These Tamilnadu State Board Class 12th Economics Solutions Chapter 4 Consumption and Investment Functions Questions and Answers help to enhance the skills. Download Solutions of Samacheer Kalvi 12th Economics Book Solutions Chapter Wise Pdf for free of cost. Refer Samacheer Kalvi Class 12th Economics Solutions pdf and kickstart your preparation. You can find the best Solutions for Samacheer Kalvi Class 12th Economics Solutions Chapterwise here.

Tamilnadu Samacheer Kalvi 12th Economics Solutions Chapter 4 Consumption and Investment Functions

With the help of the Samacheer Kalvi Class 12th Economics Solutions Chapter 4 Consumption and Investment Functions you can get an idea about the subject. The topics covered in Samacheer Kalvi Class 12th Economics Solutions Chapter 4 Consumption and Investment Functions Solutions Questions and Answers. Tap the link and Download Samacheer Kalvi Class 12th Economics Solutions for Chapter 4 Consumption and Investment Functions to cover all the topics.

Samacheer Kalvi 12th Economics Consumption and Investment Functions Text Book Back Questions and Answers

Part – A

Multiple Choice Questions.

Question 1.

The average propensity to consume is measured by –

(a) C / Y

(b) C × Y

(c) Y / C

(d) C + Y

Answer:

(a) C / Y

Question 2.

An increase in the marginal propensity to consume will:

(a) Lead to consumption function becoming steeper

(b) Shift the consumption function upwards

(c) Shift the consumption function downwards

(d) Shift savings function upwards

Answer:

(a) Lead to consumption function becoming steeper.

Question 3.

If the Keynesian consumption function is C = 10 + 0.8 Y then, if disposable income is Rs 1000, what is amount of total consumption?

(a) ₹ 0.8

(b) ₹ 800

(c) ₹ 810

(d) ₹ 0.81

Answer:

(c) ₹ 810

Question 4.

If the Keynesian consumption function is C = 10 + 0.8 Y then, when disposable income is Rs 100, what is the marginal propensity to consume?

(a) ₹ 0.8

(b) ₹ 800

(c) ₹ 810

(d) ₹ 0.81

Answer:

(a) ₹ 0.8

Question 5.

If the Keynesian consumption function is C = 10 + 0.8 Y then, and disposable income is ₹ 100, what is the average propensity to consume?

(a) ₹ 0.8

(b) ₹ 800

(c) ₹ 810

(d) ₹ 0.9

Answer:

(d) ₹ 0.9

Question 6.

As national income increases –

(a) The APC falls and gets nearer in value to the MPC.

(b) The APC increases and diverges in value from the MPC.

(c) The APC stays constant

(d) The APC always approaches infinity.

Answer:

(a) The APC falls and gets nearer in value to the MPC.

Question 7.

As increase in consumption at any given level of income is likely to lead –

(a) Higher aggregate demand

(b) An increase in exports

(c) A fall in taxation revenue

(d) A decrease in import spending

Answer:

(a) Higher aggregate demand

Question 8.

Lower interest rates are likely to:

(a) Decrease in consumption

(b) increase cost of borrowing

(c) Encourage saving

(d) increase borrowing and spending

Answer:

(d) increase borrowing and spending

Question 9.

The MPC is equal to:

(a) Total spending / total consumption

(b) Total consumption / total income

(c) Change in consumption / change in income

(d) None of the above

Answer:

(c) Change in consumption / change in income

Question 10.

The relationship between total spending on consumption and the total income is the –

(a) Consumption function

(b) Savings function

(c) Investment function

(d) aggregate demand function

Answer:

(a) Consumption function

Question 11.

The sum of the MPC and MPS is –

(a) 1

(b) 2

(c) 0.1

(d) 1.1

Answer:

(a) 1

Question 12.

As income increases, consumption will –

(a) fall

(b) not change

(c) fluctuate

(d) increase

Answer:

(d) increase

Question 13.

When investment is assumed autonomous the slope of the AD schedule is determined by the –

(a) marginal propensity to invest

(b) disposable income

(c) marginal propensity to consume

(d) average propensity to consume

Answer:

(c) marginal propensity to consume

Question 14.

The multiplier tells us how much changes after a shift in –

(a) Consumption, income

(b) investment, output

(c) savings, investment

(d) output, aggregate demand

Answer:

(d) output, aggregate demand

Question 15.

The multiplier is calculated as –

(a) 1 / (1 – MPC)

(b) 1 / MPS

(c) 1 / MPC

(d) a and b

Answer:

(d) a and b

Question 16.

It the MPC is 0.5, the multiplier is –

(a) 2

(b) 1/2

(c) 0.2

(d) 20

Answer:

(a) 2

Question 17.

In an open economy import ………………………. the value of the multiplier

(a) Reduces

(b) increase

(c) does not change

(d) changes

Answer:

(a) Reduces

Question 18.

According to Keynes, investment is a function of the MEC and –

(a) Demand

(b) Supply

(c) Income

(d) Rate of interest

Answer:

(d) Rate of interest

Question 19.

The term super multiplier was first used by –

(a) J.R.Hicks

(b) R.G.D. Allen

(c) Kahn

(d) Keynes

Answer:

(a) J.R.Hicks

Question 20.

The term MEC was introduced by –

(a) Adam Smith

(b) J.M. Keynes

(c) Ricardo

(d) Malthus

Answer:

(b) J.M. Keynes

Part – B

Answer The Following Questions In One or Two Sentences

Question 21.

What is consumption function?

Answer:

Meaning of Consumption Function:

1. The consumption function or propensity to consume refers to income consumption relationship. It is a “functional relationship between two aggregates viz., total consumption and gross national income.”

2. Symbolically, the relationship is represented as C = f (Y)

Where,

C = Consumption; Y = Income; f = Function

3. Thus the consumption function indicates a functional relationship between C and Y, where C is the dependent variable and Y is the independent variable, i.e., C is determined by Y. This relationship is based on the ceteris paribus (other things being same) assumption, as only income consumption relationship is considered and all possible influences on consumption are held constant.

Question 22.

What do you mean by propensity to consume?

Answer:

1. The consumption function or propensity to consume refers to income consumption relationship. It is a “functional relationship between two aggregates viz., total consumption and gross national income.”

2. Symbolically, the relationship is represented as C = f(Y) Where, C = Consumption; Y = Income; f = Function

3. Thus the consumption function indicates a functional relationship between C and Y, where C is the dependent variable and Y is the independent variable, i.e., C is determined by Y. This relationship is based on the ceteris paribus (other things being same) assumption, as only income consumption relationship is considered and all possible influences on consumption are held constant.

Question 23.

Define average propensity to consume (APC)?

Answer:

The average propensity to consume is the ratio of consumption expenditure to any particular level of income.

(or)

APC = C/Y

C- consumption

Y- Income

Question 24.

Define marginal propensity to consume (MPC)?

Answer:

Marginal Propensity to Consume:

1. The marginal propensity to consume may be defined as the ratio of the change in the consumption to the change in income. Algebraically it may be expressed as under:

MPC = \(\frac { \Delta C }{ \Delta Y } \)

Where, ∆C = Change in Consumption; ∆Y = Change in Income

MPC is positive but less than unity, 0 < \(\frac { \Delta C }{ \Delta Y } \) < 1.

Question 25.

What do you mean by a propensity to save?

Answer:

propensity to save is the relationship between income and savings.

or

Propensity to save is merely the propensity not to consume.

Question 26.

Define average propensity to save (APS)?

Answer:

Average Propensity to Save (APS):

- The average propensity to save is the ratio of saving to income.

- APS is the quotient obtained by dividing the total saving by the total income. In other words, it is the ratio of total savings to total income. It can be expressed algebraically in the form of equation as under

- APS = \(\frac{S}{Y}\) Where, S = Saving; Y = Income

Question 27.

Define Marginal Propensity to Save (MPS)?

Answer:

MPS is the ratio of change in saving to a change in income.

(or)

\(\mathrm{MPS}=\frac{\Delta \mathrm{S}}{\Delta \mathrm{Y}}\)

ΔS = Change in saving

ΔY = Change in income

Question 28.

Define Multiplier?

Answer:

- The multiplier is defined as the ratio of the change in national income to change in investment.

- If AI stands for an increase in investment and AY stands for a resultant increase in income, the multiplier K =AY/AI.

- Since AY results from AI, the multiplier is called the investment multiplier.

Question 29.

Define Accelerator?

Answer:

The accelerator expresses the ratio of the net change in investment to change in consumption.

Part – C

Answer The Following Questions In One Paragraph.

Question 30.

State the propositions of Keynes’s Psychological Law of Consumption?

Answer:

Propositions of the Law:

This law has three propositions:

1. When income increases, consumption expenditure also increases but by a smaller amount. The reason is that as income increases, our wants are satisfied side by side so that the need to spend more on consumer goods diminishes. So, the consumption expenditure increases with an increase in income but less than proportionately.

2. The increased income will be divided in some proportion between consumption expenditure and saving. This follows from the first proposition because when the whole • of increased income is not spent on consumption, the remaining is saved. In this way, consumption and saving move together.

3. Increase in income always leads to an increase in both consumption and saving. This means that increased income is unlikely to lead to fall in either consumption or saving. Thus with increased income both consumption and saving increase.

Question 31.

Differentiate autonomous and induced investment?

Answer:

Autonomous Investment:

- Independent

- Income inelastic

- Welfare motive

Induced Investment:

- Planned

- Income elastic

- Profit Motive

Question 32.

Explain any three subjective and objective factors influencing the consumption function?

Answer:

Subjective factors:

- The motive of precaution

- The motive of financial independence

- The motive of foresight

Objective factors:

- income distribution

- Price level

- wage level

Question 33.

Mention the differences between accelerator and multiplier effect?

Answer:

Accelerator Effect Multiplier Effect:

1. Accelerator is the numerical value of the relation between an increase in consumption and the resulting increasing in Investment. The multiplier is the ratio of the change in national income to change in Investment.

2. Accelerator (β) = \(\frac { \Delta I }{ \Delta C } \)

ΔI = Change in Investment

ΔC = Change in consumption demand Multiplier (K) = \(\frac { \Delta I }{ \Delta C } \)

ΔI = Increase in Investment ΔY = Increase in Income ΔY results from ΔI

3. Accelerator Effects are

- Increase in consumer demand.

- Films get close to full capacity.

- Film investment to meet rising demand. Multiplier Effects are

Multiplier Effect:

1. Multiplier is the ratio of the change in national income to change in Investment.

2. Multiplier:

Multiplier (K) = \(\frac { \Delta Y }{ \Delta I } \)

ΔI = Increase in Investment

ΔY = Increase in Income

ΔY results from ΔI

Multiplier Effects are:

- Positive Multiplier an initial increase is an injection (or a decrease in a leakage) that leads to a greater final increase in real GDP.

- Negative Multiplier an initial increase in an injection (or an increase in a leakage) leads to a greater final decrease in real GDP.

Question 34.

State the concept of the super multiplier?

Answer:

Super Multiplier: (k and β interaction):

- The super multiplier is greater than simple multiplier which includes only autonomous investment and no induced investment, while super multiplier includes induced investment.

- In order to measure the total effect of initial investment on income, Hicks has combined the k and β mathematically and given it the name of the Super Multiplier.

- The super multiplier is worked out by combining both induced consumption and induced investment.

Question 35.

Specify the limitations of the multiplier?

Answer:

- Payment towards past debts.

- Purchase of exiting wealth

- Import of goods and services

- Non- availability of consumer goods

- Full employment situation.

Part – D

Answer The Following Questions In About A Page.

Question 36.

Explain Keynes psychological law of consumption function with a diagram?

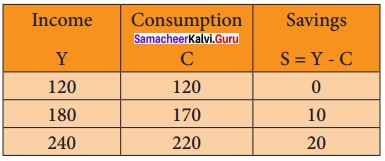

The three propositions of the law:

Proposition (1):

Income increases by ₹ 60 crores and the increase in consumption is by ₹ 50 crores.

Proposition (2):

The increased income of ₹ 60 crores in each case is divided in some proportion between consumption and saving respectively, (i.e., ₹ 50 crores and ₹ 10 crores).

Proposition (3):

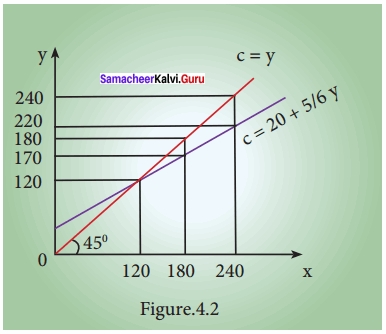

As income increases consumption as well as saving increase. Neither consumption nor saving has fallen. Diagrammatically, the three propositions are explained in figure. Here, income is measured horizontally and consumption and saving are measured on the vertical axis. C is the consumption function curve and 45° line represents income consumption equality.

Proposition (1):

When income increases from 120 to 180 consumption also increases from 120 to 170 but the increase in consumption is less than the increase in income, 10 is saved.

Proposition (2):

When income increases to 180 and 240, it is divided in some proportion between consumption by 170 and 220 and saving by 10 and 20 respectively.

Proposition (3):

Increases in income to 180 and 240 lead to increased consumption 170 and 220 and increased saving 20 and 10 than before. It is clear from the widening area below the C curve and the saving gap between 45° line and C curve.

Question 37.

Briefly explain the subjective and objective factors of consumption function?

Answer:

Subjective factors:

Subjective factors are the internal factors related to psychological feelings.

Keynes lists eight motives for consumption They are:

- The motive of precaution Eg: Accident, sickness.

- The motive of foresight Eg: old age

- The motive of calculation ÷ desire to enjoy interest

- The motive of improvement ÷ to enjoy a better standard of living

- The motive of financial independence

- The motive of enterprise: the desire to forward trading

- The motive of pride ÷ desire to bequeath a fortune

- The motive of avarice + purely miserly instinct

The government, institutions and business corporation, and firms may also consume mainly because of the following motives:

- The motive of enterprise

- The motive of liquidity

- The motive of improvement.

- The motive of financial prudence.

According to Keynes, the subjective factors do not change in the short run, so consumption function remains stable in the short period

Objective factors:

Objective factors are the external factors which are real and measurable.

They are,

- Income Distribution: The community with more equal distribution of income tends to have high propensity to consume.

- Price level: It plays an important role in determining consumption function..

- Wage level: There is a positive relationship between wage and consumption.

- Interest rate: Higher rate of interest encourages more savings and reduces consumption.

- Fiscal policy: when the government reduces tax the propensity to consume increases and vice versa.

- Consumer credit: Easy availability of consumer credit pushes up consumption

- Demographic factors: Ceteris paribus, the larger the size of the family, the greater is the consumption.

Question 38.

Illustrate the working of Multiplier?

Answer:

Working of Multiplier:

- Suppose the Government undertakes investment expenditure equal to ₹ 100 crores on some public works, by way of wages, price of materials etc.

- Thus income of labourers and suppliers of materials increases by ₹ 100 crores. Suppose the MPC is 0.8 that is 80 %.

- A sum of ₹ 80 crores is spent on consumption (A sum of ₹ 20 Crores is saved).

- As a result, suppliers of goods get an income of ₹ 80 crores.

- They intum spend ₹ 64 crores (80% of ₹ 80 cr).

- In this manner consumption expenditure and increase in income act in a chain like a maimer.

The final result is ∆Y = 100 + 100 × 4/5 + 100 × [4/5]2 + 100 × [4/5]3 or,

∆Y = 100 + 100 × 0.8 + 100 × (0.8)2 + 100 × (0.8)3

= 100 + 80 + 64 + 51.2… = 500 .

that is 100 × 1/1 – 4/5

100 × 1/1/5

100 × 5 = ₹ 500 crores

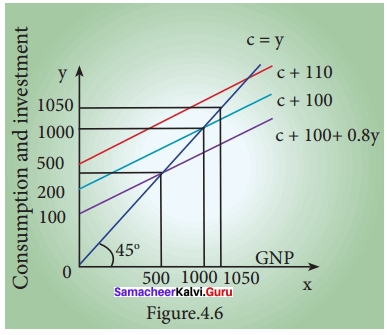

For instance if C = 100 + 0.8Y, I = 100,

Then Y = 100 + 0.8Y + 100

0.2Y = 200

Y = 200/0.2 = 1000 → Point B

If I is increased to 110, then

0.2Y = 210

Y = 210/0.2 = 1050 → Point D

For ₹ 10 increase in I, Y has increased by ₹ 50.

This is due to the multiplier effect.

At point A, Y = C = 500

C = 100 + 0.8 (500) = 500; S = 0

At point B, Y = 1000

C = 100 + 0.8 (1000) = 900; S = 100 = I At point D, Y = 1050

C = 100 + 0.8 (1050) = 940; S = 110 = I

When I is increased by 10, Y increases by 50.

This is multiplier effect (K = 5)

K = \(\frac{1}{0.2}\) = 5

Question 39.

Explain the operation of the Accelerator?

Answer:

The operation of the accelerator may be illustrated as follows:

- Let us suppose that in order to produce 1000 consumer goods, loo machines. are required. Also, suppose that the working life of a machine is 10 years. This means that every 10 machines have to be replaced. This might be called replacement demand.

- Suppose that demand for consumer goods rises by 10 percent. This results in an increase in demand for 10 more machines. So that total demand for machines is 20 so a mild change in demand for consumer goods will lead to a wide change in investment.

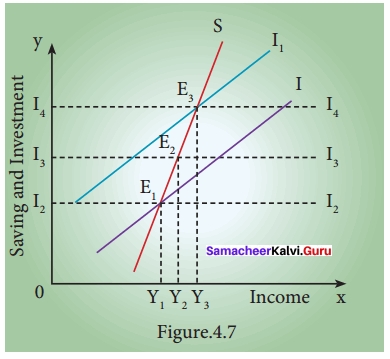

Operation of Accelerator:-

SS → saving curve ‘ ‘

II → investment curve

E1 → y Equilibrium with OY income

OI2 → Saving and investment

- If the investment is increased from 0I2 to 0I4 income increases from OY to OY3 then Equilibrium is E3.

- In the diagram, it is assumed that exogenous investment is only by I2I3 and induced investment is by

I3I4 - Therefore, increase in income by y1 y2 is due to the multiplier effect and the increase in income by y2 y3 is due to the accelerator effect.

Question 40.

What are the differences between MEC and MEI?

Answer:

Marginal Efficiency of Capital (MEC):

- It is based on a given supply price for capital.

- It represents the rate of return on all successive units of capital without regard to existing capital.

- The capital stock is taken on the X-axis of the diagram.

- It is a “stock” concept.

- It determines the optimum capital stock in an economy at each level of the interest rate.

Marginal Efficiency of Investment (MEI):

- It is based on the induced change in the price due to a change in the demand for capital.

- It shows the rate of return on just those units of capital over and above the existing capital stock.

- The amount of investment is taken on the X-axis of the diagram.

- It is a “flow” concept.

- It determines the net investment of the economy at each interest rate given the capital stock.

Samacheer Kalvi 12th Economics Consumption and Investment Functions Additional Questions and Answers

Part – A

I. Multiple Choice Questions.

Question 1.

The consumption function is expressed as …………………..

a) C = f(x)

b) C = f(y)

c) Y = f(c)

d) C = Y(f)

Answer:

b) C = f(y)

Question 2.

Does the progressive tax system increase the ……………………….. of the people by altering the income distribution in favour of the poor?

(a) price level

(b) wage level

(c) propensity to consume

(d) Fiscal policy

Answer:

(c) propensity to consume

Question 3.

…………………….. means purchase of stocks and shares, debentures, government bonds, and equities?

(a) Consumption

(b) Investment

(c) Finance

(d) Saving

Answer:

(b) Investment

Question 4.

Investment function is expressed as ……………………

a) I = f(y)

b) I = f(r)

c) I = f(s)

d) I = f(k)

Answer:

b) I = f(r)

Question 5.

An additional investment that is independent of income is called ……………………

(a) Autonomous Investment

(b) Autonomous Consumption

(c) Average Investment

(d) Marginal Investment

Answer:

(a) Autonomous Investment

Question 6.

Induced investment is motivated?

(a) Investment

(b) Capital

(c) Saving

(d) Profit

Answer:

(d) Profit

Question 7.

MEI is the expected rate of return on investment as additional units of ……………………

(a) Saving

(b) Investment

(c) Consumption

(d) Expenditure

Answer:

(b) Investment

Question 8.

The dynamic multiplier is also known as ……………………

(a) Sequence multiplier

(b) Static multiplier

(c) Double multiplier

(d) Single multiplier

Answer:

(a) Sequence multiplier

Question 9.

Leverage effect can be expressed as

a) Y = c + Ip + IA

b) Y = c + Is + IA

c) Y= c + IA+ Ip

d) Y= c + Ic + Ip

Answer:

c) Y= c + IA + Ip

Question 10.

The tendency to initiate a Superior consumption pattern is called ……………………

(a) Accelerator effect

(b) Multiplier effect

(c) Super Multiplier effect

(d) Demonstration effect

Answer:

(d) Demonstration effect

Question 11.

The multiplier is the reciprocal of one minus ……………………

(a) MPC

(b) MPS

(c) Multiplier

(d) Accelerator

Answer:

(a) MPC

Question 12.

The concept of multiplier was first developed by ……………………

(a) J.M. Keynes

(b) David Ricardo

(c) R.F. Khan

(d) J.B. Say

Answer:

(c) R.F. Khan

Question 13.

…………………… the larger size of the family, the greater is the consumption?

(a) Demographic factors

(b) Income Distribution

(c) Duesenberry hypothesis

(d) Wage level

Answer:

(b) Income Distribution

Question 14.

MPS is the ratio of change in saving to a change in ……………………

(a) profit

(b) money

(c) finance

(d) income

Answer:

(d) income

Question 15.

The consumption function is called the relationship between ……………………….. and Income?

(a) Money

(b) Consumption

(c) Finance

(d) Investment

Answer:

(b) Consumption

Question 16.

Consumer’s surplus is useful to the Finance Minister in formulating ……………………….. policies?

(a) Surplus

(b) Consumption

(c) Taxation

(d) Income

Answer:

(c) Taxation

Question 17.

Consumer surplus is called potential price – ……………………………. price?

(a) real

(b) actual

(c) normal

(d) high

Answer:

(b) actual

Question 18.

The dynamic multiplier is also known as ………………………. Multiplier.

(a) Sequence

(b) Static

(c) Timeless

(d) Logical

Answer:

(a) Sequence

Question 19.

Static Multiplier is otherwise known as …………………………… Multiplier.

(a) Dynamic

(b) Leakage

(c) Simultaneous

(d) Multi-effect

Answer:

(c) Simultaneous

Question 20.

The propensity to consume refers to the portion of Income spent on ……………………….

(a) Income

(b) Profit

(c) Expenditure

(d) Consumption

Answer:

(d) Consumption

Question 21.

………………………. redefined it as investment multiplier.

(a) R.K. Khan

(b) David Ricardo

(c) J.M. Keynes

(d) Marshall

Answer:

(c) J.M. Keynes

Question 22.

Accelerator Model was made by ……………………

(a) J.M. Keynes

(b) J.M. Clark

(c) R.F. Khan

(d) Marshall

Answer:

(b) J.M. Clark

Question 23.

The multiplier tells us …………………………. changes after a shift in ……………………

(a) income

(b) investment

(c) aggregate demand

(d) savings

Answer:

(c) aggregate demand

Question 24.

The simple accelerated model was made by J.M. Clark in ……………………

(a) 1915

(b) 1916

(c) 1914

(d) 1917

Answer:

(d) 1917

II. Match the following and choose the correct answer by using codes given below

Question 1.

A. Consumption function – (i) Consumption increased

B. Induced Investment – (ii) Borrowings

C. Income Increases – (iii) Subjective and objective

D. Autonomous consumption – (iv) Profit motive

Codes:

(a) A (iii) B (iv) C (i) D (ii)

(b) A (iv) B (i) C (ii) D (iii)

(c) A (i) B (ii) C (iii) D (iv)

(d) A (ii) B (iii) C (iv) D (i)

Answer:

(a) A (iii) B (iv) C (i) D (ii)

Question 2.

A. MPS – measured – (i) K = 1/MPS

B. Multiplier developed by – (ii) MEC

C. Investment depends on – (iii) ∆S/∆Y

D. Value of the multiplier – (iv) R.F. Khan

Codes:

(a) A (i) B (ii) C (iv) D (iii)

(b) A (ii) B (iii) C (i) D (iv)

(c) A (iii) B (iv) C (ii) D (i)

(d) A (iv) B (i) C (iii) D (ii)

Answer:

(c) A (iii) B (iv) C (ii) D (i)

Question 3.

A. Reduced Investment – (i) 1930

B. Keynes employment depends on – (ii) Highest interest rate

C. Fall in investment – (iii) Zero

D. Long fun autonomous consumption will – (iv) Investment

Codes:

(a) A (i) B (iii) C (iv) D (ii)

(b) A (ii) B (iv) C (i) D (iii)

(c) A (iii) B (i) C (ii) D (iv)

(d) A (iv) B (ii) C (iii) D (i)

Answer:

(b) A (ii) B (iv) C (i) D (iii)

Question 4.

A. MPS – (i) AC/AY

B. MPC – (ii) C/Y

C. APS – (iii) S/Y

D. APC – (iv) AS/AY

Codes:

(a) A (iv) B (i) C (iii) D (ii)

(b) A (i) B (ii) C (iv) D (iii)

(c) A (ii) B (iii) C (i) D (iv)

(d) A (iii) B (iv) C (ii) D (i)

Answer:

(a) A (iv) B (i) C (iii) D (ii)

Question 5.

A. Investment means – (i) Expenditure on capital formation

B. Uses of multiplier – (ii) Consumption forgone

C. Saving is – (iii) Achieve full employment

D. Autonomous investment – (iv) Stocks and shares

Codes:

(a) A (ii) B (i) C (iv) D (iii)

(b) A (iii) B (ii) C (iii) D (iv)

(c) A (iv) B (iii) C (ii) D (i)

(d) A (i) B (iv) C (i) D (ii)

Answer:

(c) A (iv) B (iii) C (ii) D (i)

III. State whether the statements are true or false.

Question 1.

(i) Keynes propounded the fundamental psychological law of consumption.

(ii) J.M. Keynes has divided factors influencing the consumption function.

(a) Both (i) and (ii) are true

(b) Both (i) and (ii) are false

(c) (i) is true but (ii) is false

(d) (i) is false but (ii) is true

Answer:

(a) Both (i) and (ii) are true

Question 2.

(i) The kinds of multiplier are called Tax Multiplier, Employment Multiplier, Foreign trade Multiplier, Investment Multiplier.

(ii) Investment means money collecting.

(a) Both (i) and (ii) are true

(b) Both (i) and (ii) are false

(c) (i) is true but (ii) is false

(d) (i) is false but (ii) is true

Answer:

(d) (i) is false but (ii) is true

Question 3.

(i) The term investment means the purchase of stocks and shares, debentures, government bonds, and equities.

(ii) The term Investment means expenditure on capital formation.

(a) Both (i) and (ii) are true

(b) Both (i) and (ii) are false

(c) (i) is true but (ii) is false

(d) (i) is false but (ii) is true

Answer:

(c) (i) is true but (ii) is false

Question 4.

(i) Leakages of the multiplier are payment only.

(ii) Leakages of multiplier limitation is called full employment situation.

(a) Both (i) and (ii) are true

(b) Both (i) and (ii) are false

(c) (i) is true but (ii) is false

(d) (i) is false but (ii) is true

Answer:

(d) (i) is false but (ii) is true

Question 5.

(i) The types of Investment are called Autonomous Investment, Induced Investment.

(ii) Induced Investment is the expenditure on fixed assets and stocks.

(a) Both (i) and (ii) are true

(b) Both 0) and (if) are false

(c) (i) is true but (ii) is false

(d) (i) is false but (ii) is true

Answer:

(a) Both (i) and (ii) are true

IV. Which of the following is correctly matched:

Question 1.

(a) J.M. Clark – Ceteris Paribus

(b) J.M. Keynes – Psychological law of consumption

(c) R.F. Khan – Accelerator model

(d) Duesenberry – Laissez-faire

Answer:

(b) J.M. Keynes – Psychological law of consumption

Question 2.

(a) Induced Investment – The profit motive

(b) MEC – Autonomous Investment

(c) MEI – Technology

(d) MPC – Accelerator

Answer:

(a) Induced Investment – The profit motive

Question 3.

(a) Dynamic Multiplier – Employment

(b) Static Multiplier – Wealth

(c) Accelerator Model – J.M. Clark

(d) Leakage Multiplier – Investment goods

Answer:

(c) Accelerator Model – J.M. Clark

Question 4.

(a) Afltalion – 1909

(b) Hawtrey – 1914

(c) Bickerdike – 1915

(d) J.M. Clark – 1916

Answer:

(a) Afltalion – 1909

Question 5.

(a) Aggregate Income – C

(b) Consumption expenditure – IA

(c) Autonomous Investment – Y

(d) Induced Private Investment – IP

Answer:

(d) Induced Private Investment – IP

V. Which of the following is not correctly matched

Question 1.

(a) Static multiplier – Simultaneous multiplier

(b) Dynamic multiplier – Sequence multiplier

(c) Leakage multiplier – Timeless multiplier

(d) Kinds of the multiplier – Tax multiplier

Answer:

(c) Leakage multiplier – Timeless multiplier

Question 2.

(a) Ratio of the consumption – APC expenditure to Income

(b) Ratio of change in consumption – MPC to change in Income

(c) Ratio of the saving to Income – APS

(d) Ratio of change in saving to change in Income – PSM change in Income

Answer:

(d) Ratio of change in saving to change in Income – PSM change in Income

Question 3.

(a) Demonstration Effect – Superior consumption pattern

(b) Subjective factors – Psychological feeling

(c) Objective factors – Real and Measurable

(d) Super multiplier – Investment demand

Answer:

(d) Super multiplier – Investment demand

Question 4.

(a) Average propensity to consume – C/Y

(b) Marginal propensity to consume – AC/AY

(c) Average propensity to consume – S/Y

(d) Marginal propensity to save – AY/AS

Answer:

(d) Marginal propensity to save – AY/AS

Question 5.

(a) The motive of precaution – Accidents, Sickness

{b) The motive of foresight – Old age

(c) The motive of improvement – Improve the standard of living

(d) The motive of calculation – Money collecting

Answer:

(d) The motive of calculation – Money collecting

VI. Pick the odd one out.

Question 1.

(a) ∆C – Change in consumption

(b) ∆Y – Change in expenditure

(c) ∆S – Change in saving 4

(d) ∆Y – Change in income

Answer:

(b) ∆Y – Change in expenditure

Question 2.

(a) APC – Algebraically Propensity to Consume

(b) MPC – Marginal Propensity to Consume

(c) APS – Average Propensity to Consume

(d) MPS – Marginal Propensity to Save

Answer:

(a) APC – Algebraically Propensity to Consume

Question 3.

Keynes’s Law is based on Assumptions.

(a) Ceteris paribus

(b) Existence of Normal conditions

(c) Existence of a Laissez-Faire

(d) Existence of Technical attributes

Answer:

(d) Existence of Technical attributes

Question 4.

Investment means

(a) Purchase of stocks and shares

(b) Debentures

(c) Government bonds and equities

(d) Bank amount

Answer:

(d) Bank amount

Question 5.

MEC – Short Run Factors

(a) Supply for the product

(b) Liquid Assets

(c) Sudden changes in Income

(d) Current rate of Investment

Answer:

(a) Supply for the product

VII. Assertion and Reason.

1. Assertion (A): Keynes Law of propositions – when Income increases, consumption expenditure also increases but by a smaller amount.

Reason (R): Keynes Law of propositions – Increase in Income always lead to an increase in both consumption and saving.

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

(b) Both ‘A’ and ‘R’ are true but ‘R’ is not the correct explanation for ‘A’

(c) ‘A’ is true but ‘R’ is false

(d) ‘A’ is false but ‘R’ is true

Answer:

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

Question 2.

Assertion (A): J.M. Keynes has influencing consumption function into subjective factors are the Internal factors related to psychological feelings.

Reason (R): J.M. Keynes has influencing consumption function into objective factors are Internal factors are not measurable.

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

(b) Both ‘A’ and ‘R’ are true but ‘R’ is not the correct explanation to ‘A’

(c) ‘A’ is true but ‘R’ is false

(d) ‘A’ is false but ‘R’ is true

Answer:

(c) ‘A’ is true but ‘R’ is false

Question 3.

Assertion (A): Autonomous Investment is the expenditure on capital formation.

Reason (R): Autonomous Investment is Independent of the change in Income, rate of interest, or rate of profit.

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

(b) Both ‘A’ and ‘R’ are true but ‘R’ is not the correct explanation for ‘A’

(c) ‘A’ is true but ‘R’ is false

(d) ‘A’ is false but ‘R’ is true

Answer:

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

Question 4.

Assertion (A): MEC – depends on the Demand yield from a capital asset.

Reason (R): MEC – depends on the Supply price of a capital asset.

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

(b) Both ‘A’ and ‘R’ are true but ‘R’ is not the correct explanation to ‘A’

(c) ‘A’ is true but ‘R’ is false

(d) ‘A’ is false but ‘R’ is true

Answer:

(d) ‘A’ is false but ‘R’ is true

Question 5.

Assertion (A): Keynes’s theory of the Multiplier Assumption is a change in autonomous investment.

Reason (R): Keynes’s theory of the Multiplier Assumption is no Induced Investment.

(а) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation for ‘A’

(b) Both ‘A’ and ‘R’ are true but ‘R’ is not the correct explanation for ‘A’

(c) ‘A’ is true but ‘R’ is false

(d) ‘A’ is false but ‘R’ is true

Answer:

(а) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation for ‘A’

Part – B

Answer The Following Questions In One or Two Sentences.

Question 1.

State the assumptions of Keynes’s psychological law of consumption?

Answer:

- Ceteris Paribus

- Existence of Normal conditions

- Existence of a Laissez-faire capitalist Economy

Question 2.

Define “Ceteris paribus”?

Answer:

Ceteris paribus (constant extraneous variables):

The other variables such as income distribution, tastes, habits, social customs, price movements, population growth, etc. do not change and consumption depends on income alone.

Question 3.

What do you mean by “Windfall Gains” or “Losses”?

Answer:

Windfall Gains or losses:

Unexpected changes in the stock market leading to gains or losses tend to shift the consumption function upward or downward.

Question 4.

What are subjective factors?

Answer:

Subjective factors are the internal factors related to psychological feelings.

Part – C

Answer the Following Questions In One Paragraph.

Question 1.

What are the assumptions of the multiplier?

Answer:

- There is a change in autonomous investment

- There is no induced investment

- The marginal propensity to consume is constant.

- Consumption is a function of current income

- There are no time lags in the multiplier process.

- Consumer goods are available in response to effective demand for them.

- There is a closed economy unaffected by foreign influences.

- There are no changes in prices.

- There is less than a full-employment level in the economy.

Question 2.

Explain the Marginal Efficiency of capital?

Answer:

Marginal Efficiency of Capital:

- MEC was first introduced by J.M Keynes in 1936 as an important determinant of autonomous investment.

- The MEC is the expected profitability of an additional capital asset.

- It may be defined as the highest rate of return over cost expected from the additional unit of a capital asset.

- Meaning of Marginal Efficiency of Capital (MEC) is the rate of discount which makes the discounted present value of the expected income stream equal to the cost of capital.

MEC depends on two factors:

- The prospective yield from a capital asset.

- The supply price of a capital asset.

Factors Affecting MEC:

Question 3.

Explain the uses of the multiplier?

Answer:

Uses of multiplier:

- Multiplier highlights the importance of investment in income and employment theory

- The process throws light on the different stages of the trade cycle.

- It also helps in bringing equality between S and I.

- It helps in formulating Government policies.

- It helps to reduce unemployment and achieve full employment.

Question 4.

Write the Accelerator Assumptions?

Answer:

Assumptions:

- Absence of excess capacity in consumer goods industries.

- Constant capital-output ratio

- An increase in demand is assumed to be permanent

- The supply of funds and other inputs is quite elastic

- Capital goods are perfectly divisible in any required size.

Question 5.

Write the “Leverage Effect” and Equation Explanation?

Answer:

Leverage Effect:

The combined effect of the multiplier and the accelerator is also called the leverage effect which may lead the economy to very high or low level of income propagation.

Symbolically Y = C + IA + IP

Y = Aggregate income

C = Consumption expenditure

T = autonomous investment; IP = induced private investment

Part – D

Answer The Following Questions In One Page.

Question 1.

Briefly explain the Leakages of Multiplier?

Answer:

Leakages of the multiplier:

- The multiplier assumes that those who earn income are likely to spend a proportion of their additional income on consumption.

- But in practice, people tend to spend their additional income on other items. Such expenses are known as leakages.

Payment towards past debts:

If a portion of the additional income is used for repayment of old loans, the MPC is reduced and as a result, the value of the multiplier is cut.

Purchase of existing wealth:

- If income is used in the purchase of existing wealth such as land, building, and shares money is circulated among people and never enters into the consumption stream.

- As a result, the value of the multiplier is affected.

Import of goods and services:

- Income spent on imports of goods or services flows out of the country and has little chance to return to the income stream in the country.

- Thus imports reduce the value of the multiplier.

Nonavailability of consumer goods:

- The multiplier theory assumes the instantaneous supply of consumer goods following demand.

- But there is often a time lag.

- During this gap (D > S) inflation is likely to rise.

- This reduces the consumption expenditure and thereby multiplier value.

Full employment situation:

- Under conditions of full employment, resources are almost fully employed.

- So, additional investment will lead to inflation only, rather than the generation of additional real income.

Question 2.

Explain Marginal Propensity to Consume [MPC] and Multiplier with diagram and Diagrammatic explanation?

Answer:

Marginal propensity to consume and multiplier.

The propensity to consume refers to the portion of income spent on consumption.

The MPC refers to the relation between change in consumption (C) and change in income (Y).

Symbolically MPC = ∆C/∆Y

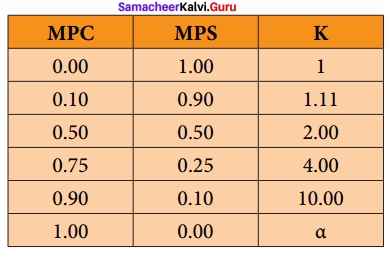

The value of the multiplier depends on MPC

Multiplier (K) = 1/1 – MPC

The multiplier is the reciprocal of one minus marginal propensity to consume.

Since marginal propensity to save is 1 – MPC. (MPC + MPS = 1).

The multiplier is 1/ MPS.

The multiplier is therefore defined as reciprocal of MPS.

The multiplier is inversely related to MPS and directly with MPC.

Numerically if MPC is 0.75, MPS is 0.25 and k is 4.

Using formula k = 1/1 – MPC

1/1 – 0.75 = 1/0.25 = 4

Taking the following values, we can explain the functioning of a multiplier.

C = 100 + 0.8 y; 1 = 100 1 = 10

Y = C + I

Y = 100 + 0.8y = 100 + (1000) = 900;

S = 100 = I

After I is raised by 10, now I = 110

Y = 100 + 0.8y + 110

0.2y = 210

Y = \(\frac{210}{0.2}\) = 1050

Here C = 100 = 0.8 (1050) = 940; S = 110 = 1

Diagrammatic Explanation.

At 45° line y = C + S

It implies the variables in axis and axis are equal.

The MPC is assumed to be at 0.8 (C = 100 + 0.8y)

The aggregate demand (C + I) curve intersects 45° line at point E.

The original national income is 500.

(C = 100 + 0.8y = 100 + 0.8 (500) = 500)

When I is 100, y = 1000, C = 900;

S = 100 = I

The new aggregate demand curve is C+F = 100 + 0.8y + 100 + 10

Y = \(\frac{210}{0.2}\) = 1050

C = 940; S = 110 = 1

Question 3.

Explain about Marginal Efficiency of Capital [MEC] short-run factors and long-run factors?

Answer:

(a) Short – Run Factors

1. Demand for the product:

- If the market for a particular good is expected to grow and its costs are likely to fall, the rate of return from the investment will be high.

- If entrepreneurs expect a fall in demand for goods and a rise in cost, the investment will decline.

2. Liquid assets:

- If the entrepreneurs are holding a large volume of working capital, they can take advantage of the investment opportunities that come their way.

- The MEC will be high.

3. Sudden changes in income:

- The MEC is also influenced by sudden changes in the income of the entrepreneurs.

- If the business community gets windfall profits, or tax concession the MEC will be high and hence investment in the country will go up.

- On the other hand, MEC falls with the decrease in income.

4. Current rate of investment:

- Another factor that influences MEC is the current rate of investment in a particular industry.

- If in a particular industry, much investment has already taken place and the rate of investment currently going on in that industry is also very large, then the marginal efficiency of capital will be low.

5. Waves of optimism and pessimism:

- The marginal efficiency of capital is also affected by waves of optimism and pessimism in the business cycle.

- If businessmen are optimistic about the future, the MEC will be likely to be high.

- During periods of pessimism, the MEC is underestimated and so will below.

(b) Long – Run Factors

The long-run factors which influence the marginal efficiency of capital are as follows:

1. Rate of growth of population:

- The marginal efficiency of capital is also influenced by the rate of growth of the population.

- If a population is growing at a rapid speed, it is usually believed that the demand for various types of goods will increase.

- So a rapid rise in the growth of population will increase the marginal efficiency of capital and a slowing down in its rate of growth will discourage investment and thus reduce marginal efficiency of capital.

2. Technological progress:

- If investment and technological development take place in the industry, the prospects of an increase in the net yield brighten up.

- For example, the development of automobiles in the 20th century has greatly stimulated the rubber industry, the steel and oil industry etc.

- So we can say that inventions and technological improvements encourage investment in various projects and increase marginal efficiency of capital.

3. Monetary and Fiscal policies:

Cheap money policy and liberal tax policy pave the way for greater profit margin and so MEC is likely to be high.

4. Political environment:

Political stability, smooth administration, maintenance of law and order help to improve MEC.

5. Resource availability:

A cheap and abundant supply of natural resources, efficient labour, and stock of capital enhances the MEC.

The main aim is to provide quality education for the students of Class 12th is very important for the students in their career. We hope the information provided in this Samacheer Kalvi Class 12th Economics Solutions Chapter 4 Consumption and Investment Functions Questions and Answers is satisfactory for all. Bookmark our site to get the latest information about the solutions.