Students can Download Accountancy Chapter 2 Accounts of Not-For-Profit Organisation Questions and Answers, Notes Pdf, Samacheer Kalvi 12th Accountancy Book Solutions Guide Pdf helps you to revise the complete Tamilnadu State Board New Syllabus and score more marks in your examinations.

Tamilnadu Samacheer Kalvi 12th Accountancy Solutions Chapter 2 Accounts of Not-For-Profit Organisation

Samacheer Kalvi 12th Accountancy Accounts of Not-For-Profit Organisation Text Book Back Questions and Answers

I. Choose the Correct Answer

12th Accountancy 2nd Chapter Answers Question 1.

Receipts and payments account is a …………….

(a) Nominal A/c

(b) Real A/c

(c) Personal A/c

(d) Representative personal account

Answer:

(b) Real A/c

12th Accountancy Chapter 2 Question 2.

Receipts and payments account records receipts and payments of …………….

(a) Revenue nature only

(b) Capital nature only

(c) Both revenue and capital nature

(d) None of the above

Answer:

(c) Both revenue and capital nature

12th Accountancy 2nd Chapter Question 3.

Balance of receipts and payments account indicates the …………….

(a) Loss incurred during the period

(b) Excess of income over expenditure of the period

(c) Total cash payments during the period

(d) Cash and bank balance as on the date

Answer:

(d) Cash and bank balance as on the date

12th Accounts 2nd Chapter Question 4.

Income and expenditure account is a …………….

(a) Nominal A/c

(b) Real A/c

(c) Personal A/c

(d) Representative personal account

Answer:

(a) Nominal A/c

Samacheer Kalvi 12th Accountancy Solutions Chapter 2 Question 5.

Income and Expenditure Account is prepared to find out …………….

(a) Profit or loss

(b) Cash and bank balance

(c) Surplus or deficit

(d) Financial position

Answer:

(c) Surplus or deficit

12th Accountancy Solutions Samacheer Kalvi Question 6.

Which of the following should not be recorded in the income and expenditure account?

(a) Sale of old news papers

(b) Loss on sale of asset

(c) Honorarium paid to the secretary

(d) Sale proceeds of furniture

Answer:

(d) Sale proceeds of furniture

Samacheer Kalvi 12th Accountancy Solutions Question 7.

Subscription due but not received for the current year is …………….

(a) An asset

(b) A liability

(c) An expense

(d) An item to be ignored

Answer:

(a) An asset

12th Account Chapter 2 Question 8.

Legacy is a …………….

(a) Revenue expenditure

(b) Capital expenditure

(c) Revenue receipt

(d) Capital receipt

Answer:

(d) Capital receipt

12 Accountancy Chapter 2 Question 9.

Donations received for a specific purpose is …………….

(a) Revenue receipt

(b) Capital receipt

(c) Revenue expenditure

(d) Capital expenditure

Answer:

(b) Capital receipt

Samacheer Kalvi Guru 12th Accountancy Question 10.

There are 500 members in a club each paying ₹ 100 as annual subscription. Subscription due but not received for the current year is ₹ 200; Subscription received in advance is ? 300. Find out the amount of subscription to be shown in the income and expenditure account,

(a) ₹ 50, 000

(b) ₹ 50, 200

(c) ₹ 49, 900

(d) ₹ 49, 800

Answer:

(a) ₹ 50,000

II. Samacheer Kalvi 12th Accountancy Guide Very Short Answer Questions

12th Samacheer Kalvi Accountancy Solution Book Question 1.

State the meaning of not-for-profit organisation.

Answer:

Some organisations are established for the purpose of rendering services to the public without any profit motive. They may be created for the promotion of art, culture, education and sports, etc. These organisations are called not-for-profit organisation.

12th Accountancy Answer Question 2.

What is receipts and payments account?

Answer:

Receipts and Payments account is a summary of cash and bank transactions of not-for-profit organisations prepared at the end of each financial year. It is a real account in nature.

12th Accountancy Guide Samacheer Kalvi Question 3.

What is legacy?

Answer:

It is the amount given to a non-trading concern as per the will. It is like a donation. It appears on the debit side of receipts and payments account, but is not treated as income because it is not of recurring nature. It is a capital receipt.

+2 Accountancy Question 4.

Write a short note on life membership fees.

Answer:

Life membership fee is accounted as a capital receipt and added to capital fund on the liabilities side of Balance sheet. It is non – recurring in nature.

Class 12 Accountancy Chapter 2 Solutions Question 5.

Give four examples for capital receipts of not-for-profit organisation.

Answer:

- Life membership fees

- Legacies

- Specific donation

- Sale of fixed assets

Class 12 Accountancy Chapter 2 Question 6.

Give four examples for revenue receipts of not-for-profit organisation.

Answer:

- Subscription

- Interest on investment

- Interest on fixed deposit

- Sale of old sports material

III. Short Answer Questions

Chapter 2 Accountancy Class 12 Solutions Question 1.

What is income and expenditure account?

Answer:

Income and expenditure account is a summary of income and expenditure of a not-for-profit organisation prepared at the end of an accounting year. It is prepared to find out the surplus or deficit pertaining to a particular year. It is a nominal account in nature in which items of revenue receipts and revenue expenditure relating to the current year alone are recorded.

Class 12th Accountancy Chapter 2 Solutions Question 2.

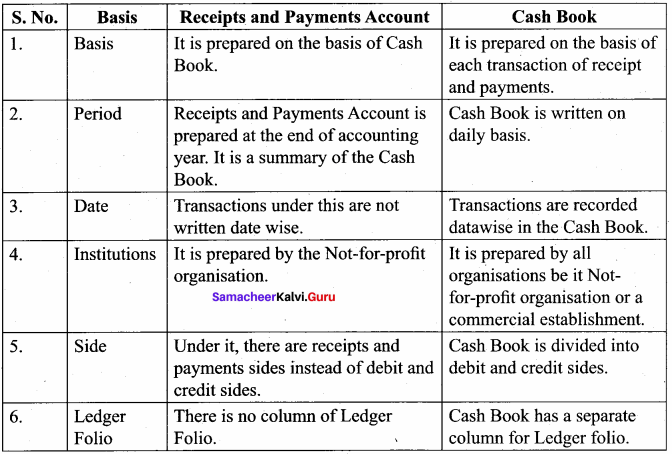

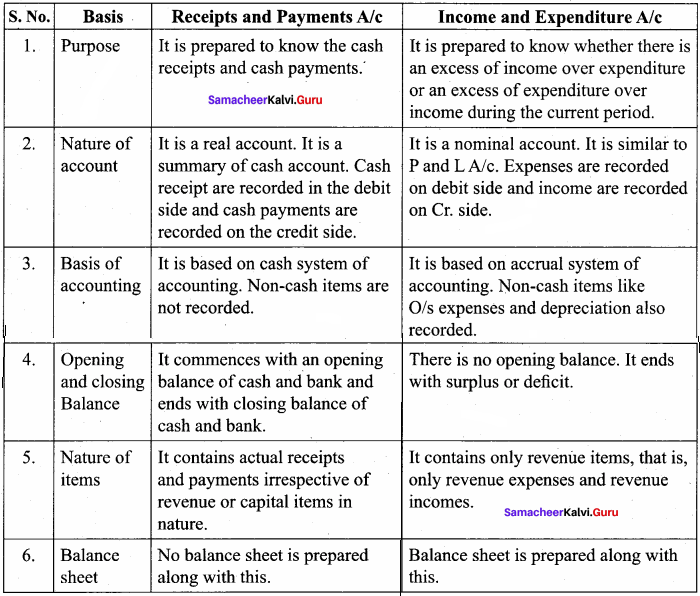

State the differences between Receipts and Payments Account and Income and Expenditure Account.

Answer:

Plus Two Accountancy Chapter 2 Question 3.

How annual subscription is dealt with in the final accounts of not-for-profit organisation?

Answer:

(A) Treatment in income and expenditure account:

When subscription received for the current year, previous years and subsequent period are given separately, subscription received for the current year will be shown on the credit side of income and expenditure account after making the adjustments given below:

- Subscription outstanding for the current year is to be added.

- Subscription received in advance in the previous year which is meant for the current year is to be added.

When total subscription received in current year is given:

- Subscription outstanding in the previous year which is received in the current year will be subtracted.

- Subscription received in advance in the previous year which is meant for the current year is added and subscription received in advance must be subtracted.

(B) Treatment in Balance sheet:

- Subscription outstanding for the current year and still outstanding for the previous year will be shown on the asset side of the Balance sheet.

- Subscriptions received in advance in the current year will be shown on the liabilities side of the Balance sheet.

Samacheer Kalvi 12th Accountancy Book Solutions Question 4.

How the following items are dealt with in the final accounts of not-for-profit organisation?

- Sale of sports materials

- Life membership fees

- Tournament fund

Answer:

1. Sale of sports materials:

The sale proceeds of old sports materials like balls and bats, etc., are revenue receipts.

2. Life membership fees:

Amount received like membership fee from members is a capital receipt as it is non – recurring in nature.

3. Tournament fund:

It is recurring in nature. It is revenue receipt. It is shown on liabilities side of balance sheet. Opening balance added donations and subtracted expenses incurred.

IV. Exercises

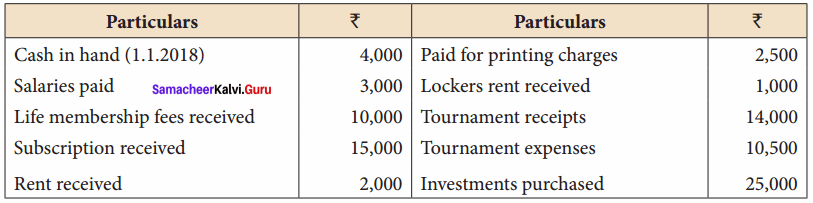

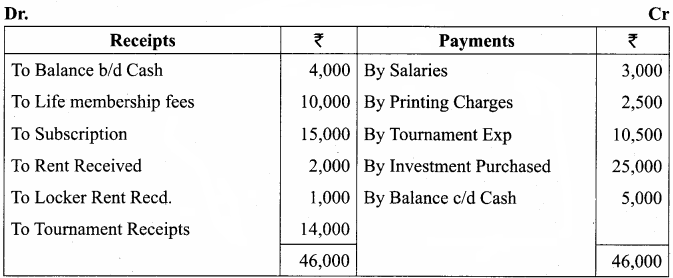

12th Samacheer Kalvi Accountancy Solutions Question 1.

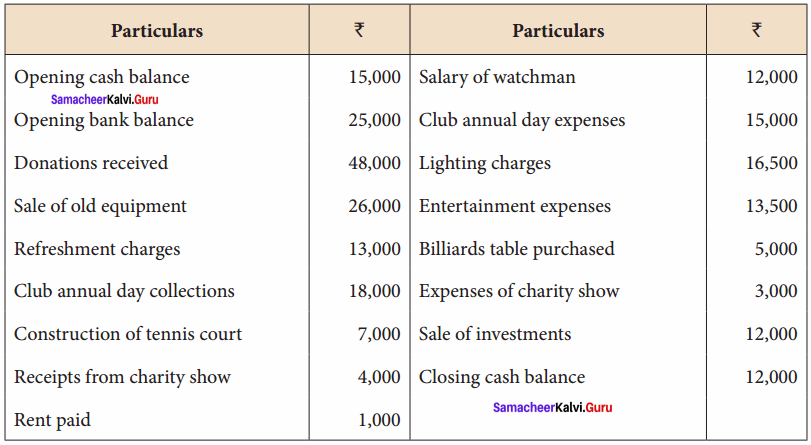

From the information given below, prepare Receipts and Payments account of Kurunji Sports Club for the year ended 31st December, 2018.

Answer:

Kurinji Sports Club Account for the year ended 31st Dec 2018

Receipts and Payments

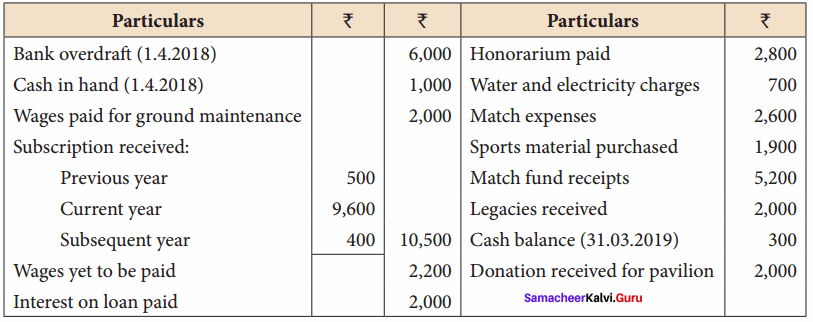

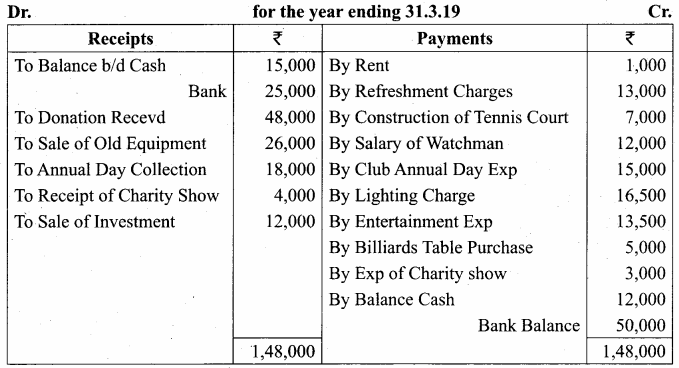

Tn 12th Accountancy Solutions Question 2.

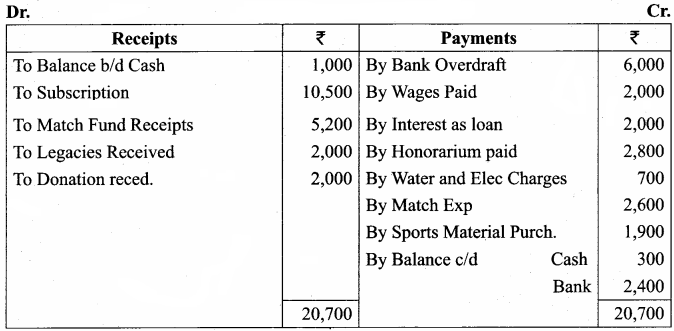

From the information given below, prepare Receipts and Payments account of Coimbatore Cricket Club for the year ending 31st March, 2019.

Answer:

Coimbatore Cricket Club Receipts and Payments Account

for the year ending 31.03.19

Samacheer Kalvi 12 Accountancy Solutions Question 3.

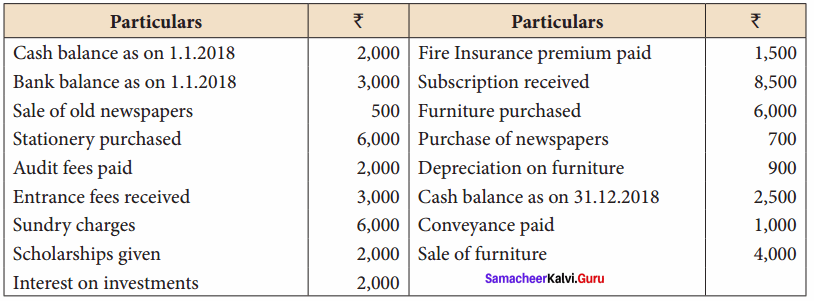

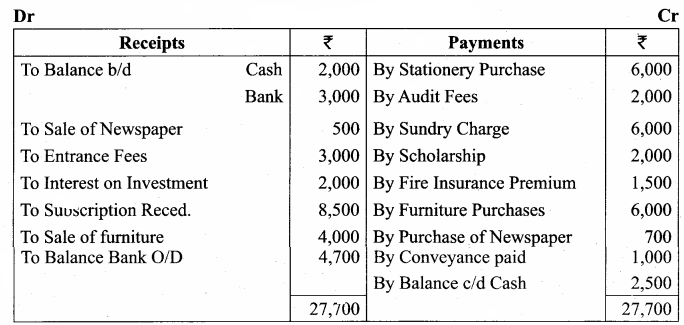

From the information given below, prepare Receipts and Payments account of Madurai Mother Theresa Mahalir Mandram for the year ended 31st December, 2018.

Answer:

Madurai Mother Theresa Mahalir Mandram Receipts and Payments Account for the year ending 31.12.18

Std 12 Account Chapter 2 Question 4.

Mayiladuthurai Recreation Club gives you the following details. Prepare Receipts and Payments account for the year ended 31st March, 2019.

Answer:

Mayiladuthurai Recreation Club Receipts and Payments Account for the year ending 31.3.19

12th Accounts Chapter 2 Question 5.

From the following information, prepare Receipts and Payments account of Cuddalore Kabaddi Association for the year ended 31st March, 2019.

Cuddalore Kabadi Association Receipts and Payments Account for the year ending 31.03.19

Answer:

12th Accountancy Book Answers Question 6.

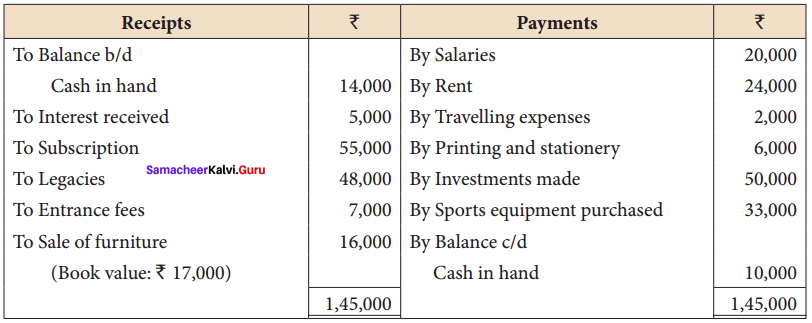

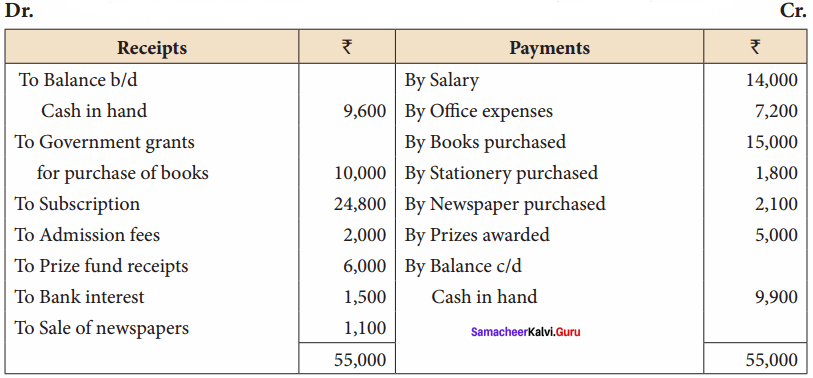

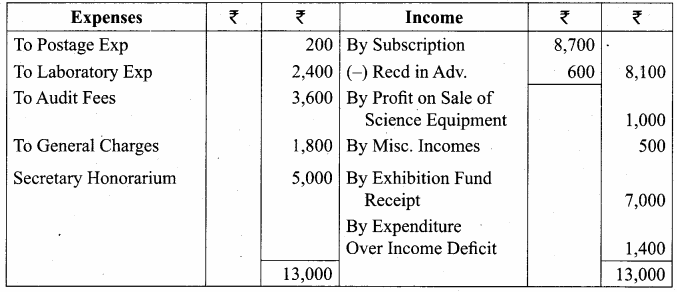

From the following receipts and payments account of Tenkasi Thiruvalluvar Manram, prepare income and expenditure account for the year ended 31st March, 2019.

Answer:

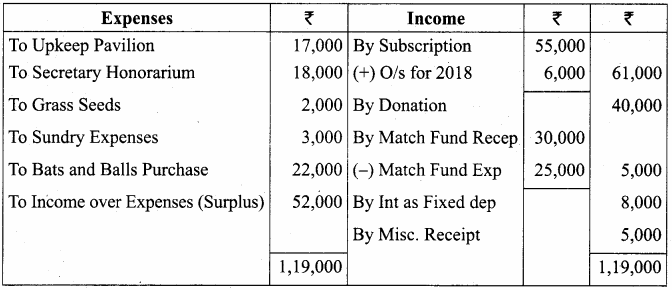

Tenkasi Thiruvalluvar Manram Income and Expenditure Account for the year ended 31.03.19

Accountancy Class 12 Chapter 2 Solutions Question 7.

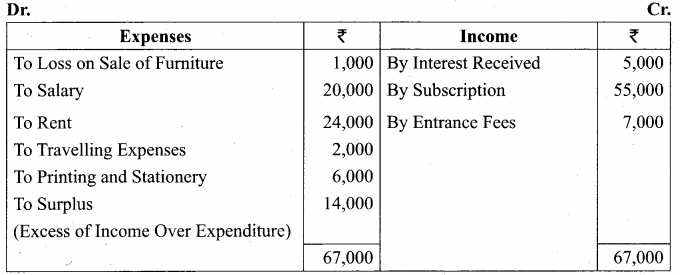

From the following receipts and payments account, prepare income and expenditure account of Kumbakonam Basket Ball Association for the year ended 31st March, 2018.

Answer:

Kumbakonam Basket Ball Association Income & Expenditure Account for the year ended 31.03.19

Accounting For Non Profit Organisation Questions And Answers Question 8.

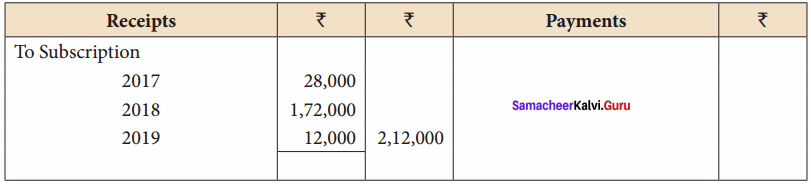

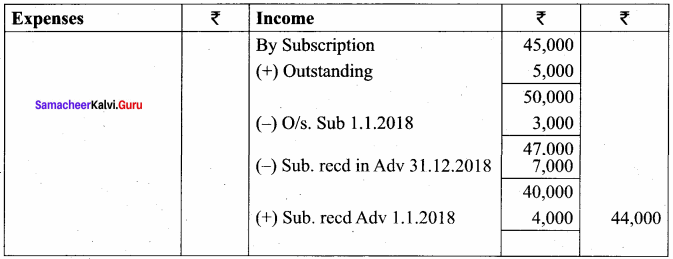

From the following receipts and payments account and the additional information given below, calculate the amount of subscription to be shown in Income and expenditure account for the year ending 31st December, 2018.

Answer:

Income and Expenditure Account for the year ended 31.12.18

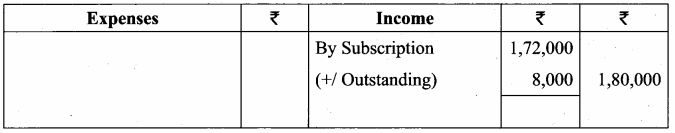

Not-For-Profit Organisation Class 12 Notes Pdf Download Question 9.

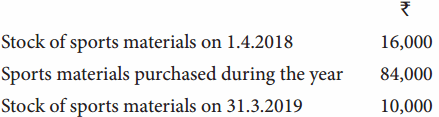

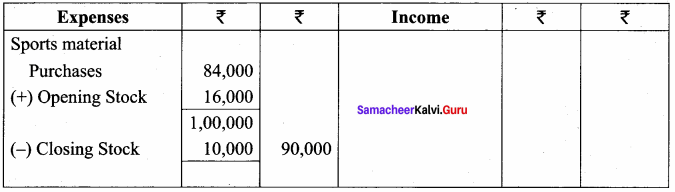

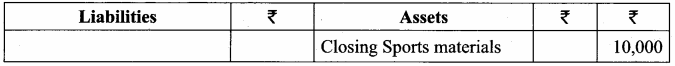

How the following items will appear in the final accounts of a club for the year ending 31st March 2019?

Receipts and Payments Account for the year ended 31st March, 2019

Answer:

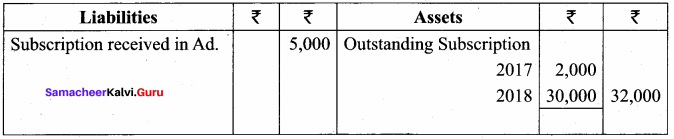

There are 200 members in the club each paying an annual subscription of ₹ 400 per annum. Subscription still outstanding for the year 2017 – 2018 is ₹ 2,000.

Income & Expenditure Account for the year ended 31.03.2019

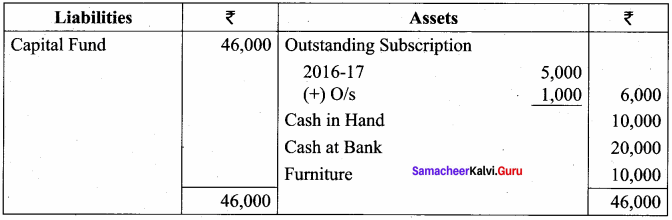

Balance Sheet as on 31.03.19

Non Profit Organisation Questions Question 10.

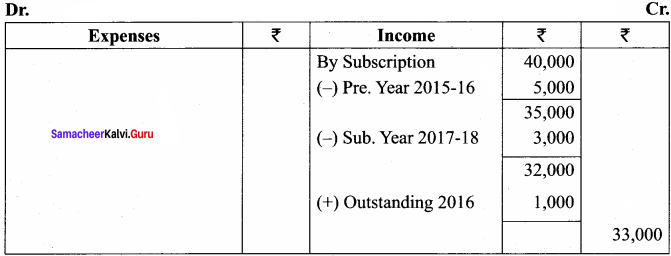

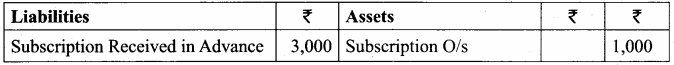

How will the following items appear in the final accounts of a club for the year ending 31st March 2017? Received subscription of ₹ 40,000 during the year 2016 – 17. This includes subscription of ₹ 5,000 for 2015 – 16 and ₹ 3,000 for the year 2017 – 18. Subscription of ₹ 1,000 is still outstanding for the year 2016 – 17.

Answer:

Income & Expenditure Account for the year ended 31.03.19

Balance Sheet as on 31.03.19

Balance Sheet as on 31.03.19

12th Accountancy Samacheer Kalvi Question 11.

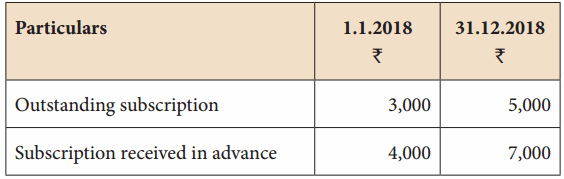

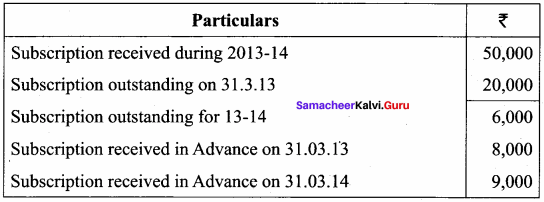

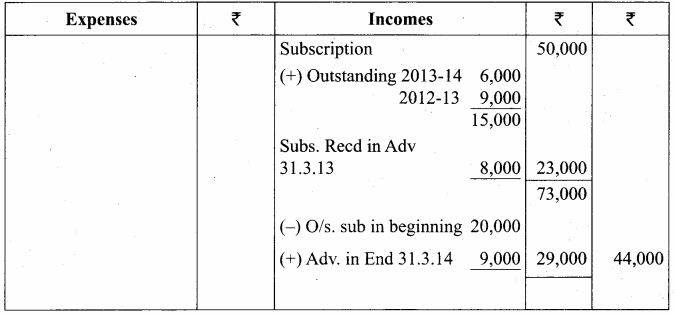

Compute income from subscription for the year 2018 from the following particulars relating to a club.

Answer:

Subscription received during the year 2018: ₹ 45,000. Income & Expenditure Account for the year ended 31.03.2019

Samacheer Kalvi 12th Accountancy Solution Book Question 12.

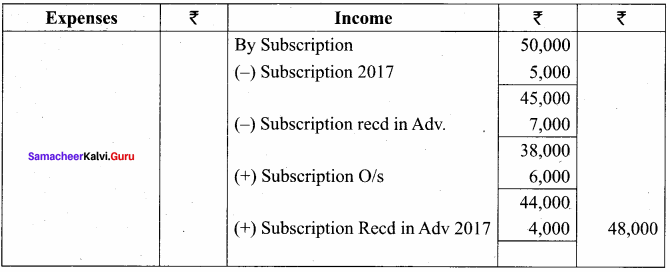

From the following particulars, show how the item ‘subscription’ will appear in the Income and Expenditure Account for the year ended 31 – 12 – 2018?

Subscription received in 2018 is ₹ 50,000 which includes ₹ 5,000 for 2017 and ₹ 7,000 for 2019. Subscription outstanding for the year 2018 is ₹ 6,000. Subscription of ₹ 4,000 was received in advance for 2018 in the year 2017.

Answer:

Income and Expenditure Account for the year ended 31.12.2018

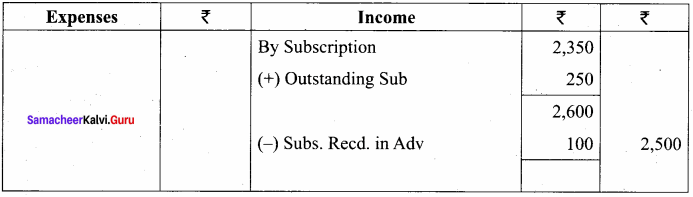

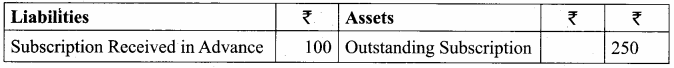

Samacheer Kalvi Accountancy Question 13.

How the following items appear in the final accounts of Thoothukudi Young Pioneers Association?

There are one hundred members in the association each paying ₹ 25 as annual subscription. By the end of the year 10 members had not paid their subscription but four members had paid for the next year in advance.

Income & Expenditure Account for the year ended

Answer:

Balance Sheet as on …………..

Samacheer Kalvi 12th Accountancy Book Solutions Guide Question 14.

How will the following appear in the final accounts of Marthandam Women Cultural Association?

Answer:

Income and Expenditure Account for the year ended 31.03.19

Balance Sheet as on 31.03.19

Samacheer Kalvi 12th Accountancy Book Question 15.

How will the following appear in the final accounts of Vedaranyam Sports club?

Answer:

Income & Expenditure Account for the year ended

Balance Sheet as on …………..

12th Accountancy Question 16.

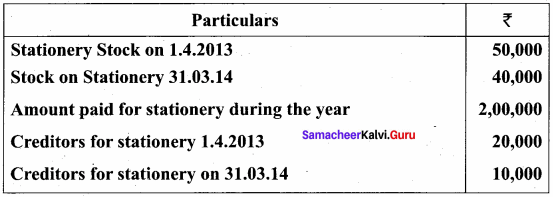

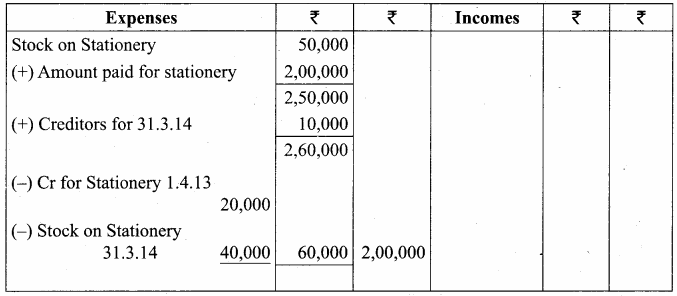

Show how the following items appear in the income and expenditure account of Sirkazhi Singers Association?

Answer:

Income and Expenditure Account for the year ended 31.03.18

Chapter 2 Accounting For Not For Profit Organisation Question 17.

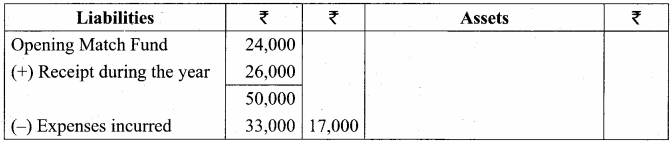

Chennai tennis club had Match fund showing credit balance of ₹ 24,000 on 1st April, 2018. Receipt to the fund during the year was ₹ 26,000. Match expenses incurred during the year was ₹ 33,000. How these items will appear in the final accounts of the club for the year ended 31st March, 2019?

Balance Sheet as on 31.03.2019

Answer:

Income and Expenditure Account for the year ended 31.03.18

Account 2nd Chapter Question 18.

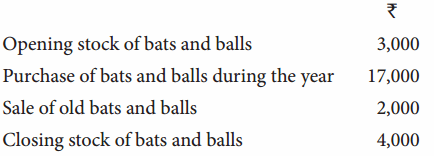

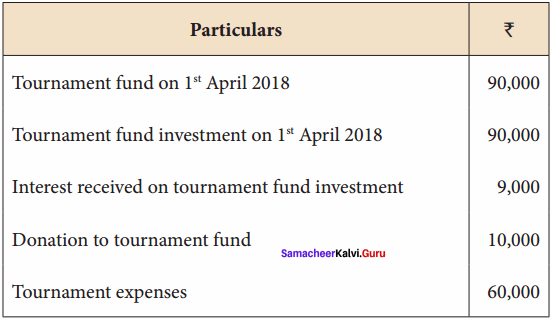

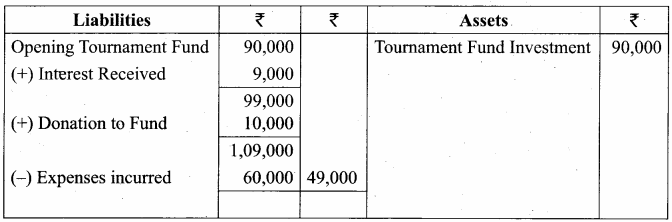

How will the following appear in the final accounts of Karaikudi sports club for the year ending 31stMarch, 2019?

Answer:

Balance Sheet as on 31.03.19

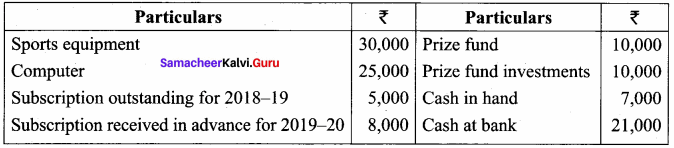

12th Samacheer Accountancy Solutions Question 19.

Compute capital fund of Salem Sports Club as on 1.4.2019.

Answer:

Balance Sheet as on 01.04.2019

Samacheer Kalvi Class 12 Accountancy Question 20.

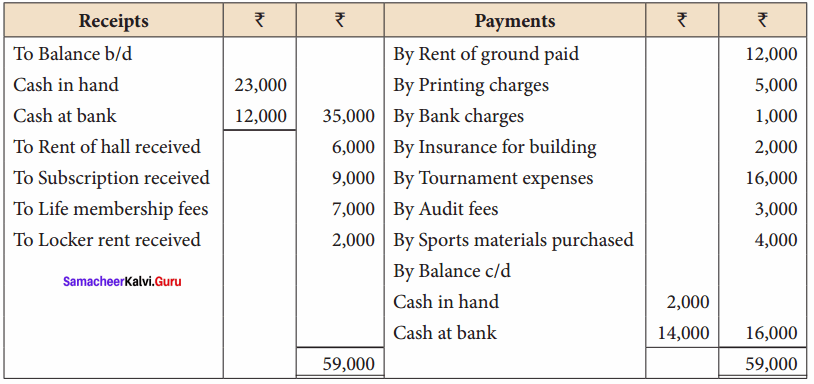

From the following Receipts and Payments account and from the information given below of Ramanathapuram Sports Club, prepare Income and Expenditure account for the year ended 31st December, 2018 and the balance sheet as on that date.

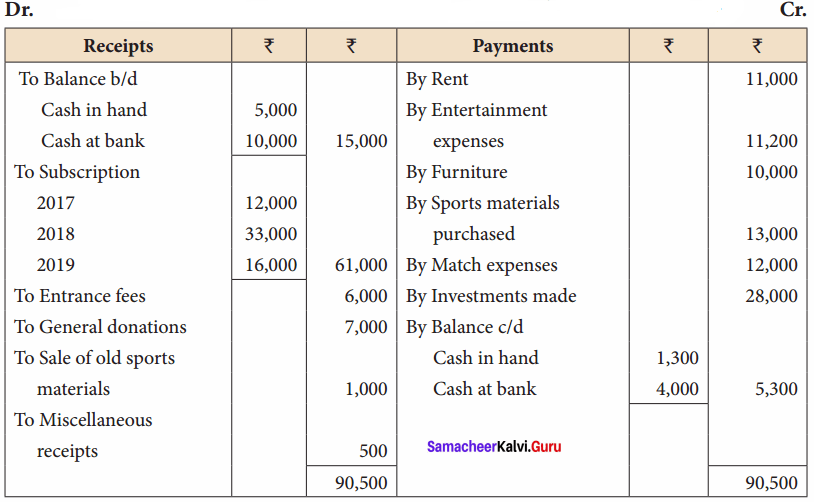

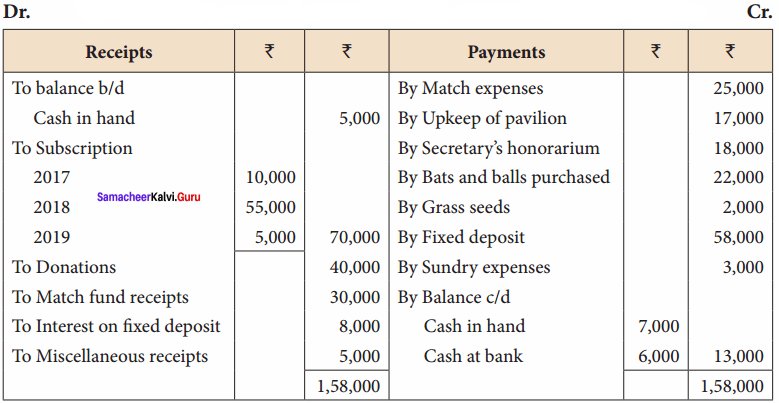

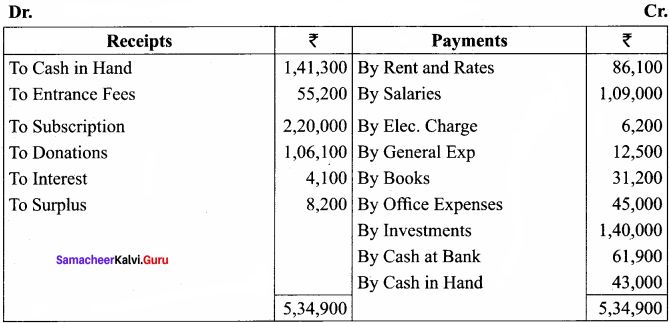

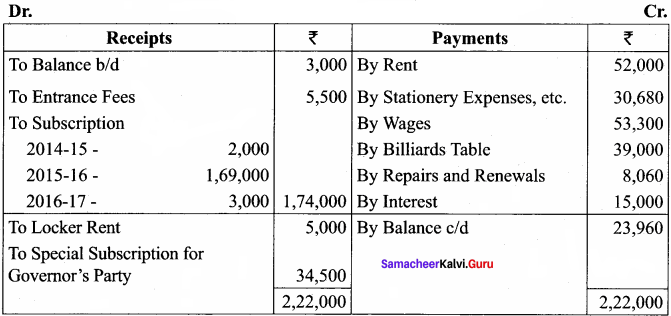

Receipts and Payments Account for the year ended 31st December, 2018

Additional information:

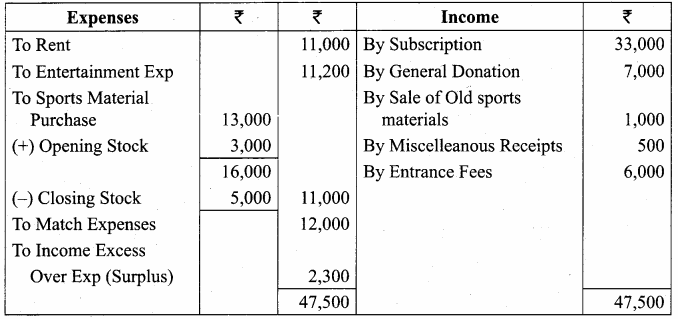

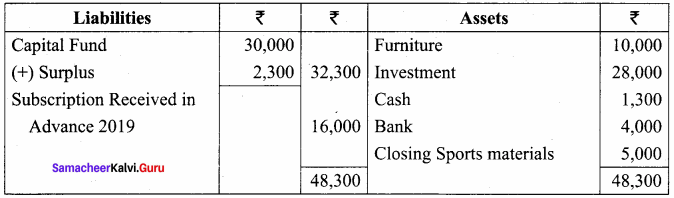

- Capital fund as on 1st January 2018 ₹ 30,000.

- Opening stock of sports material ₹ 3,000 and closing stock of sports material ₹ 5,000.

Answer:

Income and Expenditure Account for the year ended 31.12.18

Balance Sheet as on 31.12.18

12th Accountancy Samacheer Question 21.

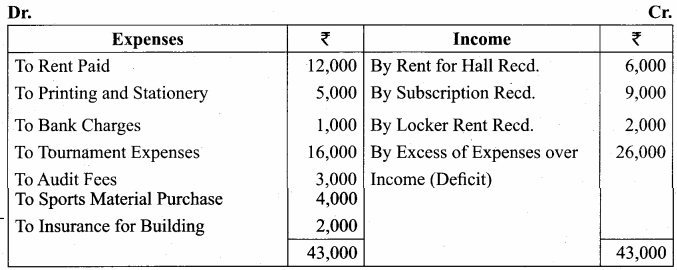

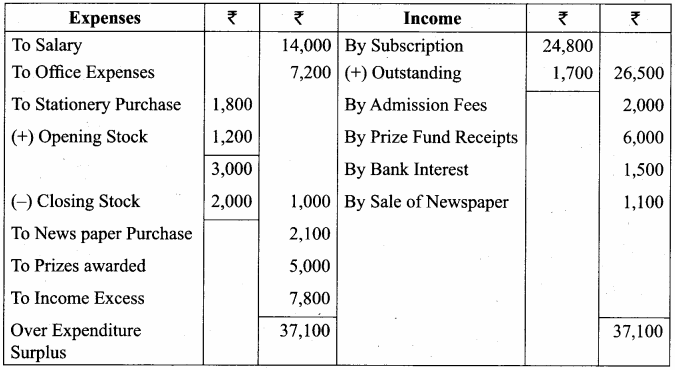

From the following Receipts and Payments account of Yercaud Youth Association, prepare Income and expenditure account for the year ended 31st March, 2019 and the balance sheet as on that date.

Receipts and Payments Account for the year ended 31st March, 2019

Additional information:

- Opening capital fund ₹ 20,000.

- Stock of books on 1.4.2018 ₹ 9,200.

- Subscription due but not received ₹ 1,700.

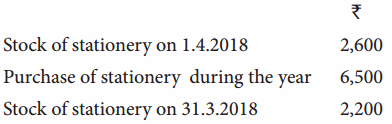

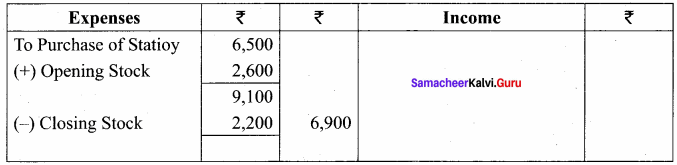

- Stock of stationery on 1.4.2018 ₹ 1,200 and stock of stationery on 31.3.2019, ₹ 2,000

Income and Expenditure Account for the year ended 31.03.19

Balance Sheet as on 31.03.2019

Samacheer Kalvi 12th Accountancy Solutions Chapter 1 Question 22.

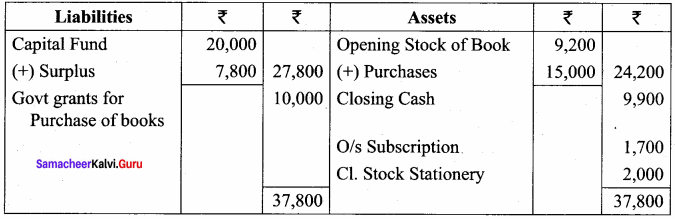

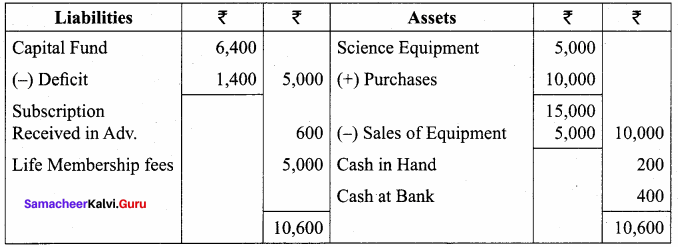

Following is the Receipts and Payments account of Neyveli Science Club for the year ended 31st December, 2018.

Receipts and Payments Account for the year ended 31st December, 2018

Additional information:

- Opening capital fund ₹ 6,400

- Subscription includes ₹ 600 for the year 2019

- Science equipment as on 1.1.2018 ₹ 5,000

- Surplus on account of exhibition should be kept in reserve for new auditorium.

Prepare income and expenditure account for the year ended 31st December, 2018 and the balance sheet as on that date.

Answer:

Income and Expenditure Account for the year ended 31.12.18

Balance Sheet as on 31.12.2018

12th Accountancy Solutions Question 23.

From the following Receipts and Payments account of Sivakasi Pensioner’s Recreation Club, prepare income and expenditure account for the year ended 31st March, 2018 and the balance sheet as on that date.

Receipts and Payments Account for the year ended 31st March, 2018

Additional information:

- The club had 300 members each paying ₹ 100 as annual subscription.

- The club had furniture ₹ 10,000 on 1.4.2017.

- The subscription still due but not received for the year 2016 – 2017 is ₹ 1,000.

Income and Expenditure Account for the year ended 31.03.18

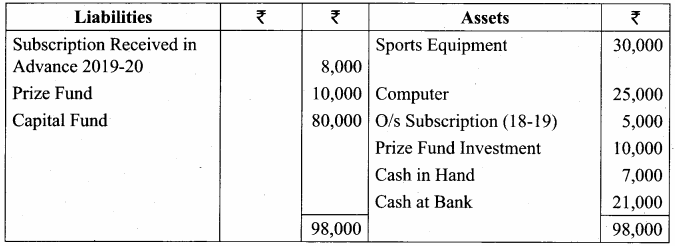

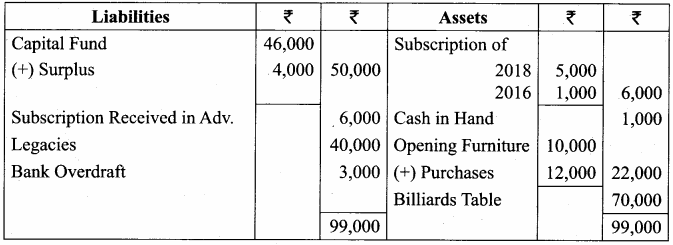

Opening Balance Sheet as on 1.1.18

Balance Sheet as on 31.12.2019

Accountancy 2nd Chapter Question 24.

Following is the Receipts and payments account of Virudhunagar Volleyball Association for the year ended 31st December, 2018.

Receipts and Payments Account for the year ended 31st December, 2018

Answer:

Additional information:

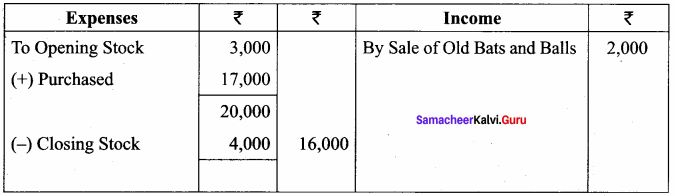

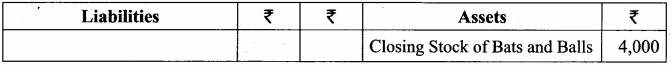

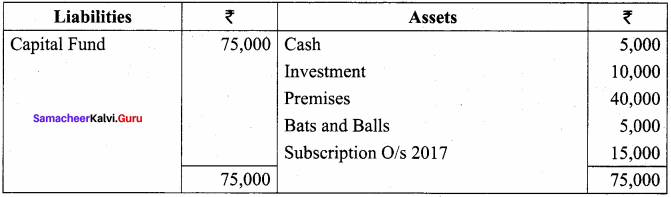

- On 1.1.2018, the association owned investments ₹ 10,000, premises and grounds ₹ 40,000, stock of bats and balls ₹ 5,000.

- Subscription ₹ 5,000 related to 2017 is still due.

- Subscription due for the year 2018, ₹ 6,000.

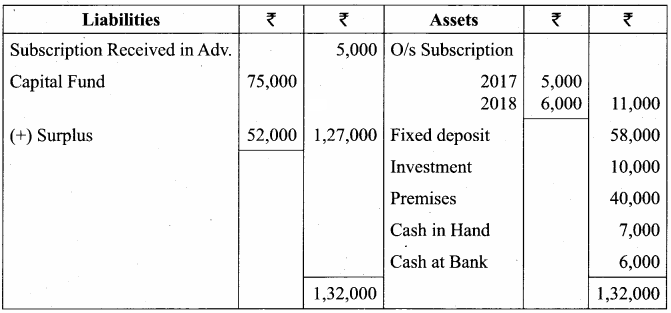

Prepare income and expenditure account for the year ended 31st December, 2018 and the balance sheet as on that date.

Answer:

Income and Expenditure Account for the year ended 31.12.18

Opening Balance Sheet as on 1.1.18

Balance Sheet as on 31.12.2109

Samacheer Kalvi 12th Accountancy Accounts of Not-For-Profit Organisation Additional Questions and Answers

I. Choose the correct answer

Question 1.

State the primary motive of not-for-profit organisation?

(a) Producing goods

(b) Provide service

(c) Both

(d) None of these

Answer:

(b) Provide service

Question 2.

State the nature of Life membership subscription.

(a) Cash Payments

(b) Cash Receipts

(c) Capital Receipt

(d) None of these

Answer:

(b) Cash Receipts

Question 3.

On which basis Receipt and Payment Account is prepared?

(a) Cash basis

(b) Credit basis

(c) Accrual basis

(d) None of these

Answer:

(a) Cash basis

Question 4.

Classify the subscription received during the year of not-for-profit organisation.

(a) Capital Receipt

(b) Capital Expenditure

(c) Revenue Receipt

(d) Both

Answer:

(c) Revenue Receipt

Question 5.

State the nature of Receipt and Payment A/c for not-for-profit organisation.

(a) Real Account

(b) Personal A/c

(c) Nominal A/c

(d) Representative Personal A/c

Answer:

(a) Real Account

Question 6.

Subscription received in advance is

(a) An Asset

(b) Income

(c) A Liability

(d) Expenditure

Answer:

(c) A Liability

II. Fill in the blanks

Question 7.

Not-for-profit organisation set up with the objective of ……………. of the society.

Answer:

Welfare

Question 8.

The nature of Receipt and Payments Account is …………….

Answer:

An Asset

Question 9.

Receipt and Payment Account is prepared as ……………. basis of accounting.

Answer:

Cash

Question 10.

Nature of Income over Expenditure Account is …………….

Answer:

Nominal Account

Question 11.

Excess of Income over Expenditure, the result is …………….

Answer:

Real surplus Account

Question 12.

Excess of Expenditure over the Income, the result is …………….

Answer:

Definite Liability

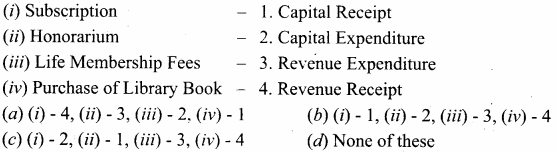

III. Match the following

Question 13.

Answer:

(a) 4, 3, 1, 2

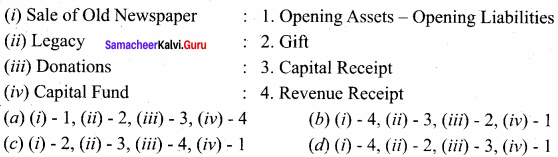

Question 14.

Answer:

(a) 4, 3, 1, 2

IV. Assertion and Reason:

Question 15.

Assertion : Life Membership Fee: Amount received towards life membership fee from the members is a capital receipt.

Reason : It is non – recurring nature.

(a) Assertion and Reason is correct

(b) Assertion is incorrect Reason is correct

(c) Assertion is correct

(d) Both are incorrect

Answer:

(a) Assertion and Reason is correct

Question 16.

Specific Donation : Assertion : Donation is received with a specific condition for a particular purpose like sports fund is a specific donations.

Reason : It is Capital Receipt.

(a) Assertion and Reason is incorrect

(b) Assertion and Reason is correct

(c) Assertion is correct Reason is incorrect

(d) Assertion is incorrect Reason is correct

Answer:

(b) Assertion and Reason is correct

Question 17.

Identify wrong statement about Entrance Fees

(a) Is a amount paid by a person at the time of becoming a member

(b) Is a income of Not-for-profit organisation

(c) It is a revenue receipt of organisation

(d) Is debited to Income and Expenditure Account

Answer:

(d) Is debited to Income and Expenditure Account

V. Very Short Answer Questions

Question 1.

What are the features of Not-for-profit-organisation?

Answer:

- Main aim is service

- Profit is not the criterion

- Surplus not distributed among its members

- Separate entity

- Unique names connect their working

- Management by elected persons

Question 2.

What are books maintained by Not-for-profit organisation?

Answer:

- Cash Book

- Ledger

- Member’s Register

- Register of Assets

- Final Accounts: (a) Receipt and payments Account

- Income and Expenditure Account

- Balance Sheet

VI. Exercises:

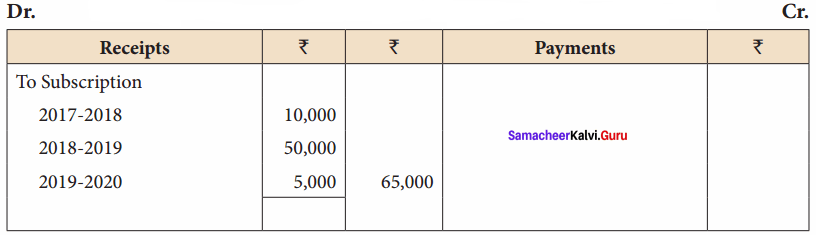

Question 1.

Subscription of ₹ 9,000 is still in arrears for the year 2012 – 13. Prepare Income and Expenditure Account for 2013 – 2014.

Answer:

Income and Expenditure Account for the year 31.03.14

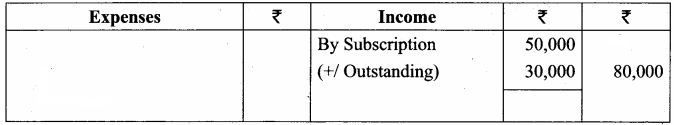

Question 2.

Answer:

Income and Expenditure Account for the year 31.3.14

Question 3.

What are the steps in preparation of Income and Expenditure from Receipts and Payments account?

Answer:

1. Opening and Closing balances of cash and bank a/cs in receipts and payment account must be excluded.

2. Capital receipts and capital expenditure must be excluded.

3. Only revenue receipts pertaining to the current year should be taken to the credit side of income and expenditure account. Due adjustments should be made for income received in advance income accrued for the current year and for the amount relating to the previous year or years.

4. Similarly revenue expenditure relating to the current year only must be taken in the debit side of income and expenditure account. Adjustment must be made for outstanding expenses of the previous year and current year and for the prepaid expenses of the previous year and current year.

5. Any income or expense relating to specific fund must not be taken to income and expenditure account.

6. Non – Cash items such as bad debts, depreciation, loss or gain on sale of assets etc. which are not recorded in receipt and payments account must be recorded in income and expenditure account.

7.The balancing figure of income and expenditure account is either surplus or deficit and will be transferred to capital fund in the balance sheet. If the total of credit side of income and expenditure account is more than the total of debit side (excess of income over expenditure), the difference represents surplus. If the debit side total income and expenditure is more than the total of credit side), the difference represents deficit.

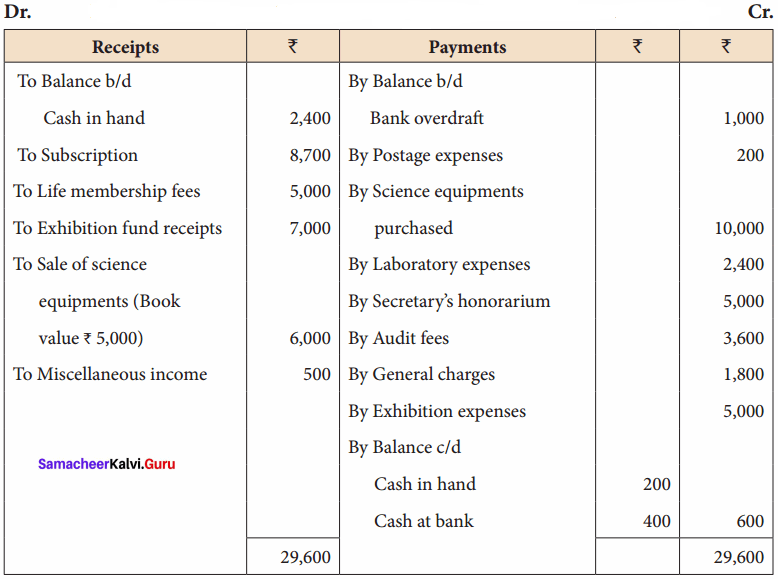

Question 4.

Following is the summary of cash transactions of Friends Club for the year ended 31st March 2016. Prepare Income and Expenditure Account for the year ended 31st March 2016, and also Balance Sheet at that date.

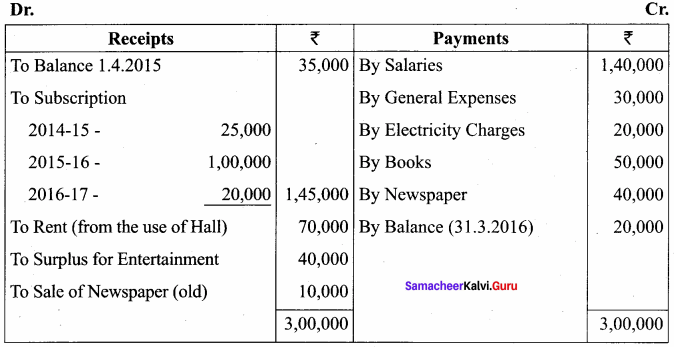

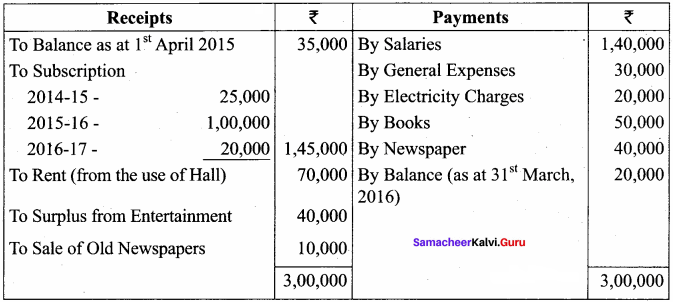

Receipts and Payments Account

Additional Information:

- In the beginning of the year, the club had books worth ₹ 3,00,000 and Furniture worth ₹ 58,000.

- Subscription in Arrear 1st April 2015 When ₹ 6,000 and ₹ 7,000 on 31st March 2016.

- 18,000 was due by of Rent in the beginning as well at the end of the year.

- Write off Rs. 5,000 from Furniture and ₹ 30,000 from Banks.

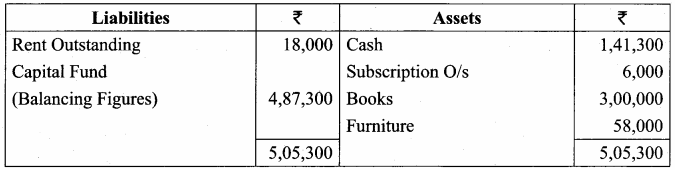

Balance Sheet as on 01.04.2015

Answer:

Friends Club:

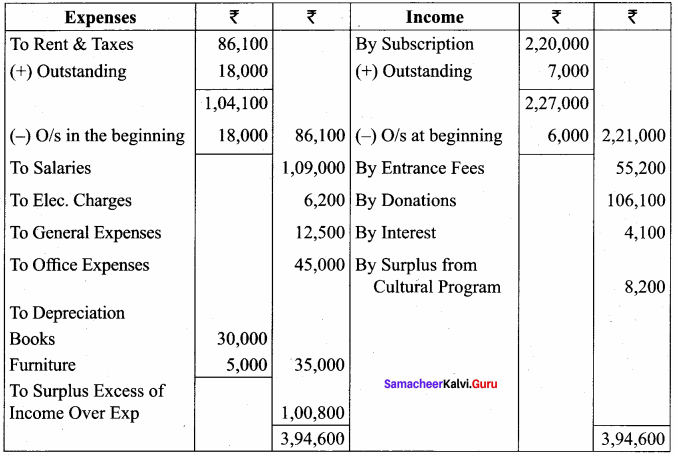

Income and Expenditure Account for the year ended.

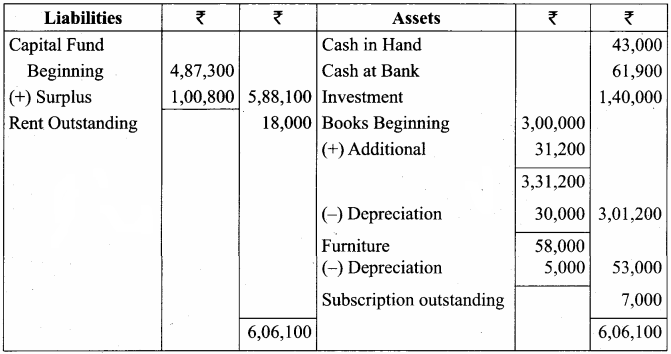

Balance Sheet as on 31.03.2016

Question 5.

From the following Receipts and Payments Account of Defence Club and from the information supplied, prepare Income and Expenditure Account for the year ended 31st March 2016 and Balance Sheet as on that date.

Receipts and Payments Account for the year ended 31.3.2016

- The Club has 50 members each paying an annual subscription of ₹ 2,500. Subscription outstanding in 31.03.2015 were to extent of ₹ 3,000

- On 31st March 2016, Salaries Outstanding amounted to ₹ 10,000. Salaries Paid in 2015 – 16 included ₹ 30,000 for the year 14 – 15

- On 1st April 2015, the Club owned Building valued @ ₹ 10,00,000; Furniture Worth of ₹ 1,00,000 and Books ₹ 1,00,000

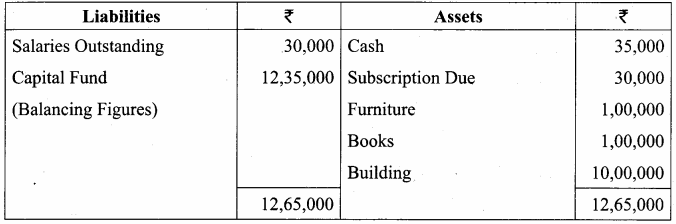

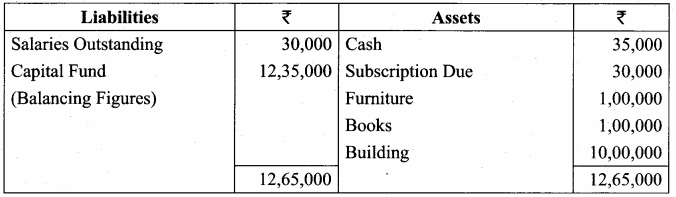

Balance Sheet as on 1.4.2015

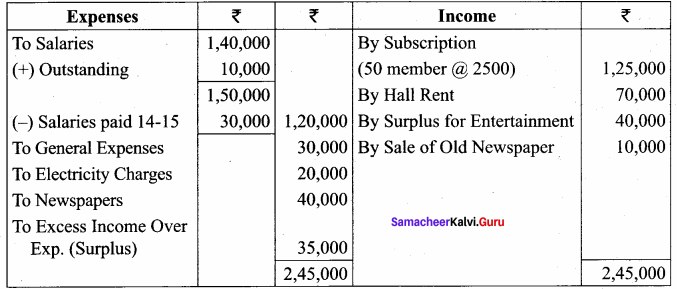

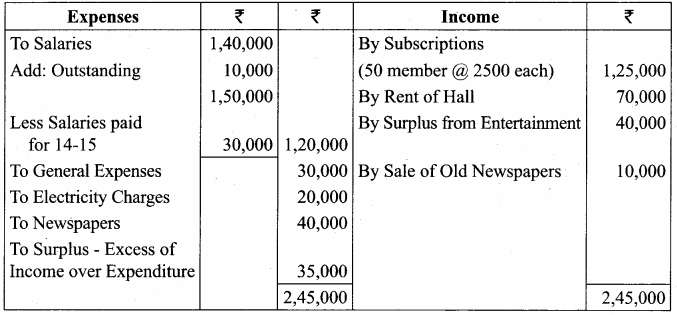

Income and Expenditure Account for the year ended 31.3.16

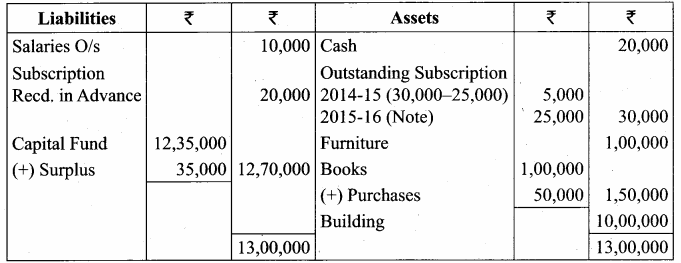

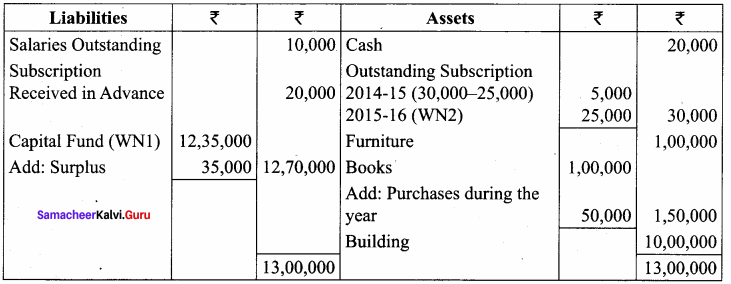

Balance Sheet as on 31.03.2016

Question 6.

From the following Receipts and Payments Account of Defence Club and from the information supplied, prepare Income and Expenditure Account for the year ended 31st March 2016 and Balance sheet as on that date.

Receipts and Payments Accounts for the year ended 31st March 2016

- The Club has 50 members each paying an annual subscription of ₹ 2,500. Subscriptions outstanding on 31st March, 2015 were to the extent of ₹ 30,000.

- On 31st March, 2016, Salaries Outstanding amounted to ₹ 10,000. Salaries Paid in 2015 – 16 included ₹ 30,000 for the year 2014 – 15

- On 1st April 2015, the Club owned building valued at ₹ 10,00,000. Furniture worth ₹ 1,00,000 and Books ₹ 1,00,000.

Answer:

Defence Club

Income and Expenditure Account for the year ended 31st March, 2016

Balance Sheet as at 31st March 2016

Working Notes 1. Calculation of Capital Fund as at 1st April, 2015

Balance Sheet as at 31st April, 2015

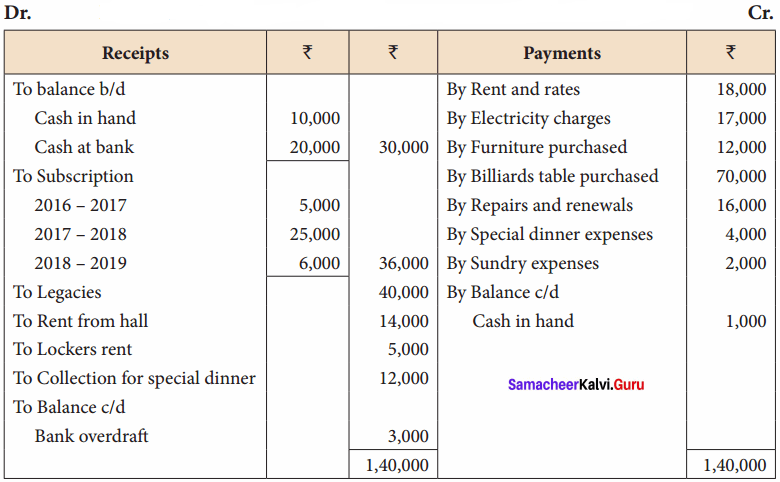

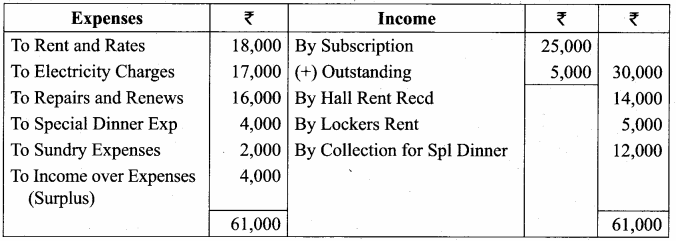

Question 7.

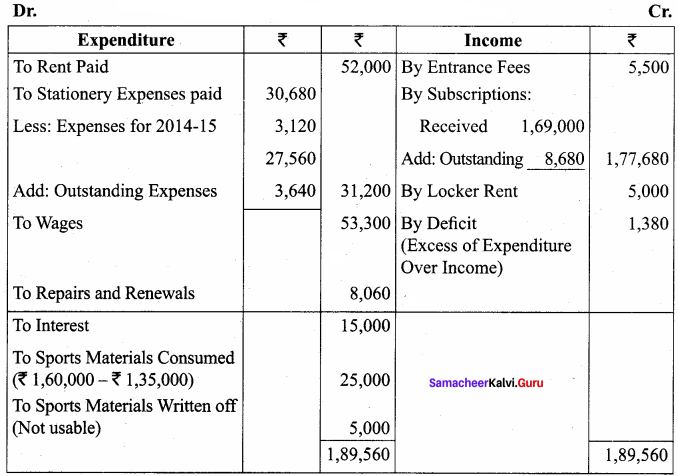

Following is the Receipts and Payments Account of the Mumbai Club for the year ended 31st March 2016:

Receipts and Payments Accounts for the year ended 31st March 2016

Additional Information:

- Stationery Expenses, etc ₹ 3,120 related to 2014 – 15 still owing ₹ 3,640.

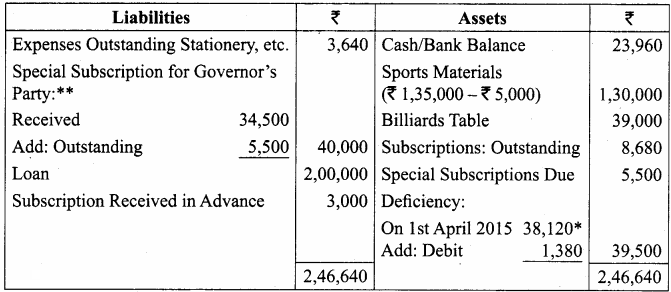

- Subscription unpaid for 2015 – 16 ₹ 8,680; Special subscriptions for Governor’s party outstanding ₹ 5,500. Governor’s party is to be held in April 2016.

- The Club owned sports materials of the value ₹ 1,60,000 on 1st April, 2015. This was valued at ₹ 1,35,000 on 31st March, 2016, stock includes sports materials of ₹ 5,000, which is to be written off being not usable. The club took a loan of ₹ 2,00,000 in 2014 – 15.

Prepare Income and Expenditure Account for the year ended on 31st March, 2016 and Balance Sheet as on that date.

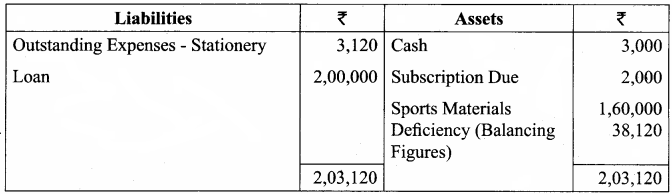

Balance Sheet as on 1st April 2015

Mumbai Club Income And Expenditure Account for the year ended 31st March, 2016

Balance Sheet as on 31st March, 2016

Question 8.

Distinction between Receipts and Payments Account and Cash Book.

Answer: