for the exam. You will discover both numerical and descriptive answers for all Chapter 10 Reserve Bank of India concepts in this Samacheer Kalvi Commerce Solutions Solutions pdf. Make use of this perfect guide and score good marks in the exam along with strong subject knowledge.

Samacheer Kalvi 11th Commerce Solutions Chapter 10 Reserve Bank of India

Candidates who are looking for Commerce Solutions Chapter 10 Reserve Bank of India topics can get them all in one place ie., from Samacheer Kalvi Class 11th Commerce Solutions Chapter 10 Reserve Bank of India. Just click on the links prevailing over here & prepare all respective concepts of Commerce Solutions properly. By viewing/practicing all Samacheer Kalvi Class 11th Commerce Solutions Chapter 10 Reserve Bank of India Questions and Answers, you can clear any kind of examinations easily with best scores.

Samacheer Kalvi 11th Commerce Reserve Bank of India Textbook Exercise Questions and Answers

I. Choose the Correct Answer

Question 1.

Which bank has the power to issue bank notes?

(a) Central bank

(b) Commercial bank

(c) Co – operative banks

(d) Foreign banks

Answer:

(a) Central bank

Question 2.

The Central bank of India is …………….

(a) PNB

(b) SBI

(c) ICICI

(d) RBI

Answer:

(d) RBI

Question 3.

The Reserve Bank of India commenced its operations from April 1,

(a) 1936

(b) 1935

(c) 1934

(d) 1933

Answer:

(b) 1935

Question 4.

Bankers are not only dealers of money but also leaders in …………….

(a) Economic development

(b) Trade development

(c) Industry development

(d) Service development

Answer:

(a) Economic development

Question 5.

Which of the following is not a function of a central bank?

(a) Guiding and regulating the banking system of a country

(b) Deal with the general public

(c) Acts essentially as Government banker

(d) Maintains deposit accounts of all other banks

Answer:

(b) Deal with the general public

II. Very Short Answer Questions

Question 1.

What are the services included in Service businesses?

Answer:

Educational, Medical, Hospitality and banking are the services included in service businesses. Bank service is the nerve center of industry and commerce in a country.

Question 2.

Write the meaning of ‘Bank’.

Answer:

In simple words, bank is an institution, which deals in money and credit. The Bank, normally refers to Commercial Bank.

Question 3.

Briefly explain about Central Bank.

Answer:

Every nation has one central bank. It is owned by the Government of the country. The control over the entire banking system of a country is vested with this apex bank. Central banks are known by different names in different countries. In India the Reserve Bank of India (RBI) is the central bank.

III. Short Answer Questions

Question 1.

Mention the importance of banking services.

Answer:

Banking service is the nerve center of industry and commerce in a country. It plays a vital role by providing the money required for their regular functioning and development.

Question 2.

Explain the origin of RBI.

Answer:

The Imperial Bank of India carried out the note issue and other functions of the central bank. In 1926 the Hilton-Young Commission or the Royal Commission on Indian Currency and Finance (J. M. Keynes and Sir Ernest Cable were its members) made recommendation to create a central bank. As a result the RBI Act 1934 was passed and RBI launched in operations from April 1,1935. RBI was established with a share capital of Rs. 5 crores divided into shares of Rs. 100 each fully paid up. The Head office of the RBI is situated in Mumbai.

Question 3.

Who are the persons involved in RBI administration?

Answer:

The RBI is governed by the central board of directors. The 21 members board is appointed by the Government of India. It consists of:

- One Governor and four deputy governors appointed for a period of four years.

- Ten Directors from various fields

- Two Government officials

- Four Directors – one each from local boards.

IV. Long Answer Questions

Question 1.

Classify the various functions of Reserve Bank of India.

Answer:

The functions of the RBI can be grouped under three heads:

(i) Leadership and Supervisory Functions, (ii) Traditional Functions and, (iii) Promotional Functions.

(i) Leadership and Supervisory Functions:

- India’s Representative in World Financial Institutions

- Regulator and Supervisor of Indian Banking System

- Monetary Authority

- Closely Monitoring Economic Parameters

- Promptly Responding to New Challenges

(ii) Traditional Functions:

- Banker and Financial Advisor to the Government

- Monopoly of Note Issue

- Banker’s Bank

- Controller of Credit and Liquidity

- Quantitative Methods of Credit Control

- Qualitative Credit Control Measures

- Lender of the Last Resort

- Clearing House Services

- Custodian of Foreign Exchange Reserves

- Maintenance of Foreign Exchange Rate

- Collection and Publication of Authentic Data

(iii) Promotional Functions:

- Nurturing Banking Habits among the Public

- Grievance Settlement Measures

- Agricultural Development

- Promotion of Small Scale Industries

- Facilitates Foreign Trade

- Supports Cooperative Sector

Question 2.

Explain the organizational structure of RBI.

Answer:

The head office of the RBI is situated in Mumbai. This central office has 33 departments in 2017. It has four zonal offices in Mumbai, Delhi, Calcutta, and Chennai functioning under local boards with deputy governors as their heads. It also has 19 regional offices and 11 sub-offices (2017). The RBI is governed by a central board of directors. The 21 member board is appointed by the Government of India. It consists of:

- One Governor and four deputy governors appointed for a period of four years,

- Ten Directors from various fields

- Two Government officials

- Four Directors – one each from local boards.

Samacheer Kalvi 11th Commerce Cooperative Organisation Additional Questions and Answers

I. Choose the Correct Answer:

Question 1.

The …………………. bank is also called as Commercial Bank.

a. World

b. Central

c. Hindustan

d. Domestic

Answer:

a. World

Question 2.

IBRD is otherwise called as …………….

(a) IMF

(b) World Bank

(c) SBI

(d) RBI

Answer:

(b) World Bank

Question 3.

The Presidential Banks were amalgamated into the Imperial Bank of India in the year …………..

a. 1995

b. 1932

c. 1965

d. 1921

Answer:

d. 1921

Question 4.

Banking Regulation Act, …………….

(a) 1947

(b) 1949

(c) 1945

(d) 1946

Answer:

(b) 1949

Question 5.

The head office of RBI is situated in ………………

a. Chennai

b. Delhi

c. Mumbai

d. Haryana

Answer:

c. Mumbai

Question 6.

When did India carry out demonetization?

(a) Nov 8, 1996

(b) Nov 8, 2016

(c) Nov 8, 2006

(d) Nov 8, 2017

Answer:

(b) Nov 8, 2016

Question 7.

…………………. is the monopoly of note issue in India.

a. PNB

b. SBI

c. ICICI

d. RBI

Answer:

d. RBI

II. Very Short Answer Questions

Question 1.

Write a note on ancient Banking service in Tamil Nadu.

Answer:

In ancient days the following concepts were in practice in Tamil Nadu:

Patru-debit, Varavu-credit, Selavu-expenditure, Laabam-profit Nashtam-loss, all collectively known as Tynthogai trial balance. The ledger is called ‘Peredu’.

Question 2.

What is Cash Reserve Ratio (CRR)?

Answer:

It is the ratio of cash reserves with the RBI kept by Scheduled banks in proportion to the total Time and Demand Liabilities with them.

Question 3.

Explain SLR.

Answer:

It is the ratio of money and money equivalents kept within the bank in proportion to the total Time and Demand Liabilities with them.

Question 4.

How did the remonetization carried out in India in the year 2016?

Answer:

The remonetization was carried out by issuing new 2000 and 500 currency notes.

For Future Learning

Question 1.

Know the Central Banks of Some other Countries.

Answer:

The Central Bank of Russia is the Bank of Russia

The Central Bank of Sri Lanka is the Central Bank of Sri Lanka

- The Central Bank of the USA is Federal Reserve tori The Fed

- The Central Bank of Pakistan is The State Bank of Pakistan

Question 2.

Mention the names of Central Banks in three other countries.

Answer:

- Australia – Reserve Bank of Australia

- Algeria – Bank of Algeria

- Canada – Bank of Canada

Case Study

Question 1.

Taka up a recent newspaper clipping about RBI such as the measures taken to reduce NPA. etc.

Answer:

The non-performing asset (NPA) situation has been one of the contentious issues in the country over the last few years. Even though demonstration has been an issue Recently, the issue of NPAs has been at the foremost of the banking fraternity’s concerns in the last year. In the Context of an ordinance issued by the government to provide more independence to the Reserve Bank of India (RBI), it is important to understand what can really be done, considering that RBI has more powers to address this issue. The question for the RBI now is “How will it solve the problem?”. While experts have commented on various measures, it would also be prudent to look across the border to China to see how to deal with this.

- The first was to reduce risks by strengthening banks and spearheading reforms to the state-owned enterprises (SOEs) by reducing their level of debt.

- The second important measure was enacting laws that allowed the creation of assets management companies, equity participation, and most important asset-based securitization.

- The third key measure that China took was to ensure the government had the financial loss of the debt “discounted” and debts equity swaps were allowed in case of growth opportunity.

- The fourth measure they took was producing incentives like tax breaks, exemption from administrative fees, and transparent evaluation norms.

- To conclude, it is important to look after some of the key measures taken by other countries to address the NPA issue.

- India should leam from it, especially in the context of valuations, securitization, and a more targeted NPA redressal mechanism. Sri Ram Balasubramanian is an economist First Published: Wednesday, May 10, 2017.

Question 2.

Arrange for a group discussion on customer grievances and the cases settled by Banking Ombudsman offices.

Answer:

Banking Ombudsman offices:

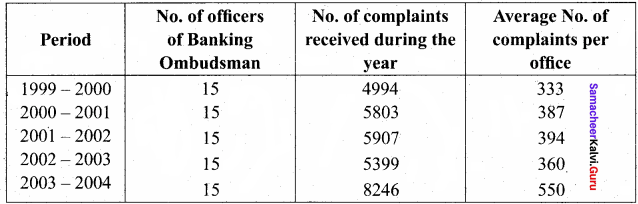

The Banking Ombudsman scheme-, 1995 was notified by RBI on June 14, 1995, in terms of the power confessed on the Bank by Section 35 A of the Banking Regulations Act 1949 (10 of 1949) to provide for a system of redressal of grievances against banks. The scheme sought to establish a system of expeditions and inexpensive resolutions of customer complaints. The scheme is operation since 1995 and was revised during the year 2002. The scheme is being executed by Banking Ombudsman appointed by RBI at 15 centers covering the entire country.

Question 3.

Visit the RBI website www.rbi.org.in to read and have a discussion on any annual report, etc.

Answer:

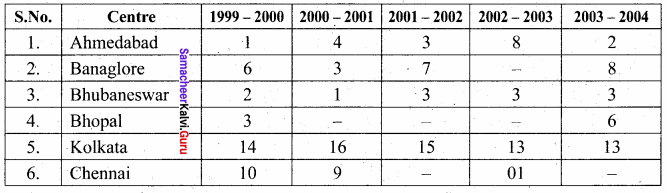

Name of the complaints received by the Banking Ombudsman

Awards issued by the Banking Ombudsman

and so on …. till 15 centres.

We hope this detailed article on Samacheer Kalvi Solutions for Class 11th Commerce Solutions Chapter 10 Reserve Bank of India aids Questions and Answers. For more doubts about Samacheer Kalvi Solutions, feel free to ask in the comment section below. We will revert back to you very soon with the best possibilities. Moreover, connect with our site and get more information on State board Solutions for various classes & subjects.