Guys who are planning to learn the fundamentals of Economics Solutions can avail the handy study material Samacheer Kalvi Class 11th Economics Solutions Chapter 9 Development Experiences in India Questions and Answers here. Refer to the Samacheer Kalvi Economics Solutions for Class 11th PDF available and score better grades. Simply click on the quick links available for Samacheer Kalvi 11th Economics Solutions Chapter 9 Development Experiences in India and prepare all the concepts in it effectively. Take your preparation to the next level by availing the Tamilnadu State Board Solutions for Class 11th Economics Solutions Chapter 9 Development Experiences in India prepared by subject experts.

Tamilnadu Samacheer Kalvi 11th Economics Solutions Chapter 9 Development Experiences in India

Do you feel the concept of Economics Solutions difficult to understand? Not anymore with our Samacheer Kalvi for Class 11th Economics Solutions Chapter 9 Development Experiences in India Questions and Answers. All the Solutions are given to you with detailed explanation and you can enhance your subject knowledge. Use the Samacheer Kalvi Textbook Chapter 9 Development Experiences in India Solutions PDF free of cost and prepare whenever you want.

Samacheer Kalvi 11th Economics Development Experiences in India Text Book Back Questions and Answers

Part – A

Multiple Choice Questions

Question 1.

Which of the following is the way of Privatisation?

(a) Disinvestment

(b) Denationalization

(c) Franchising

(d) All the above

Answer:

(d) All the above

Question 2.

Countries today are to be ______ for their growth.

(a) Dependent

(b) Interdependent

(c) Free trade

(d) Capitalist

Answer:

(b) Interdependent

Question 3.

The Arguments against LPG is ______

(a) Economic growth

(b) More investment

(c) Disparities among people and regions

(d) Modernization

Answer:

(c) Disparities among people and regions

Question 4.

Expansion of FDI ______

(a) Foreign Private Investment

(b) Foreign Portfolio

(c) Foreign Direct Investment

(d) Forex Private Investment

Answer:

(c) Foreign Direct Investment

Question 5.

India is the largest producer of ______ in the world.

(a) fruits

(b) gold

(c) petrol

(d) diesel

Answer:

(a) fruits

Question 6.

Foreign investment includes ______

(a) FDI only

(b) FPI and FFI

(c) FDI and FPI

(d) FDI and FFI

Answer:

(a) FDI only

Question 7.

The Special Economic Zones policy was announced in ______

(a) April 2000

(b) July 1990

(c) April 1980

(d) July 1970

Answer:

(a) April 2000

Question 8.

Agricultural Produce Market Committee is a ______

(a) Advisory body

(b) Statutory body

(c) Both a and b

(d) none of these above

Answer:

(b) Statutory body

Question 9.

Goods and Services Tax is ______

(a) a multi point tax

(b) having cascading effects

(c) like Value Added Tax

(d) a single point tax with no cascading effects.

Answer:

(d) a single point tax with no cascading effects.

Question 10.

The New Foreign Trade Policy was announced in the year ______

(a) 2000

(b) 2002

(c) 2010

(d) 2015

Answer:

(d) 2015

Question 11.

Financial Sector reforms mainly related to ______

(a) Insurance Sector

(b) Banking Sector

(c) Both a and b

(d) Transport Sector

Answer:

(c) Both a and b

Question 12.

The Goods and Services Tax Act came in to effect on ______

(a) 1st July 2017

(b) 1st July 2016

(c) 1st January 2017

(d) 1st January 2016

Answer:

(a) 1st July 2017

Question 13.

The new economic policy is concerned with the following ______

(a) foreign investment

(b) foreign technology

(c) foreign trade

(d) all the above

Answer:

(d) all the above

Question 14.

The recommendation of Narashimham Committee Report was submitted in the year ______

(a) 1990

(b) 1991

(c) 1995

(d) 2000

Answer:

(b) 1991

Question 15.

The farmers have access to credit under Kisan credit card scheme through the following except ______

(a) co-operative banks

(b) RRBs

(c) Public sector banks

(d) private banks

Answer:

(a) co-operative banks

Question 16.

The Raja Chelliah Committee on Trade Policy Reforms suggested the peak rate on import duties at ______

(a) 25%

(b) 50%

(c) 60%

(d) 100%

Answer:

(b) 50%

Question 17.

The first ever SEZ in India was set up at

(a) Mumbai

(b) Chennai

(c) Kandla

(d) Cochin

Answer:

(c) Kandla

Question 18.

‘The Hindu Rate of Growth’ coined by Raj Krishna refers to ______

(a) low rate of economic growth

(b) high proportion of Hindu population

(c) Stable GDP

(d) none

Answer:

(a) low rate of economic growth

Question 19.

The highest rate of tax under GST ______ is (as on July, 2017)

(a) 18%

(b) 24%

(c) 28%

(d) 32%

Answer:

(c) 28%

Question 20.

The transfer of ownership from public sector to private sector is known as ______

(a) Globalization

(b) Liberalization

(c) Privatization

(d) Nationalization

Answer:

(c) Privatization

Part – B

Answer the following questions in one or two sentences

Question 21.

Why was structural reform implemented in Indian Economy?

Answer:

Indian economy introduced structural reforms to face the economic crisis in the form of balance of payments problem in 1991.

Question 22.

State the reasons for implementing LPG.

Answer:

To correct the weaknesses and rigidities in the various sectors of the economy India implemented LPG which is the triple pillars of New Economic Policy.

Question 23.

State the meaning of Privatization.

Answer:

Privatization means transfer of ownership and management of enterprises from public sector to private sector.

Question 24.

Define disinvestment.

Answer:

Disinvestment means selling of government securities of public sector undertakings to other PSUs or private sector or banks.

Question 25.

Write three policy initiative introduced in 1991 – 1992 to correct the fiscal imbalance.

Answer:

- Reduction in fertilizer subsidy.

- Abolition of subsidy on sugar.

- Disinvestment of a part of the government’s equity holdings in select public sector undertakings.

- Expenditures on welfare measures were reduced.

Question 26.

State the meaning of Special Economic Zones.

Answer:

SEZs is an area in which business and trade laws are different from rest of the country mainly aiming at increasing trade, investment and job creation.

Question 27.

State the various components of Central government schemes under post – harvest measures.

Answer:

- Mega food parks, Integrated cold chain, value addition preservation infrastructure, modernization of slaughter house.

- Scheme for quality-assurance, codex standards, research and development and other promotional activities.

Part – C

Answer the following questions in one Paragraph

Question 28.

How do you justify the merits of Privatisation?

Answer:

Privatisation was necessitated because of the belief that the private sector was not given enough opportunities to earn more money.

Question 29.

What are the measures taken towards Globalization?

Answer:

Globalization refers to the integration of the domestic economy with the rest of the world. Import liberalization through reduction of tariff and non-tariff barriers, opening the doors to foreign direct investment and foreign portfolio investment are some of the measures towards globalization.

Question 30.

Write a note on Foreign investment policy?

Answer:

The major feature of the economic reform opened gate to foreign investment and foreign technology. Foreign investment including FDI and FPI were allowed.

In 1991, the government announced a specified list of industries where in automatic permission was granted for FDI. Foreign Investment Promotion Board (FIPB) has been set up to negotiate with international firms and approve foreign direct investment in select areas.

Question 31.

Give short note on Cold storage.

Answer:

Problems relating to the marketing of fruits and vegetables is related with their perishability. Perishability is responsible for high marketing costs, market gluts, price fluctuations and other similar problems.

In order to overcome this constraint, the Government of India and the ministry of agriculture promulgated “Cold Storage Order 1964” under section 3 of the Essential Commodities Act, 1955.

However, the cold storage facility is still very poor and highly inadequate.

Question 32.

Mention the functions of APMC.

Answer:

- To promote public private partnership in the ambit of agricultural markets.

- To provide market led extension services to farmer.

- To promote agricultural activities.

- To bring transparency in pricing system and market transactions.

- To ensure payments to the farmer for the sale on the same day.

- To display data on arrivals and rates from time to time in the market.

Question 33.

List out the features of new trade policy.

Answer:

The trade policy of 1 April 1992 freed imports of almost all intermediate and capital goods. Only 71 items remained restricted. This would affect the domestic industries. Rationalization of tariff structure and removal of quantitative restrictions.

The Chelliah Committee’s report had suggested drastic reduction in import duties. As a first step towards a gradual reduction in the tariffs, the 1991 -92 budget had reduced the peak rate of import duty.

Question 34.

What is GST? Write its advantages.

Answer:

GST is a comprehensive indirect tax levied on manufacture, sale and consumption of goods as well as services.

Advantages of GST :

- Removing cascading tax effect.

- Single point tax.

- Higher threshold for registration

- Composition scheme for small business.

- Online simpler procedure under GST.

- Defined treatment for e-commerce.

- Increased efficiency in logistics

Question 35.

Explain the objectives and characteristics of SEZs.

Answer:

The Special Economic Zones (SEZs) policy was announced in April 2000.

The major objectives of SEZs are :

- To enhance foreign investment especially to attract foreign direct investment (FDI) and thereby increasing GDP.

- To increase shares in global export.

- To generate additional economic activity.

- To create employment opportunities.

- To develop infrastructure facilities.

- To exchange technology in the global market.

Main characteristics of SEZs :

Geographically demarked area with physical security.

- Administrated by single body / authority.

- Streamlined procedures.

- Having separate custom area

- Governed by more liberal economic laws.

- Greater freedom to the firms located in SEZS.

Question 37.

Describe the salient features of EXIM policy (2015 – 2020)

Answer:

The new EXIM policy has been formulated focusing on increasing in exports scenario, boosting production and supporting the concepts like Make in India and Digital India.

- Reduce export obligations by 25% and give boost to domestic manufacturing supporting the “Make in India” concept.

- As a step to Digital India concept, online procedure to upload digitally signed document, and mobile app for filing tax, stamp duty has been developed.

- Repated submission of physical copies of documents are not required.

- Export obligation period for export items related to defence, military store, aerospace and nuclear energy to be 24 months.

- EXIM policy 2015 – 2020 is expected to double the share of India in World Trade from present level of 3% by the year 2020.This appears to the too ambitious.

Samacheer Kalvi 11th Economics Development Experiences in India Additional Questions and Answers

Part-A

Choose the best options

Question 1.

The expansion of FDI is

(a) Foreign comprehensive investment ______

(b) Foreign direct investment

(c) Foreign indirect investment

(d) Foreign private investment

Answer:

(b) Foreign direct investment

Question 2.

India ranked ______ position in Asia’s GDP.

(a) 4

(b) 3

(c) 1

(d) 2

Answer:

(b) 3

Question 3.

The monopoly and Restrictive Trade Practices Act was abolished in ______

(a) 1919

(b) 1971

(c) 1991

(d) 1791

Answer:

(c) 1991

Question 4.

Crop Insurance scheme was launched on

(a) 2009

(b) 2014

(c) 2016

(d) 2012

Answer:

(c) 2016

Question 5.

The expansion of KCC ______

(a) Kisan Crop Card

(b) Kisan Cash Card

(c) Kisan Credit Card

(d) None of the above

Answer:

(c) Kisan Credit Card

Question 6.

EPZ means ______

(a) Export Pay Zone

(b) Export Policy Zone

(c) Export Processing Zone

(d) Special Economic Zone

Answer:

(c) Export Processing Zone

Question 7.

Goods and Services Tax came into effect on ______

(a) 30,h June 2017

(b) 1st July 2016

(c) 1st July 2017

(d) 1st April 2017

Answer:

(c) 1st July 2017

Question 8.

Fiscal deficit should not exceed ______ percent of GDP

(a) 2

(b) 4

(c) 3

(d) 5

Answer:

(c) 3

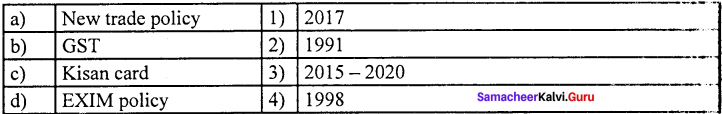

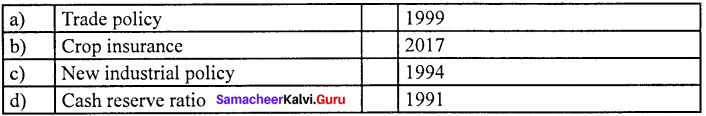

Match the following and choose the answer using the codes given below

Question 1.

(a) 1 2 3 4

(b) 2 1 4 3

(c) 3 4 2 1

(d) 1 2 4 3

Answer:

(b) 2 1 4 3

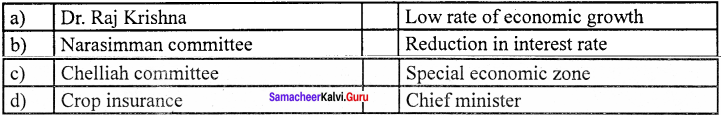

Question 2.

(a) 4 3 2 1

(b) 3 2 4 1

(c) 1 2 3 4

(d) 3 1 4 2

Answer:

(d) 3 1 4 2

Choose the correct option

Question 3.

New economic policy was introduced in

(a) 2010

(b) 1991

(c) 1884

(d) 1894

Answer:

(b) 1991

Question 4.

Kisan card was introduced in

(a) 2000

(b) 2015

(c) 1998

(d) 2017

Answer:

(c) 1998

Question 5.

was one of the first in Asia to recognize the effectiveness of the export processing zone

(a) India

(b) China

(c) America

(d) Soviet Union

Answer:

(a) India

Fill in the blanks with suitable option given below

Question 6.

Disinvestment means

(a) Selling of government securities

(b) Selling of public sectors

(c) Selling of private securities

(d) None

Answer:

(a) Selling of government securities

Question 7.

was set up to encourage FDI

(a) Domestic investment promotion board

(b) Foreign investment promotion board

(c) Both

(d) None

Answer:

(b) Foreign investment promotion board

Question 8.

The share of India to Asia’s GDP is

(a) 7.50%

(b) 6.50%

(c) 8.50%

(d) 9.50%

Answer:

(c) 8.50%

Choose the incorrect statement

Question 9.

(a) Prime minister’s crop insurance scheme was launched on 2016

(b) New industrial policy was established on 1991

(c) Kisan credit card was introduced by RBI and NABARD

(d) Goods and Services Tax was introduced in 2015

Answer:

(d) Goods and Services Tax was introduced in 2015

Question 10.

(a) New foreign trade policy was introduced on 2015

(b) First ever export processing zone was set up by China

(c) Cold storage order was introduced on 1964.

(d) India’s GDP crossed 2 trillion dollars in 2015-16

Answer:

(b) First ever export processing zone was set up by China

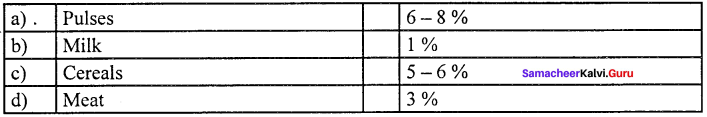

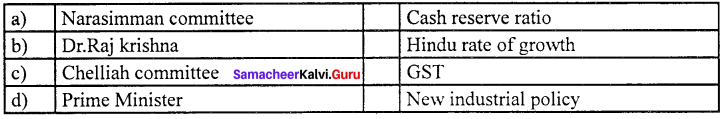

Choose the incorrect pair

Question 11.

(a) 1 2 3 4

(b) 2 1 4 3

(c) 3 4 2 1

(d) 1 2 4 3

Answer:

(b) 2 1 4 3

Question 12.

(a) 4 3 2 1

(b) 3 2 4 1

(c) 1 2 3 4

(d) 3 1 4 2

Answer:

(c) Chelliah committee (iii) GST

Choose the correct pair

Question 13.

Answer:

(d) Cash reserve ratio (iv) 1991

Question 14.

Answer:

(a) Dr.Raj Krishna (i) Low rate of economic growth

Pick the odd one out

Question 15.

(a) Liberalization

(b) Industrialization

(c) Privatization

(d) Globalization

Answer:

(b) Industrialization

Question 16.

(a) Crop insurance

(b) Cold storage

(c) Agriculture subsidy reduction

(d) Kisan credit card

Answer:

(c) Agriculture subsidy reduction

Choose the correct statement

Question 17.

(a) China is the largest producer of fruits.

(b) India is the largest producer of vegetables.

(c) Agricultural produce market committee (ADMC) promote agricultural activities.

(d) Tobacco is a plantation crop

Answer:

(c) Agricultural produce market committee (ADMC) promote agricultural activities.

Question 18.

(a) Privatization measures discourages the continuance of monopoly.

(b) Disinvestment process was fully implemented

(c) New industrial policy abolished MRTP act.

(d) Foreign investment includes FDI and FII

Answer:

(c) New industrial policy abolished MRTP act.

Analyse the reason for the following

Question 19.

Assertion (A) : Agriculture in India is highly prone to risks like droughts and floods.

Reason (R) : Agriculture is a seasonal activity.

(a) (A) and (R) are true; (R) is the correct explanation of (A)

(b) (A) and (R) are true. (R) is not the correct explanation of (A)

(c) Both (A) and (R) are false.

(d) (A) is true (R) is false.

Answer:

(a) (A) and (R) are true; (R) is the correct explanation of (A)

Question 20.

Assertion (A) : GST is a comprehensive indirect tax.

Reason (R) : GST is a multi point tax

(a) (A) is true (R) is false.

(b) (A) is false (R) is true

(c) Both (A) and (R) are true.

(d) Both (A) and (R) are false.

Answer:

(a) (A) is true (R) is false.

Part -B

Answer the following questions in one or two sentences

Question 1.

What is industrial delicensing policy or Red Tapism?

Answer:

The new industrial policy of 1991 abolished the procedure of securing licenses (Red Tapism) to start an industry which is called as industrial delicensing policy.

Question 2.

What is liberalization?

Answer:

Liberalization refers to removal of relaxation of governmental restrictions in all stages in industry.

Question 3.

What is Statutory Liquidity Ratio (SLR) ?

Answer:

SLR refers to the amount that the commercial banks require to maintain in the form of cash or gold or government approved securities before providing credit to the customers. Agricultural Produce Market Committee (APMC) is a statutory body constituted by state government in order to trade in agricultural or horticultural or livestock produce.

Question 5.

Write a note on Kisan Credit Card.

Answer:

A Kisan Credit Card (KCC) is a credit delivery mechanism that is aimed at enabling farmers to have quick and timely access to affordable credit. It was launched in 1998 by RBI and NABARD.

Question 6.

What is globalization ?

Answer:

Globalization stand for the consolidation of the various economies of the world.

Question 7.

Explain agrarian crisis after the economic reforms of 1991.

Answer:

- High input costs

- Cutback in agricultural subsidies

- Reduction of import duties

- Paucity of credit facilities.

Part – C

Answer the following questions in one Paragraph

Question 1.

What is crop insurance scheme ?

Answer:

To protect the farmers from natural calamities and ensure their credit eligibility for the next season, the Government of India introduced many agricultural schemes throughout the country.

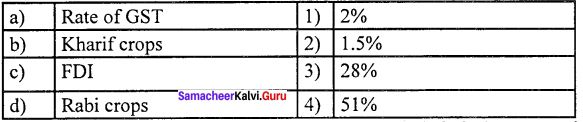

One of the scheme is the Pradhan Mantri Fasal Bima Yojana which was launched on 18 February 2016. It envisages a uniform premium of 2% for Kharif and 1.5% for Rabi and 5% for commercial and horticultural crops.

Question 2.

State the arguments against LPG.

Answer:

- Liberalization measures favor the unrestricted entry of foreign companies which prevents the growth of the local manufactures.

- Privatization measures favor the continuance of the monopoly power.

- Only the developed countries are favored under globalization but the welfare of (he less developed countries will be neglected.

Question 3.

Explain the major changes in India after 1991.

Answer:

- Foreign exchange reserves started rising.

- There was a rapid industrialization.

- The pattern of consumption started improving.

- Infrastructure facilities such as express highways, metro rails, flyovers and airports started expanding (but the local people were thrown away).

Part -D

Answer the following questions in about a page

Question 1.

Explain the measures taken in Ranking system under new economic policy 1991.

Answer:

- Reduction in statutory liquidity ratio (SLR) and the Cash Reserve Ratio (CRR) were recommended by the Narasimham Committee Report 1991.

- Interest rate liberalization.

- Greater competition among public, private and foreign banks and elimination of administrative constraints.

- Liberalization of bank branch licensing policy.

- Banks were given freedom to relocate branches and open specialised branches.

- Guidelines for opening new private sector banks.

- New accounting norms regarding classification of assets and provisions of bad debt were introduced.

We wish the knowledge shared regarding Samacheer Kalvi for Class 11th Economics Solutions Chapter 9 Development Experiences in India Questions and Answers has been helpful to you. If you need any further help feel free to ask us and we will get back to you with the possible solution. Bookmark our site to avail the latest updates on different state boards solutions in split seconds.