Students can Download Accountancy Chapter 3 Accounts of Partnership Firms-Fundamentals Questions and Answers, Notes Pdf, Samacheer Kalvi 12th Accountancy Book Solutions Guide Pdf helps you to revise the complete Tamilnadu State Board New Syllabus and score more marks in your examinations.

Tamilnadu Samacheer Kalvi 12th Accountancy Solutions Chapter 3 Accounts of Partnership Firms-Fundamentals

Samacheer Kalvi 12th Accountancy Accounts of Partnership Firms-Fundamentals Text Book Back Questions and Answers

I. Choose the Correct Answer

12th Accountancy 3rd Chapter Solutions Question 1.

In the absence of a partnership deed, profits of the firm will be shared by the partners in …………….

(a) Equal ratio

(b) Capital ratio

(c) Both (a) and (b)

(d) None of these

Answer:

(a) Equal ratio

12th Accountancy Chapter 3 Question 2.

In the absence of an agreement among the partners, interest on capital is …………….

(a) Not allowed

(b) Allowed at bank rate

(c) Allowed @ 5% per annum

(d) Allowed @ 6% per annum

Answer:

(a) Not allowed

Chapter 3 Accountancy Class 12 Solutions Question 3.

As per the Indian Partnership Act, 1932, the rate of interest allowed on loans advanced by partners is …………….

(a) 8% per annum

(b) 12% per annum

(c) 5% per annum

(d) 6% per annum

Answer:

(d) 6% per annum

Class 12 Accountancy Chapter 3 Solutions Question 4.

Which of the following is shown in Profit and loss appropriation account?

(a) Office expenses

(b) Salary of staff

(c) Partners’ salary

(d) Interest on bank loan

Answer:

(c) Partners’ salary

12th Accountancy Answer Pdf Question 5.

When fixed capital method is adopted by a partnership firm, which of the following items will appear in capital account?

(a) Additional capital introduced

(b) Interest on capital

(c) Interest on drawings

(d) Share of profit

Answer:

(a) Additional capital introduced

Class 12th Accounts Chapter 3 Solutions Question 6.

When a partner withdraws regularly a fixed sum of money at the middle of every month, period for which interest is to be calculated on the drawings on an average is …………….

(a) 5.5 months

(b) 6 months

(c) 12 months

(d) 6.5 months

Answer:

(b) 6 months

12th Account Chapter 3 Question 7.

Which of the following is the incorrect pair?

(a) Interest on drawings – Debited to capital account

(b) Interest on capital – Credited to capital account

(c) Interest on loan – Debited to capital account

(d) Share of profit – Credited to capital account

Answer:

(c) Interest on loan – Debited to capital account

Accountancy Class 12 Chapter 3 Solutions Question 8.

In the absence of an agreement, partners are entitled to …………….

(a) Salary

(b) Commission

(c) Interest on loan

(d) Interest on capital

Answer:

(c) Interest on loan

12th Accountancy Chapter 3 Solutions Question 9.

Pick the odd one out …………….

(a) Partners share profits and losses equally

(b) Interest on partners’ capital is allowed at 7% per annum

(c) No salary or remuneration is allowed

(d) Interest on loan from partners is allowed at 6% per annum.

Answer:

(b) Interest on partners’ capital is allowed at 7% per annum

Accountancy Chapter 3 Class 12 Solutions Question 10.

Profit after interest on drawings, interest on capital and remuneration is ₹ 10,500. Geetha, a partner, is entitled to receive commission @ 5% on profits after charging such commission. Find out commission. …………….

(a) ₹ 50

(b) ₹ 150

(c) ₹ 550

(d) ₹ 500

Answer:

(d) ₹ 500

II. Accountancy Chapter 3 Class 12 Very short answer questions

12th Accounts 3rd Chapter Answer Key Question 1.

Define partnership.

Answer:

According to Section 4 of the Indian Partnership Act, 1932, partnership is defined as, “the relation between person who have agreed to share the profits of a business carried on by all or any of them acting for all.

Samacheer Kalvi 12th Accountancy Solutions Chapter 3 Question 2.

What is a partnership deed?

Answer:

Partnership deed is a document in writing that contains the terms of the agreement among the partners. It is not compulsory for a partnership to have a partnership deed as per the Indian Partnership Act, 1932. But, it is desirable to have a partnership deed as it serves as an evidence of the terms of the agreement among the partners.

Class 12 Accountancy Chapter 3 Question 3.

What is meant by fixed capital method?

Answer:

Under fixed capital method, the capital of the partners is not altered and it remains generally fixed. Two accounts are maintained for each partner namely:

- Capital account and

- Current account

The transactions relating to initial capital introduced, additional capital introduced and capital permanently withdrawn are entered in the capital account and all other transactions are recorded in the current account.

Class 12 Account Chapter 3 Solution Question 4.

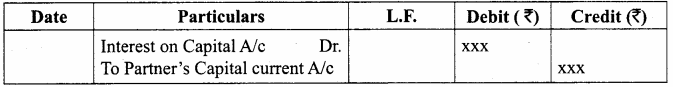

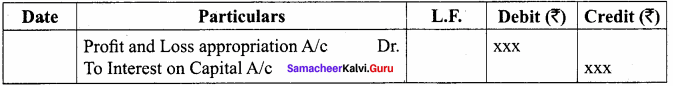

What is the journal entry to be passed for providing interest on capital to a partner?

Answer:

(a) For providing interest on capital

(b) For closing interest on capital account

Accountancy 3rd Chapter Question 5.

Why is Profit and loss appropriation account prepared?

Answer:

The profit and loss appropriation account is an extension of profit and loss account prepared for the purpose of adjusting the transactions relating to amounts due to and amounts due from partners. It is nominal account in nature. The balance being the profit or loss is transferred to the partners’ capital or current account in the profit sharing ratio.

III. Short answer questions

12th Accountancy Guide Samacheer Kalvi Question 1.

State the features of partnership.

Answer:

- Partnership is an association of two or more persons. The maximum number of partners is limited to 50.

- There should be an agreement among the persons to share the profit or loss of the business. The agreement may be oral or written or implied.

- The agreement must be to carry on a business and to share the profits of the business.

- The business may be carried on by all the partners or any of them acting for all.

Chapter 3 Accounts Class 12 Solutions Question 2.

State any six contents of a partnership deed.

Answer:

The contents of partnership deed are:

- The name of the firm and nature and place of business.

- Date of commencement and duration of business.

- Names and address of all partners.

- Capital contributed by each partner.

- Profit sharing ratio.

- Amount of drawings allowed to each partner.

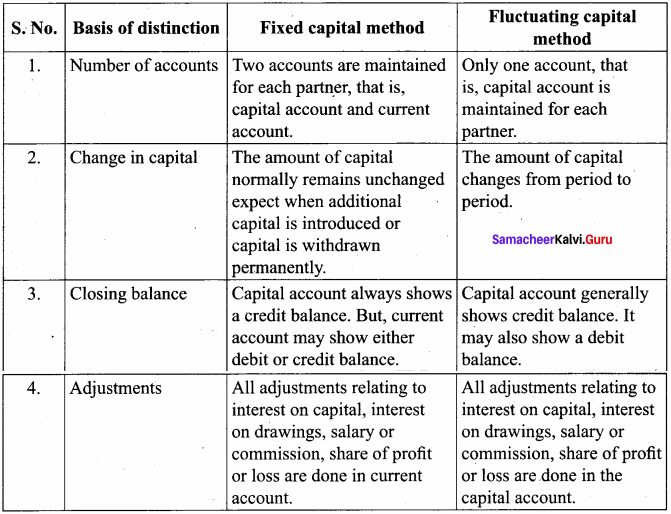

12th Final Accounts Problems With Solutions Pdf Question 3.

State the differences between fixed capital method and fluctuating capital method.

Answer:

Question 4.

Write a brief note on the applications of the provisions of the Indian Partnership Act, 1932 in the absence of partnership deed.

Answer:

1. Remuneration to partners : No salary or remuneration is allowed to any partner. [Section 13(a)]

2. Profit sharing ratio : Profit and losses are to be shared by the partners equally. [Section 13(b)]

3. Interest on capital : No interest is allowed on the capital. When a partner is entitled to interest on capital contributed as per partnership deed, such interest on capital will be payable only out of profits [Section 13(c)]

4. Interest on loans advanced by partners to the firm : Interest on loan is to be allowed at the rate of 6 percent per annum. [Section 13(d)]

5. Interest on drawings : No interest is charged on the drawings of the partners.

Question 5.

Jayaraman is a partner who withdrew ₹ 10,000 regularly in the middle of every month. Interest is charged on the drawings at 6% per annum. Calculate interest on drawings for the year ended 31st December, 2018.

Answer:

Jayaraman:

Interest on drawings: 10,000 × \(\frac { 12 }{ 24 }\) × \(\frac { 6 }{ 100 }\) × 12 = ₹ 3600

IV. Exercises

Question 1.

Akash, Bala, Chandru and Daniel are partners in a firm. There is no partnership deed. How will you deal with the following?

- Akash has contributed maximum capital. He demands interest on capital at 10% per annum.

- Bala has withdrawn ₹ 3,000 per month. Other partners ask Bala to pay interest on drawings @ 8% per annum to the firm. But, Bala did not agree to it.

- Akash demands the profit to be shared in the capital ratio. But, others do not agree.

- Daniel demands salary at the rate of ₹ 10,000 per month as he spends full time for the business.

- Loan advanced by Chandru to the firm is ₹ 50,000. He demands interest on loan @ 12% per annum.

Answer:

- No interest on capital is payable to any partner.

- No interest is charged on drawing made by the partner.

- Profit should be distributed equally.

- No remuneration is payable to any partner.

- Interest on loan is payable at 6% per annum.

Question 2.

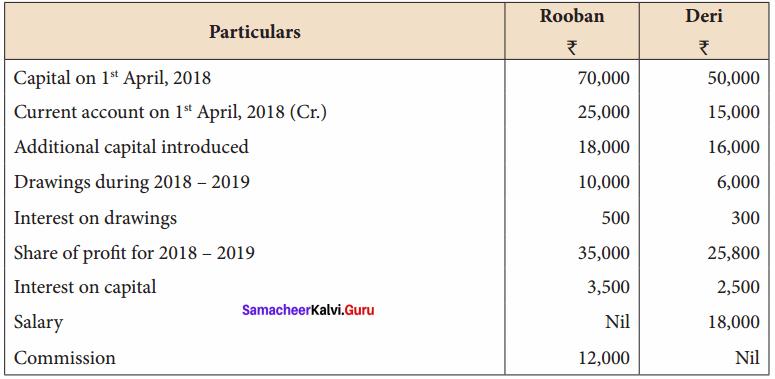

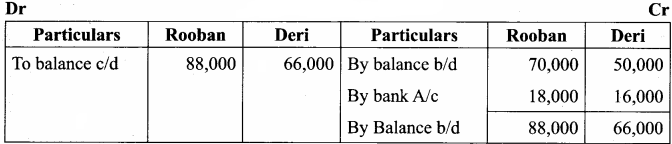

From the following information, prepare capital accounts of partners Rooban and Deri, when their capitals are fixed.

Answer:

Capital Account

Current Account

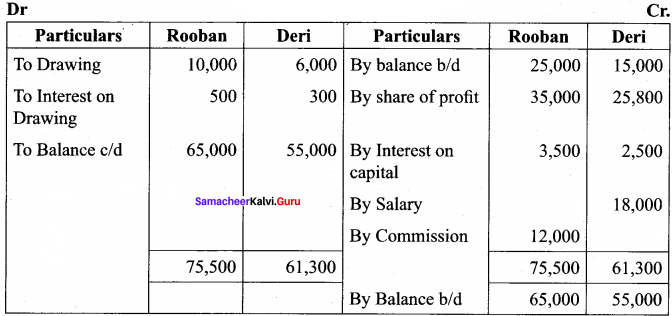

Question 3.

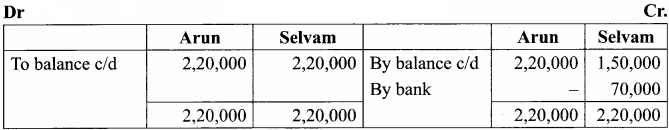

Arun and Selvam are partners who maintain their capital accounts under fixed capital method. From the following particulars, prepare capital accounts of partners.

Answer:

Capital Account

Current Account

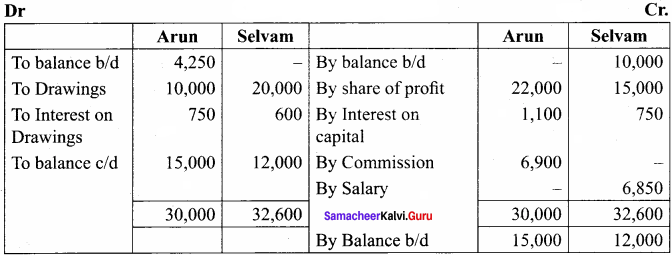

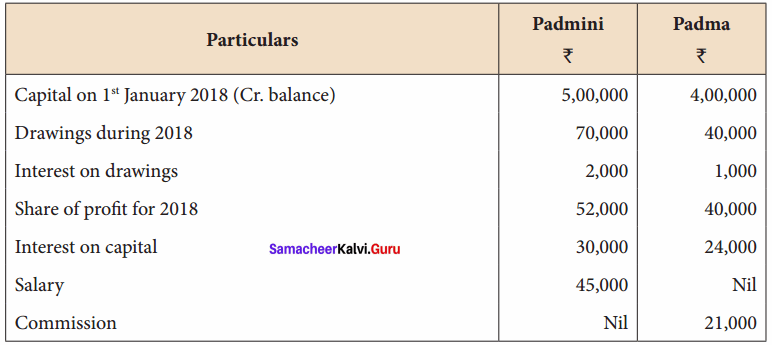

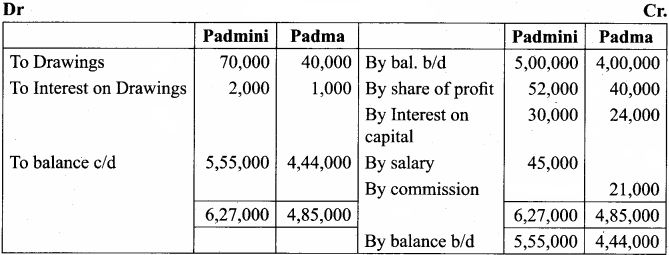

Question 4.

From the following information, prepare capital accounts of partners Padmini and Padma, when their capitals are fluctuating.

Answer:

Question 5.

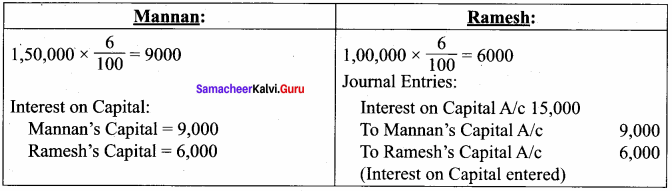

Mannan and Ramesh share profits and losses in the ratio of 3:2 and their capital on 1st April, 2018 was Mannan ₹ 1,50,000 and Ramesh ₹ 1,00,000 respectively and their current accounts show a credit balance of’ 25,000 and ₹ 20,000 respectively. Calculate interest on capital at 6% p.a. for the year ending 31st March, 2019 and show the journal entries.

Answer:

Question 6.

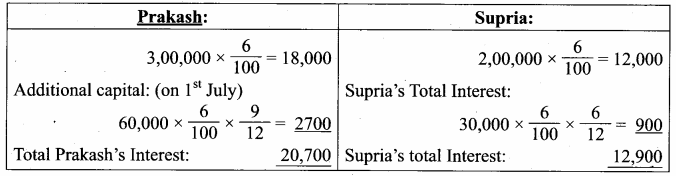

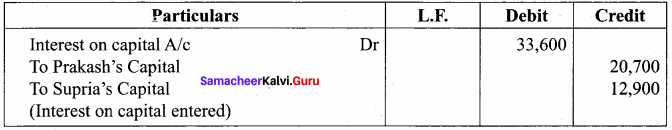

Prakash and Supria were partners who share profits and losses in the ratio of 5:3. Balance in their capital account on 1st April, 2018 was Prakash ₹ 3,00,000 and Supria ₹ 2,00,000. On 1st July, 2018 Prakash introduced additional capital of ₹ 60,000. Supria introduced additional capital of ₹ 30,000 during the year. Calculate interest on capital at 6% p.a. for the year ending 31st March, 2019 and show the journal entries.

Answer:

Journal Entries

Question 7.

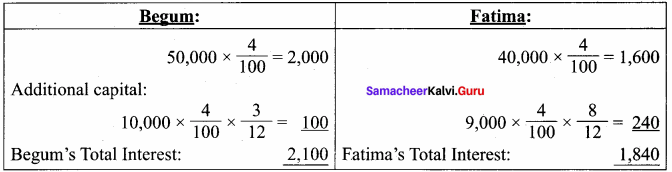

The capital account of Begum and Fatima on 1st January, 2018 showed a balance of ₹ 50,000 and ₹ 40,000 respectively. On 1st October, 2018, Begum introduced an additional capital of? 10,000 and on 1st May, 2018 Fatima introduced an additional capital of ₹ 9,000.

Answer:

Calculate interest on capital at 4% p.a. for the year ending 31st December, 2018.

Question 8.

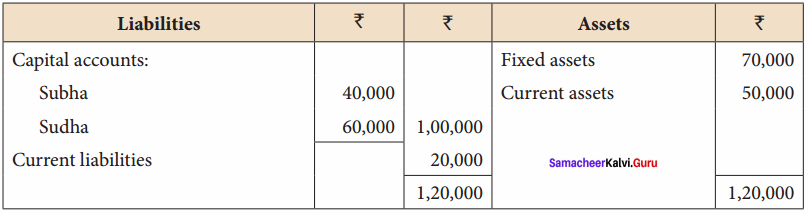

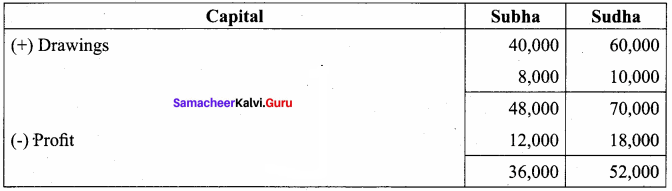

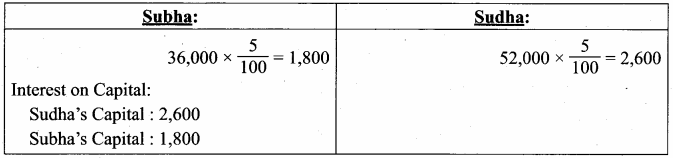

From the following balance sheets of Subha and Sudha who share profits and losses in 2:3, calculate interest on capital at 5% p.a. for the year ending 31st December, 2018.

Balance sheet as on 31st December, 2018

Drawings of Subha and Sudha during the year were ₹ 8,000 and ₹ 10,000, respectively. Profit earned during the year was ₹ 30,000.

Answer:

Question 9.

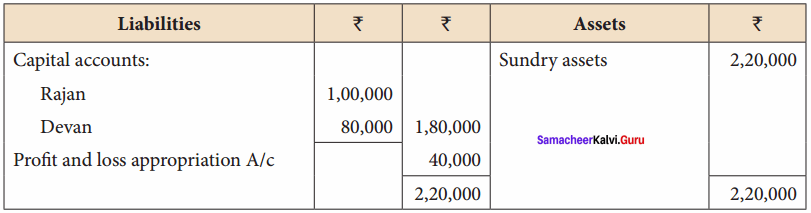

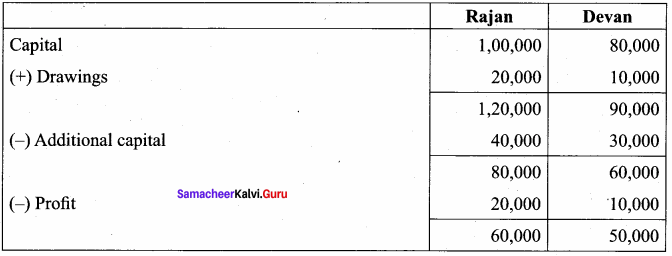

From the following balance sheets of Rajan and Devan who share profits and losses 2:1, calculate interest on capital at 6% p.a. for the year ending 31st December, 2018.

Balance sheet as on 31st December 2018

On 1st April, 2018, Rajan introduced an additional capital of ₹ 40,000 and on 1st September, 2018, Devan introduced ₹ 30,000. Drawings of Rajan and Devan during the year were ₹ 20,000 and ₹ 10,000 respectively. Profit earned during the year was ₹ 70,000.

Answer:

Question 10.

Ahamad and Basheer contribute ₹ 60,000 and ₹ 40,000 respectively as capital. Their respective share of profit is 2 : 1 and the profit before interest on capital for the year is ₹ 5,000. Compute the amount of interest on capital in each of the following situations:

- if the partnership deed is silent as to the interest on capital

- if interest on capital @ 4% is allowed as per the partnership deed

- if the partnership deed allows interest on capital @ 6% per annum.

Answer:

1. No Interest on capital is allowed.

2. Since the profit is sufficient, Interest on capital will be provided.

Ahamad:

60, 000 × \(\frac { 4 }{ 100 }\) = ₹ 2, 400

Basheer:

40, 000 × \(\frac { 4 }{ 100 }\) = ₹ 1, 600

3. Since the profit is insufficient, Interest on capital will be provided.

Ahamad:

60, 000 × \(\frac { 6 }{ 100 }\) = ₹ 3, 600

Basheer:

40, 000 × \(\frac { 6 }{ 100 }\) = ₹ 2, 400

Profit of 5,000 will be distributed to the partners in their capital ratio of 3:2.

Question 11.

Mani is a partner, who withdrew ₹ 30,000 on 1st September, 2018. Interest on drawings is charged at 6% per annum. Calculate interest on drawings on 31st December, 2018 and show the journal entries by assuming that fluctuating capital method is followed.

Answer:

Mani:

30, 000 × \(\frac { 6 }{ 100 }\) = ₹ 600

Interest on drawings of Mani = ₹ 600.

Question 12.

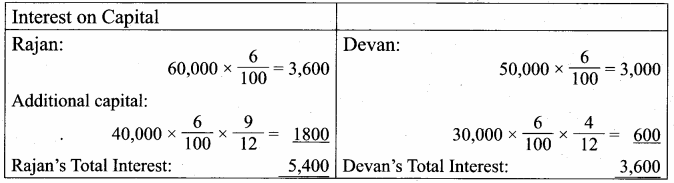

Santhosh is a partner in a partnership firm. As per the partnership deed, interest on drawings is charged at 6% per annum. During the year ended 31st December, 2018 he withdrew as follows:

Calculate the amount of interest on drawings.

Interest on Drawings = Amount x Rate of Interest x Period

Feb 1 ⇒ 2,000 x \(\frac { 6 }{ 100 }\) = ₹ 600

May 1 ⇒ 10, 000 x \(\frac { 6 }{ 100 }\) x \(\frac { 8 }{ 12 }\) = ₹ 400

July 1 ⇒ 4,000 x \(\frac { 6 }{ 100 }\) x \(\frac { 6 }{ 12 }\) = ₹ 120

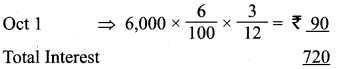

Question 13.

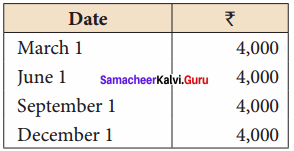

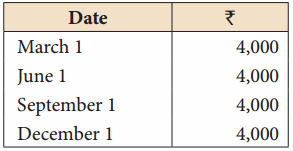

Kumar is a partner in a partnership firm. As per the partnership deed, interest on drawings is charged at 6% per annum. During the year ended 31st December, 2018 he withdrew as follows:

Interest on Drawings = Amount x Rate of Interest x Period

March 1 ⇒ 4, 000 x \(\frac { 6 }{ 100 }\) = ₹ 200

June 1 ⇒ 4, 000 x \(\frac { 6 }{ 100 }\) x \(\frac { 7 }{ 12 }\) = ₹ 140

Sep 1 ⇒ 4,000 x \(\frac { 6 }{ 100 }\) x \(\frac { 4 }{ 12 }\) = ₹ 80

Question 14.

Mathew is a partner who withdrew ₹ 20,000 during the year 2018. Interest on drawings is charged at 10% per annum. Calculate interest on drawings on 31st December 2018.

Mathew:

20 000 x \(\frac { 10 }{ 100 }\) x \(\frac { 6 }{ 12 }\) = ₹ 1, 000

Question 15.

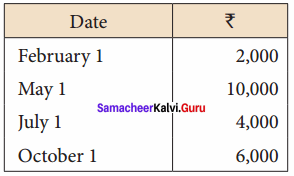

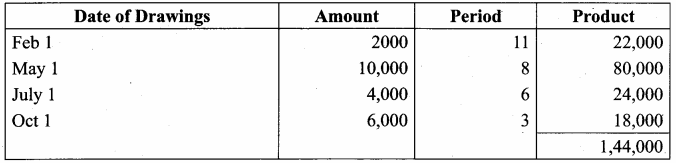

Santhosh is a partner in a partnership firm. As per the partnership deed, interest on drawings is charged at 6% per annum. During the year ended 31st December, 2018 he withdrew as follows:

Calculate the amount of interest on drawings by using product method.

Interest on drawings = Product x Rate of interest x \(\frac { 1 }{ 12 }\)

= 1,44,000 x \(\frac { 6 }{ 100 }\) x \(\frac { 1 }{ 12 }\) = ₹ 720

Question 16.

Kavitha is a partner in a firm. She withdraws ₹ 2,500 p.m. regularly. Interest on drawings is charged @ 4% p.a. Calculate the interest on drawings using average period, if she draws

- At the beginning of every month

- In the middle of every month

- At the end of every month

Answer

1. At the beginning of every month:

= 2, 500 x 12 x \(\frac { 4 }{ 100 }\) x \(\frac { 13 }{ 24 }\) = ₹ 650

2. In the middle of every month:

= 2,500 x 12 x \(\frac { 4 }{ 100 }\) x \(\frac { 12 }{ 24 }\) = ₹ 600

3. At the end of every month:

= 2, 500 x 12 x \(\frac { 4 }{ 100 }\) x \(\frac { 11 }{ 24 }\) = ₹ 550

Question 17.

Kevin and Francis are partners. Kevin draws ₹ 5,000 at the end of each quarter. Interest on drawings is chargeable at 6% p.a. Calculate interest on drawings for the year ending 31st March 2019 using average period.

Answer:

Calculation of interest on drawings of Kevin.

Total amount of drawings: 5000 x 4 = 20,000

![]()

= 20,000 x \(\frac { 6 }{ 100 }\) x \(\frac { 4.5 }{ 12 }\) = ₹ 450

Question 18.

Ram and Shy am were partners. Ram withdrew ₹ 18,000 at the beginning of each half year. Interest on drawings is chargeable @ 10% p.a. Calculate interest on the drawings for the year ending 31st December 2018 using average period.

Answer:

Total amount of drawing: 18, 000 x 2 = 36,000

Interest on drawings = Amount x Rate of Interest x ![]()

= 36,000 x \(\frac { 10 }{ 100 }\) x \(\frac { 9 }{ 12 }\) = ₹ 2700

Question 19.

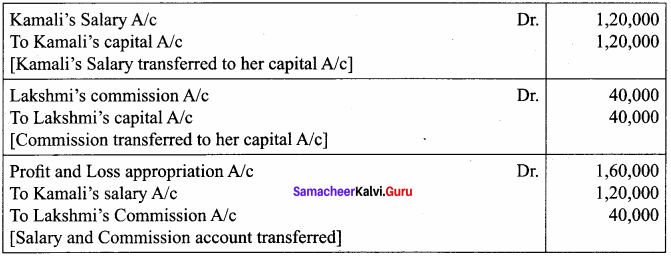

Janani, Kamali and Lakshmi are partners in a firm sharing profits and losses equally. As per the terms of the partnership deed, Kamali is allowed a monthly salary of ₹ 10,000 and Lakshmi is allowed a commission of ₹ 40,000 per annum for their contribution to the business of the firm. You are required to pass the necessary journal entry. Assume that their capitals are fluctuating.

Answer:

Question 20.

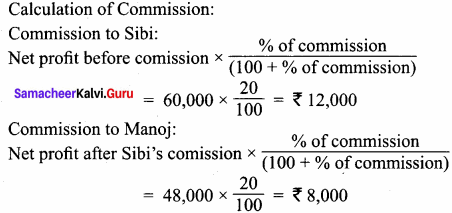

Sibi and Manoj are partners in a firm. Sibi is to get a commission of 20% of net profit before charging any commission. Manoj is to get a commission of 20% on net profit after charging all commission. Net profit for the year ended 31st December 2018 before charging any commission was ₹ 60,000. Find the commission of Sibi and Manoj. Also show the distribution of profit.

Answer:

Question 21.

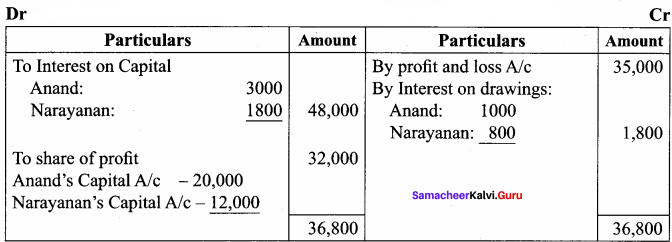

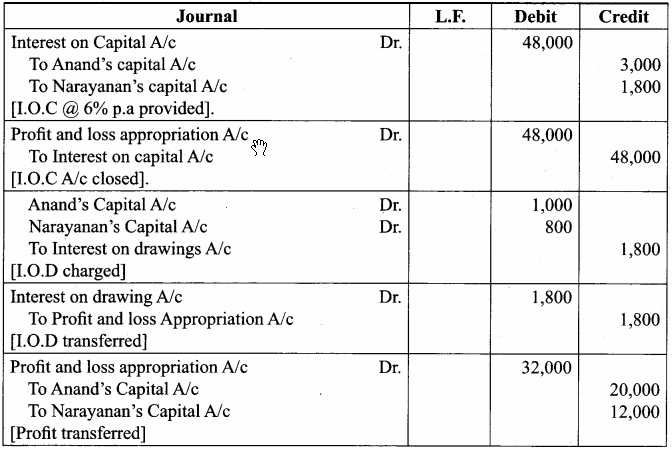

Anand and Narayanan are partners in a firm sharing profits and losses in the ratio of 5 : 3. On 1st January 2018, their capitals were ₹ 50,000 and ₹ 30,000, respectively. The partnership deed specifies the following:

- Interest on capital is to be allowed at 6% per annum.

- Interest on drawings charged to Anand and Narayanan are ₹ 1,000 and ₹ 800, respectively.

- The net profit of the firm before considering interest on capital and interest on drawings amounted to ₹ 35,000.

Give necessary journal entries and prepare profit and loss appropriation account as on 31st December 2018. Assume that the capitals are fluctuating.

Answer:

Profit and Loss Appropriation Account

Journal Entries

Question 22.

Dinesh and Sugumar entered into a partnership agreement on 1st January 2018, Dinesh contributing ₹ 1,50,000 and Sugumar ₹ 1,20,000 as capital. The agreement provided that:

- Profits and losses to be shared in the ratio 2 : 1 as between Dinesh and Sugumar.

- Partners to be entitled to interest on capital @ 4% p.a.

- Interest on drawings to be charged Dinesh: ₹ 3,600 and Sugumar: ₹ 2,200

- Dinesh to receive a salary of ₹ 60,000 for the year, and

- Sugumar to receive a commission of ₹ 80,000

During the year ended on 31st December 2018, the firm made a profit of ₹ 2,20,000 before adjustment of interest, salary and commission.

Prepare the Profit and loss appropriation account.

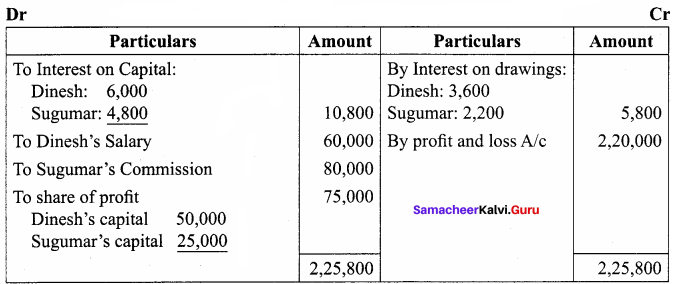

Profit and Loss Appropriation Account

Question 23.

Antony and Ranjith started a business on 1st April 2018 with capitals of ₹ 4,00,000 and ₹ 3,00,000 respectively. According to the Partnership Deed, Antony is to get salary of ₹ 90,000 per annum, Ranjith is to get 25% commission on profit after allowing salary to Antony and interest on capital @ 5% p.a. but before charging such commission. Profit – sharing ratio between the two partners is 1:1. During the year, the firm earned a profit of ₹ 3,65,000.

Answer:

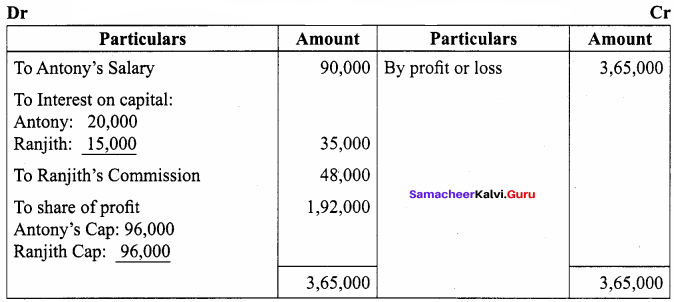

Prepare profit and loss appropriation account. The firm closes its accounts on 31st March every year.

Samacheer Kalvi 12th Accountancy Accounts of Partnership Firms-Fundamentals Additional Questions and Answers

I. Choose the correct answer

Question 1.

Under fixed capital system, the capitals of the partners ……………. year after year.

(a) keep changing

(b) remain fixed

(c) Both are possible

Answer:

(b) remain fixed

Question 2.

Under fluctuating capital system, the capitals of the partners year after years …………….

(a) keep changing

(b) Remain fixed

(c) Both are possible

Answer:

(a) keep changing

Question 3.

Under fluctuating capital system, the partners ……………. accounts are opened.

(a) current

(b) drawing

(c) capital

Answer:

(c) capital

Question 4.

Under fixed capital system, the profits and losses of partners will be transferred to their ……………. accounts.

(a) current

(b) drawings

(c) Both

Answer:

(a) current

Question 5.

Interest capital is calculated as the …………….

(a) opening capital

(b) closing capital

(c) Both

Answer:

(a) opening capital

Question 6.

……………. is an extension of profit and loss account

(a) Balance sheet

(b) Profit and loss appropriation account

(c) Both

Answer:

(b) Profit and loss appropriation account

Question 7.

The persons who have entered into partnership are collectively known as …………….

(a) partnership

(b) partners

(c) firm

Answer:

(c) firm

Question 8.

Name the method of calculating interest on drawings of the partner if different amounts are withdrawn are different dates …………….

(a) Direct method

(b) Product method

(c) Average period method

Answer:

(A) Product method

Question 9.

Which of the following items, does not appear in the profit and loss appropriation account?

(a) Salaries to partners

(b) Interest on capital

(c) Interest on drawings

(d) Drawings

Answer:

(d) Drawings

II. Fill in the Blanks

Question 10.

The partners share the ……………. of the business.

Answer:

Profit and losses.

Question 11.

The ……………. accounts of partners may show credit or debit balance.

Answer:

Current.

Question 12.

Interest on partners drawings is changed to their respective …………….

Answer:

Capital A/c.

Question 13.

Salary to the partner will be paid only if it is allowed by the …………….

Answer:

Agreement

Question 14.

The capital accounts of partners may be ……………. or fluctuating.

Answer:

Fixed

Question 15.

Interest Drawings for regular interval is calculated by the formula …………….

Answer:

Total Drawings x \(\frac { Rate }{ 100 }\) x \(\frac { 16 }{ 12 }\)

Question 16.

In the case of fluctuating capital, where will you record drawings, interest on drawing …………….

Answer:

Dr. Side of Capital A/c

III. Match the following

Question 17.

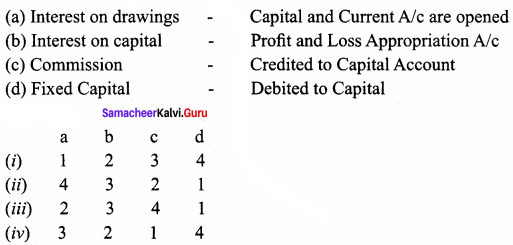

Answer:

(ii) 4 3 2 1

IV. Short answer Questions

Question 1.

What is Current Account?

Answer:

Under fixed capital method, Capital Account and Current accounts are maintained. In current a/c all adjustments relating to partners are recorded on the credit side of current account viz. Interest on capital, share of profits, salary and commission etc., are recorded. On the debit side, drawings, interest on drawings, share of loss are recorded. Current account sometimes show credit balance or debit balance.

Question 2.

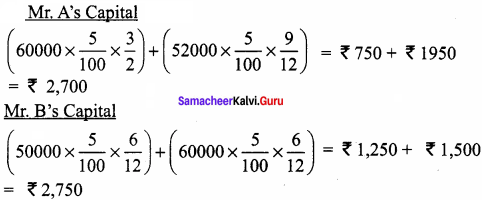

Interest on Capital: Mr A and B started a business on 1.4.2014, with capital of Rs. 60,000 and 50,000, respectively. On 1st July 2014. Mr. A withdrew Rs 8,000 from his capital. Mr. B introduced additional capital of Rs 10,000 on 30.9.2014. Calculate interest on capital @ 5% p.a. for year ending 31.3.2015.

Solution:

Question 3.

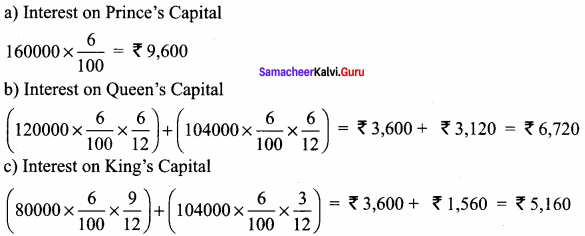

Prince, Queen and Kings had capital of Rs. 1,60,000, Rs. 1,20,000 and Rs. 80,000 respectively, on 1.4.2010. Queen withdraw Rs. 16,000 on 30.9.2010. King introduced additional capital Rs. 24,000 on 31.12.10. Calculate interest on capital @ 6% p.a. on 31.3.2011.

Solution:

Question 4.

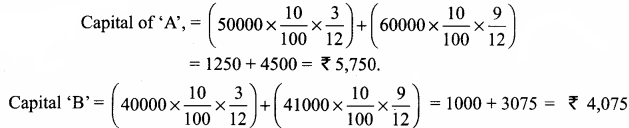

A and B are partners, sharing profits and losses in an equal ratio with Capital of Rs. 50,000 and Rs 40,000 on 1.4.2017. On 1st July 2017, A introduced Rs 10,000 as his additional capital, where B introduced only Rs 1,000. Interest 10% p.a. Calculate interest on capital.

Solution:

Question 5.

Interest on Drawings:

Sundar and Shanmugam are two partners equally. Sundar drew regularly Rs. 4,000 end of every month. Shanmugam draws Rs. 8,000 regularly beginning of every month. Calculate interest on their drawings @10%.

Solution:

Interest on Drawings of Sundar:

Total drawings x \(\frac { Rate }{ 100 }\) x \(\frac { 5.5 }{ 12 }\)

4000 x 12 x \(\frac { 10 }{ 100 }\) x \(\frac { 5.5 }{ 2 }\) = ₹ 2, 200

Interest on Drawings of Shanmugam:

Total drawing x \(\frac { Rate }{ 100 }\) x \(\frac { 6.5 }{ 12 }\)

8000 x 12 x \(\frac { 10 }{ 100 }\) x \(\frac { 6.5 }{ 12 }\) = ₹ 5, 200

Question 6.

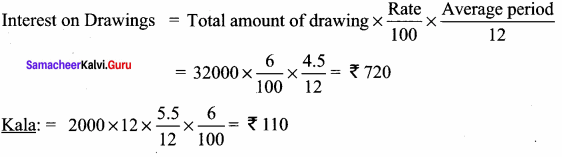

Priya and Kala are partners Priya draws Rs. 8,000 at end of each quarter. Interest on drawings @6% p.a. Kala draws Rs. 2000/- per month at the end of the month.

Solution:

Interest of drawings:

Priya: 8,000 x 4 = 32,000

V. Exercise

Question 1.

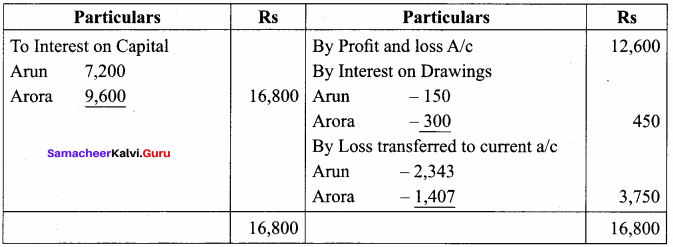

Arun and Arora were partners sharing profits and losses in the ratio 5:3. Their fixed capitals on 1.4.2016 were Arun Rs. 60,000; Arora Rs. 80,000. Interest on capital @ Rs. 12%. Interest on drawings @15% p.a. Profit for the year ended 31.3.2017 before all above adjustment was Rs. 12,600. Drawings: Arun Rs. 2,000. Arora Rs. 4,000 during the year. Prepare profit and loss appropriation account.

Solution:

Interest on Drawings:

Arun: 2000 x \(\frac { 15 }{ 100 }\) x \(\frac { 6 }{ 12 }\) = ₹ 150

Arora: 4000 x \(\frac { 15 }{ 100 }\) x \(\frac { 6}{ 12 }\) = ₹ 300

Question 2.

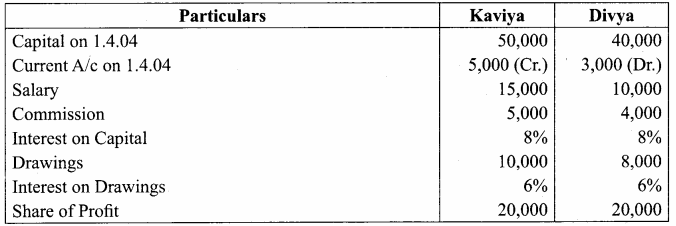

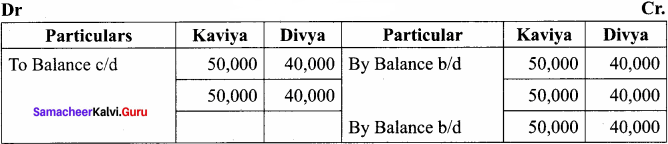

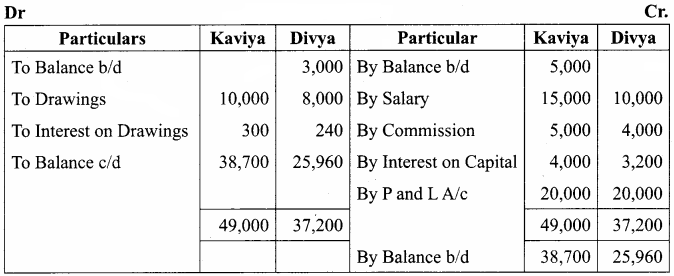

Write up the capital accounts and current accounts of the partners Kaviya and Divya from the following:

Solution:

Capital Account

Current Account

Question 3.

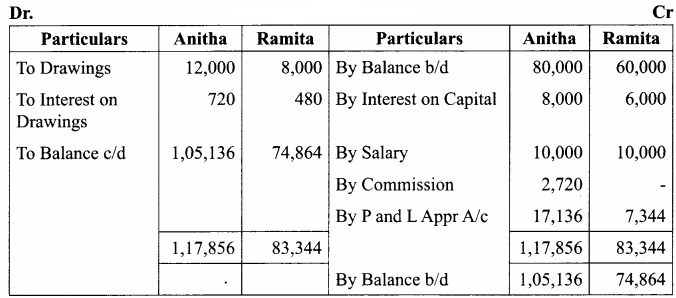

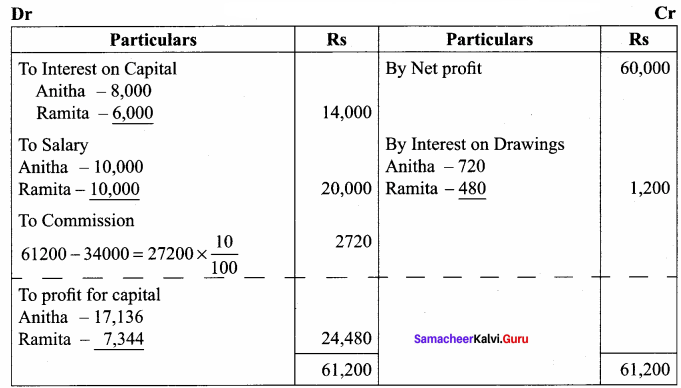

Distribution of Profits: Anitha, Ramita were partners sharing profit and losses in the ratio of 7:3. Their capitals were Rs. 80,000 and Rs. 60,000, respectively.

- Interest on capital @10% p.a.

- Interest on drawings @12% p.a.

- Both to get a salary of Rs. 10,000 each per annum.

- Anitha to get a commission of 10% on the net profit before charging such commission.

The profit for the year Rs. 60,000. Drawings were Anitha Rs. 12,000 and Ramita Rs. 8,000. Show profit and loss appropriation account and the capital A/c.

Solution:

Profit and Loss Appropriation Account

Capital Accounts