Students can Download Tamil Nadu 12th Accountancy Model Question Paper 2 English Medium Pdf, Tamil Nadu 12th Accountancy Model Question Papers helps you to revise the complete Tamilnadu State Board New Syllabus and score more marks in your examinations.

TN State Board 12th Accountancy Model Question Paper 2 English Medium

General Instructions:

- The question paper comprises of four parts.

- You are to attempt all the parts. An internal choice of questions is provided wherever applicable.

- All questions of Part I, II, III and IV are to be attempted separately.

- Question numbers 1 to 20 in Part I are Multiple Choice Questions of one mark each.

These are to be answered by choosing the most suitable answer from the given four alternatives and writing the option code and the corresponding answer. - Question numbers 21 to 30 in Part II are two-mark questions. These are to be answered in about one or two sentences.

- Question numbers 31 to 40 in Part III are three-mark questions. These are to be answered in above three to five short sentences.

- Question numbers 41 to 47 in Part IV are five-mark questions. These are to be answered in detail Draw diagrams wherever necessary.

Time: 2.30 Hours

Maximum Marks: 90

Part – I

Answer all the questions. Choose the correct answer. [20 × 1 = 20]

Question 1.

Which one of the following statements is not true in relation to incomplete records?

(a) It is an unscientific method of recording transactions

(b) Records are maintained only for cash and period accounts

(c) It is suitable for all types of organisations

(d) Tax authorities do not accept

Answer:

(c) It is suitable for all types of organisations

Question 2.

What is the amount of capital of the proprietor, if his assets are ₹ 85,000 and liabilities are ₹ 21,000?

(a) ₹ 85,000

(b) ₹ 1,06,000

(c) ₹ 21,000

(d) ₹ 64,000

Answer:

(d) ₹ 64,000

Question 3.

Subscription due but not received for the current year is ________.

(a) An asset

(b) A liability

(c) An expense

(d) An item to be ignored

Answer:

(a) An asset

![]()

Question 4.

Legacy is a ________.

(a) Revenue expenditure

(b) Capital expenditure

(c) Revenue receipt

(d) Capital receipt

Answer:

(d) Capital receipt

Question 5.

Which of the following is the incorrect pair?

| (a) Interest on drawings | Debited to capital A/c |

| (b) Interest on capital | Credited to capital A/c |

| (c) Interest on loan | Debited to capital A/c |

| (d) Share of profit | Credited to capital A/c |

Answer:

(c) Interest on loan – Debited to capital A/c

Question 6.

In the absence of an agreement, partners are entitled to ________.

(a) Salary

(b) Commission

(c) Interest on loan

(d) Interest on capital

Answer:

(c) Interest on loan

Question 7.

Book profit of 2017 is ₹ 35000; non-recuring income included in the profit is ₹ 1000 and abnormal loss charged in the year was ₹ 2000 then the adjusted profit is ________.

(a) ₹ 36,000

(b) ₹ 35,000

(c) ₹ 38,000

(d) ₹ 34,000

Answer:

(a) ₹ 36,000

Question 8.

The total capitalised value of business is ₹ 1,00,000 assets are ₹ 1,50,000; and the liabilities are ₹ 80,000; the value of goodwill as per the capitalisation method will be ________.

(a) ₹ 40,000

(b) ₹ 90,000

(c) ₹ 1,00,000

(d) ₹ 30,000

Answer:

(d) ₹ 30,000

![]()

Question 9.

Select the odd one out:

(a) Revaluation profit

(b) Accumulated loss

(c) Goodwill brought by new partner

(d) Investment fluctuation fund

Answer:

(c) Goodwill brought by new partner

Question 10.

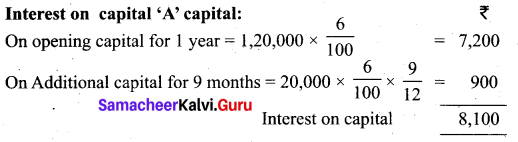

Match list I with list II and select the correct answer:

| List I | List II |

| (i) Sacrificing ratio | 1) Investment fluctuation fund |

| (ii) Old profit sharing ratio | 2) Accumulated profit |

| (iii) Revaluation Account | 3) Good will |

| (iv) Capital Account | 4) Unrecorded liability |

Answer:

(b) i – 3, ii – 2, iii – 4, iv – 1

Question 11.

‘A’ was a partner in a partnership firm. He died on 31.3.2019. The final amount due to him ₹ 25,000, which is not paid immediately. It will be transferred to ________.

(a) A’s capital A/c

(b) A’s current A/c

(c) A’s executors A/c

(d) A’s executors loan A/c

Answer:

(d) A’s executors loan A/c

![]()

Question 12.

A, B and C are partners sharing profit in the ratio of 2:2:1. On retirement of B, goodwill of the firm was valued as ₹ 30,000. Find the contribution of A and C to compensate B __________.

(a) ₹ 20,000 and ₹ 10,000

(b) ₹ 8,000 and ₹ 4,000

(c) ₹ 10,000 and ₹ 20,000

(d) ₹ 15,000 and ₹ 1,50,000

Answer:

(b) ₹ 8,000 and ₹ 4,000

Question 13.

When shares are issued for purchase of assets, the amount should be credited to _________.

(a) Vendor’s A/c

(b) Sundry assets A/c

(c) Share capital A/c

(d) Bank A/c

Answer:

(c) Share capital A/c

Question 14.

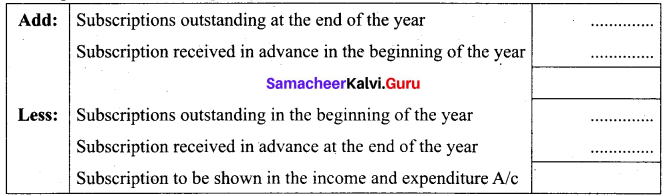

Match the pair and identify the correct option:

| List I | List II |

| 1) Under subscription | (i) Amount prepaid for calls |

| 2) Over subscription | (ii) Subscription above the offered share |

| 3) Calls-in-arrear | (iii) Subscription below the offered shares |

| 4) Calls-in-advance | (iv) Amount unpaid on calls |

Answer:

(a) 1 – i, 2 – ii, 3 – iii, 4 – iv

Question 15.

Which of the following statements is not true?

(a) All the limitations of financial statements are applicable to financial statement analysis also

(b) Financial statement analysis is only the means and not an end

(c) Expert knowledge is not required in analysing the financial statements

(d) Interpretation of the analysed data involves personal judgements

Answer:

(c) Expert knowledge is not required in analysing the financial statements

![]()

Question 16.

A limited company’s sales has increased from ₹ 1,25,000 to ₹ 1,50,000. How does this appear in comparative income statement?

(a) + 20%

(b) + 120%

(c) – 120%

(d) – 20%

Answer:

(a) + 20%

Question 17.

Proportion of share holders funds to total assets is called __________.

(a) Propbrietary ratio

(b) Capital gearing ratio

(c) Deb equity ratio

(d) Current ratio

Answer:

(a) Propbrietary ratio

Question 18.

Which one of the following is not correctly matched?

| (a) Liquid ratio | Proportion |

| (b) Gross profit ratio | Percentage |

| (c) Fixed assets turnover ratio | Percentage |

| (d) Deb equity ratio | Proportion |

Answer:

(c) Fixed assets turnover ratio – Percentage

Question 19.

Salary account comes under which of the following head?

(a) Direct incomes

(b) Direct expenses

(c) Indirect incomes

(d) Indirect expenses

Answer:

(d) Indirect expenses

![]()

Question 20.

₹ 25,000 withdrawn from bank for office use. In which voucher type, this transactions will be recorded ________.

(a) Contra voucher

(b) Receipt voucher

(c) Payment voucher

(d) Sales voucher

Answer:

(a) Contra voucher

Part – II

Answer any seven questions in which question No. 30 is compulsory. [7 × 2 = 14]

Question 21.

Mention any two features of incomplete records:

Answer:

(i) Nature:

It is an unscientific and unsystematic way of recording transactions. Accounting principles and accounting standards are not followed properly.

(ii) Lack of uniformity:

There is no uniformity in recording the transactions among different organisations. Different organisations record their transactions according to their needs and conveniences.

Question 22.

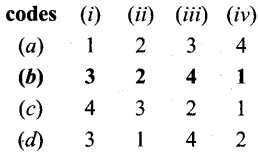

Show the calculation of subscription account how to write?

Answer:

Subscription received during the year.

![]()

Question 23.

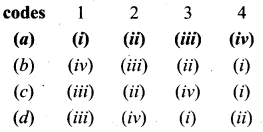

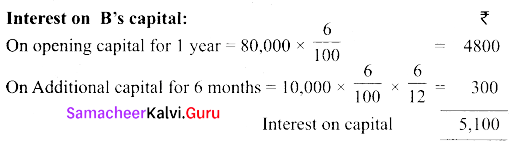

A and B were partners sharing ratio of 3:2. Balance in their capital account on. 1st January 2018 was ‘A’ ₹ 1,20,000 and ‘B’ ₹ 80,000 on 1st April 2018. ‘A’ introduced additional capital of ₹ 20,000. ‘B’ introduced additional capital of ₹ 10,000 during the year. Calculate interest on capital at 6% p.a. year ending 31st Dec 2018.

Answer:

Question 24.

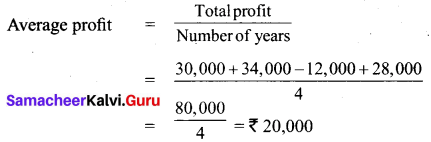

The Profits and losses of a firm for the last four years:

2015 = ₹ 30,000

2016 = ₹ 34,000

2017 = ₹ 12,000 (Loss)

2018 = ₹ 28,000

you are required to calculate the amount of goodwill on the basis of 5 years purchase of average profits of last 4 year.

Answer:

Goodwill = Average profit × No. of years of purchase

Goodwill = Average profit × No. of years of purchase .

= ₹ 20,000 × 5

= ₹ 1,00,000

![]()

Question 25.

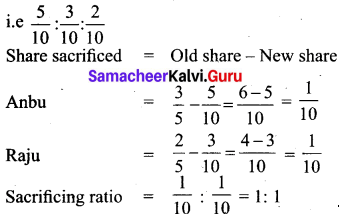

Anbu and Raju are partners sharing profits in the ratio of 3:2. Akshai is admitted as a partner. The new profit sharing ratio among Anbu, Raju and Akshai is 5:3:2. Find out the sacrificing ratio.

Answer:

Old ratio of Anbu and Raju 3:2 that is \(\frac{3}{5}: \frac{2}{5}\)

New ratio of Anbu, Raju and Akshai 5:3:2

Question 26.

Kiran, Vinoth and Vimal are partners sharing profits in the ratio of 5:3:2. Kiran retires and the new profit sharing ratio between Vinoth and Vimal is 2:1. Calculate the gaining ratio.

Share gained = New share – Old Share

![]()

∴ The gaining ratio of Vinoth and Vimal is 11 : 4

Question 27.

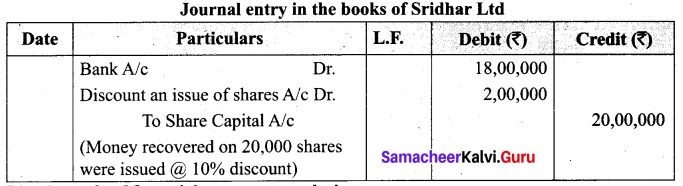

Sridhar Ltd issued 20,000 shares of? 100 each at discount of 10%. Give journal entry.

Answer:

Question 28.

List the tools of financial statement analysis.

Answer:

Following are the commonly used tools of financial statement analysis.

- Comparative statement

- Common size statement

- Trend – analysis

- Funds flow analysis

- Cash flow analysis

![]()

Question 29.

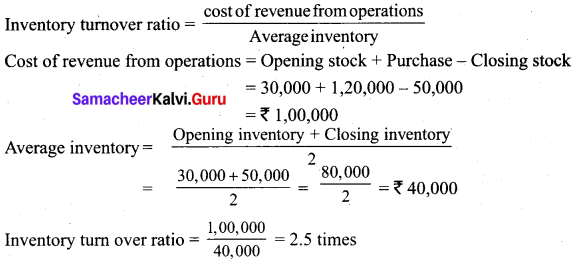

Calculate inventory turnover ratio:

Opening stock = ₹ 30,000; Closing stock = ₹ 50,000; Purchases = ₹ 1,20,000

Answer:

Question 30.

What are the steps involved in designing accounting reports?

Answer:

- Define the objective of generating report

- Specify the structure of the report

- Creating data base queries to interact with the database to retrieve, modify, add or delete data from the records.

Part – III

Answer any seven questions in which question No. 40 is compulsory. [7 × 3 = 21]

Question 31.

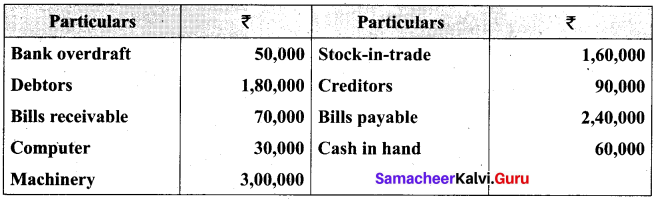

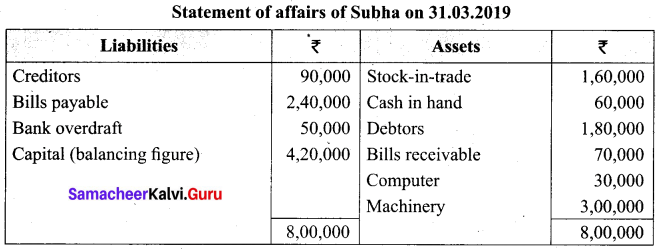

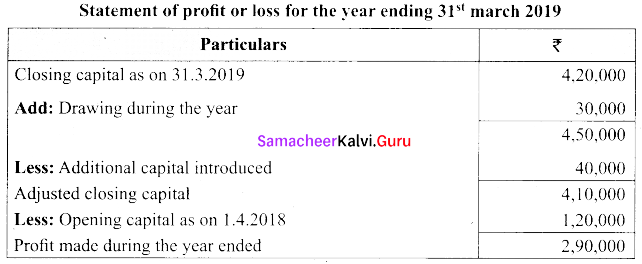

On 1st April 2018, Subha started her business with a capital ₹ 1,20,000; she did not maintain proper books of accounts.

Following particulars are available from her books as on 31.3.2019.

Answer:

![]()

Question 32.

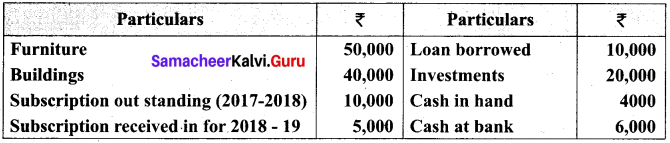

Compute capital fund of Karu social club on 31.3.2018.

Answer:

Question 33.

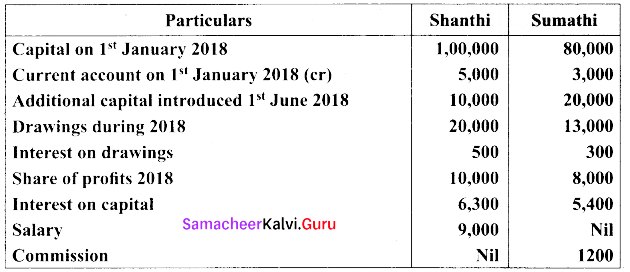

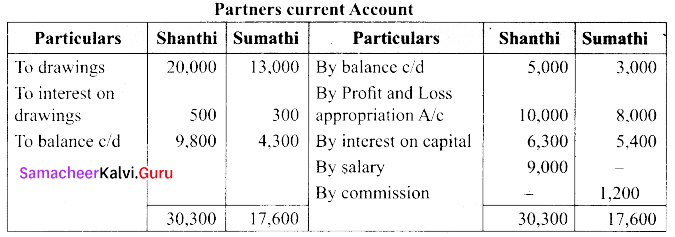

From the following information prepare capital accounts of partners, Shanthi and Sumathi when their capitals are fixed.

Answer:

![]()

Question 34.

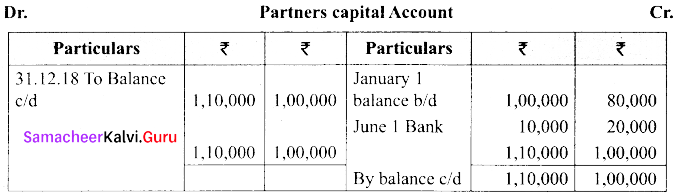

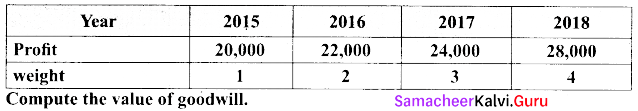

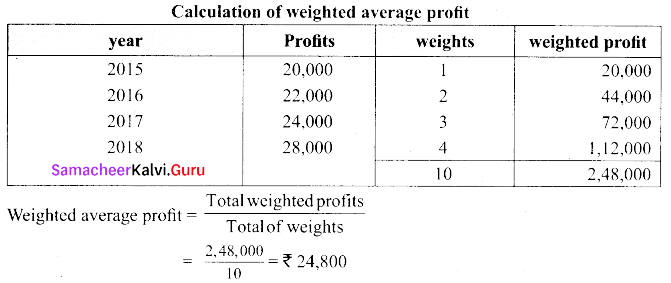

For the purpose of admitting a new partner a firm has decided to value goodwill at 3 years purchase of average profits of the last 4 years using weighted average method. Profits of the past 4 years and the respective weight.

Answer:

Goodwill = Weighted average profit × No. of years of purchase

= ₹ 24,800 × 3 = ₹ 74,400

Question 35.

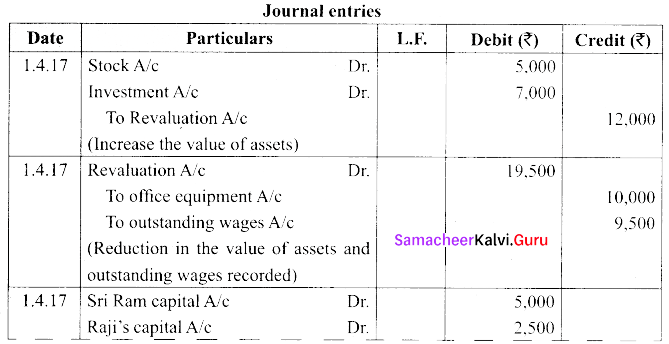

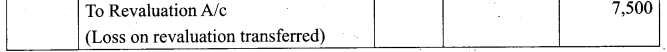

Sri Ram and Raj are partners sharing ratio 2:1. Nelson joins as a partner on 1st April 2017. The following adjustments are to made

(i) Increase the value of stock by ₹ 5,000

(ii) Bring into record investment of ₹ 7,000 which had not been recorded in the books of the firm

(iii) Reduce the value of office equipment by ₹ 10,000

(iv) A provision would also be made for outstanding wages for ₹ 9,500. Give journal entries and prepare revaluation A/c.

Answer:

![]()

Question 36.

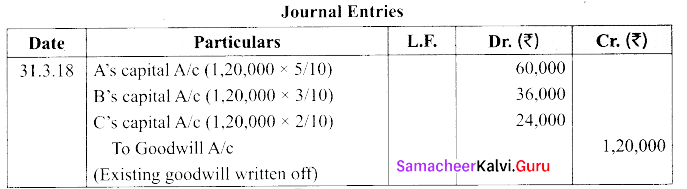

A, B and C are partners in a firm sharing profit and losses in the ratio of 5:3:2 on 31st March 2018. ‘C’ retires from the firm. Goodwill appeared in the books of a firm ₹ 1,20,000 by assuming fluctuating capital account. Pass the journal entries.

(a) Write off the entire amount of existing goodwill

(b) Write off half of the existing goodwill

Answer:

(b) Write off half of the existing goodwill

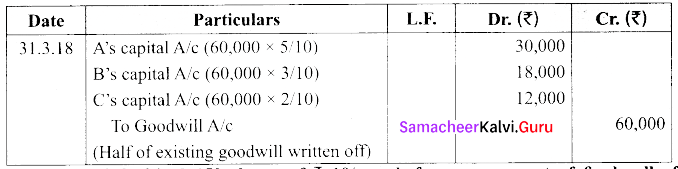

Question 37.

Maruthi Ltd forfeited 150 shares of ₹ 10/- each for non-payment of final call of ₹ 4/- of these 100 shares were reissued @ 9 per share. Pass journal entries for forfeiture and reissue.

Answer:

Question 38.

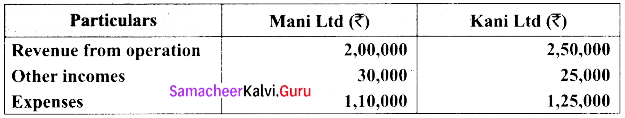

From the following particulars of Mani Ltd and Kani Ltd, prepare a common size income statement for the year ended 31st March 2019.

Answer:

Answer:

![]()

Question 39.

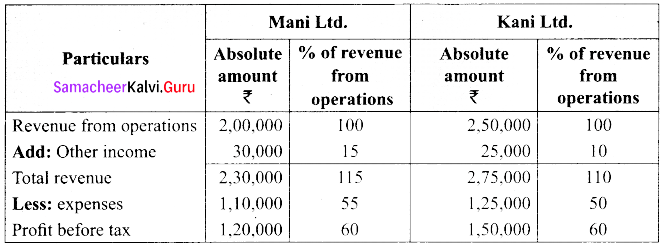

Calculate gross profit ratio, net profit ratio, stock turnover ratio, opening stock ₹ 1,00,000; Purchases ₹ 3,50,000; Gross profit ₹ 1,50,000; Net profit 90,000; Revenue from operations ₹ 4,50,000; closing stock ₹ 1,50,000.

Answer:

Cost of revenue from operations = Revenue from operations – gross profit

= 45,00,000 – 1,50,000

= ₹ 3,00,000

Question 40.

What is meant by voucher and what are its types?

Answer:

Voucher is a document which contains details of transactions. Transactions are to be recorded through voucher entries. Tally has a set of predefined vouchers such as purchase, sales, payment, receipts and contra to view the list of voucher type. Gateway of tally → Masters → Accounts info → voucher type → display.

Following are some of major accounting voucher:

- Receipt voucher

- Payment voucher

- Contra voucher

- Purchase voucher

- Sales voucher

- Journal voucher

As per the requirement of users, additional voucher type can be created.

Part – IV

Answer all the following questions. [7 × 5 = 35]

Question 41.

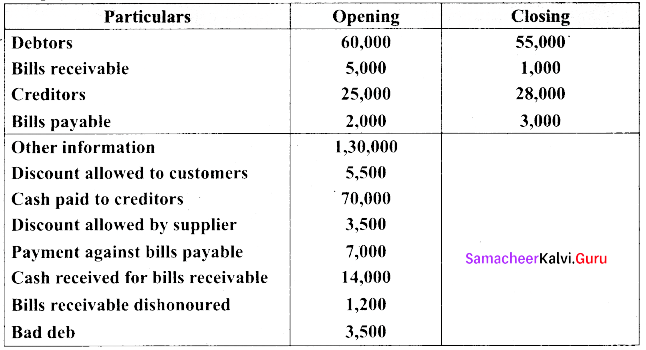

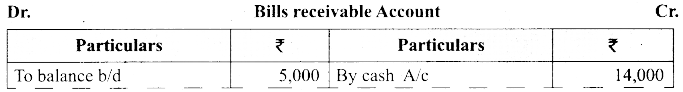

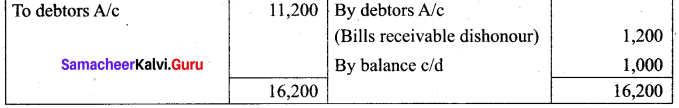

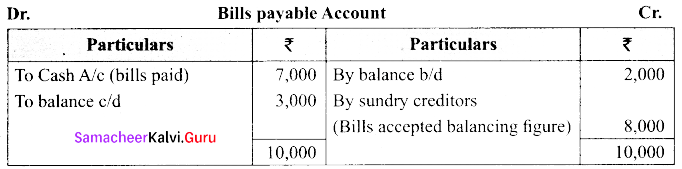

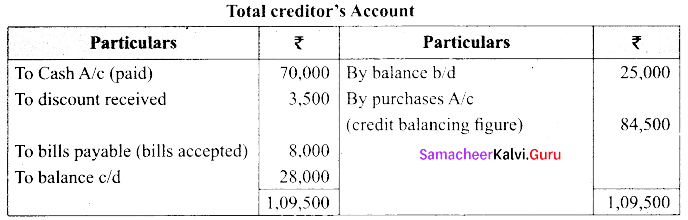

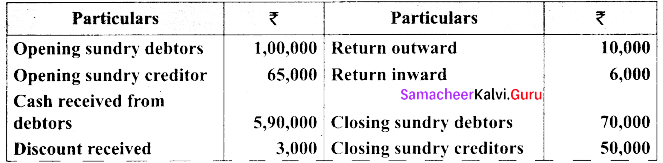

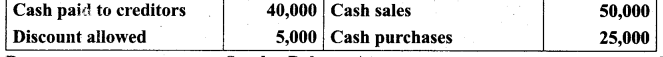

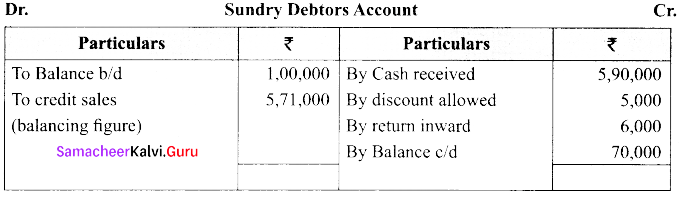

(a) From the following details, you are required to calculate credit sales and credit purchases by preparing total debtors account, total creditors account, bills receivable account and bills payable account.

Answer:

[OR]

(b) Find out total purchases and total sales from the following details by preparing accounts.

Answer:

Answer:

Total sales = Cash sales + Credit sales

= ₹ 50,000 + ₹ 5,71,000

= ₹ 6,21,000

Cash purchases + credit purchases

= ₹ 25,000 + ₹ 38,000

= ₹ 63,000

![]()

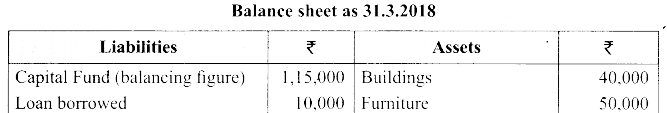

Question 42.

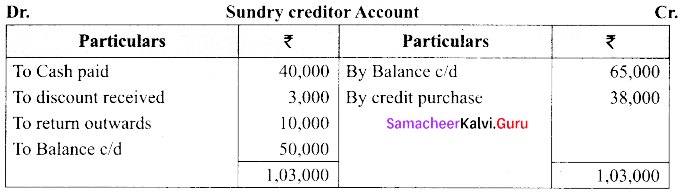

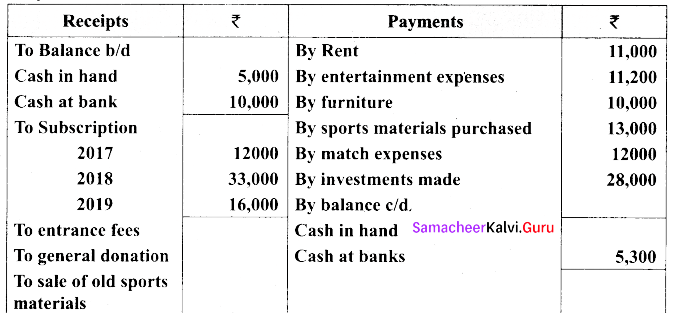

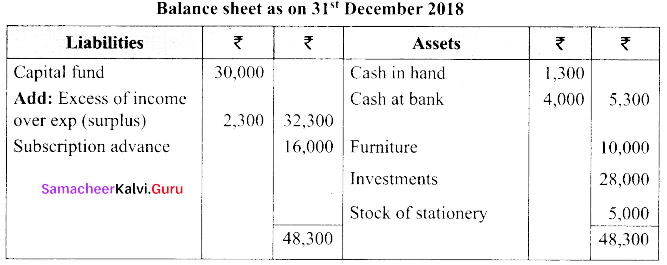

(a) From the following Receipts and Payments account and from the information given below of Ramanathapuram Sports Club, prepare Income and Expenditure account for the year ended 31st December, 2018 and the balance sheet as on that date.

Answer:

Additional information:

(i) Capital fund as on 1st January 2018. ₹ 30,000

Opening stock of sports materials ₹ 3,000 and closing stock of sports material ₹ 5,000

Answer:

[OR]

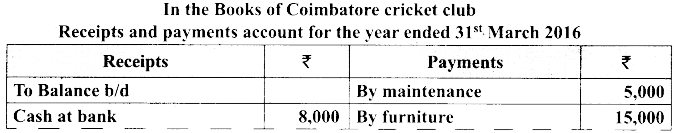

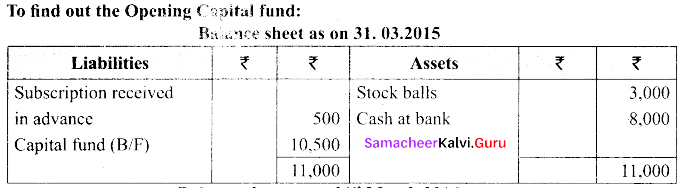

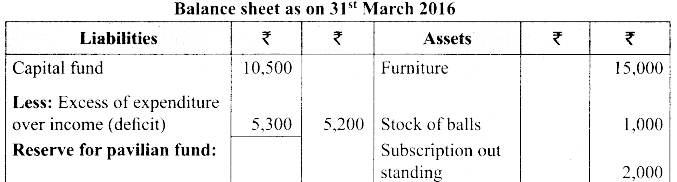

(b) From the following receipt and payment account of Coimbatore cricket club for the year ending 31st March 2016. Prepare income and expenditure account for the year ending 31st March 2016 and a balance sheet as on that date.

Answer:

Additional Information:

On 1st April 2015 the club had stock of balls and bats ₹ 3,000 and an advance subscription of ₹ 500. Surplus an account of tournament should be kept in reserve for permanent pavilian. subscription due on 31st March 2016 was ₹ 2,000. Stock of bats and balls 31.3.2016 ₹ 1,000.

Answer:

![]()

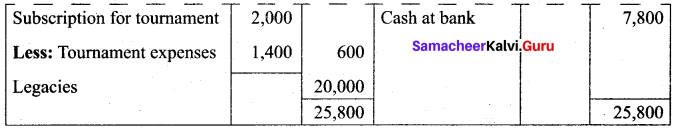

Question 43.

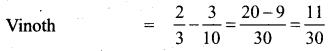

(a) A and B were partners sharing ratio of 7:3. Their capitals ₹ 80,000 and ₹ 60,000 respectively. Their partnership deed.

(i) Interest on capital @ 10% P.a.

(ii) Interest on drawing @ 12% P.a.

(iii) A and B to get a salary of ₹ 10,000 each. Per annum

(iv) A to get a commission of 10% on the net profit before changing such commission.

The profit of the firm for 2018 before making the above adjustments was drawing of the partners during the year were A ₹ 12,000; B ₹ 8,000

Show the profit and loss appropriation account of firm.

Answer:

[OR]

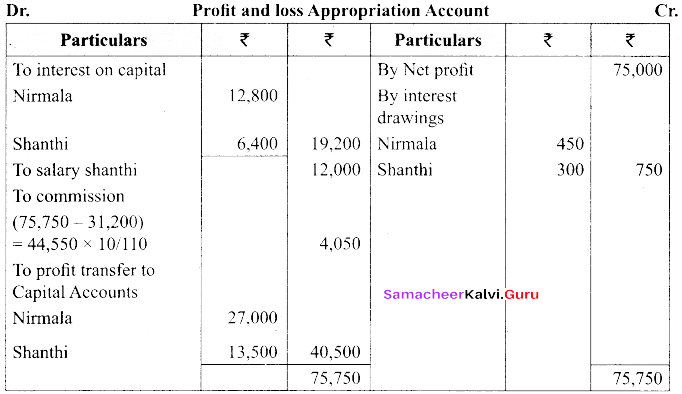

(b) Nirmala and shanthi were partners in a firm ratio 2:1. Their capital ₹ 1,60,000 and ₹ 80,000 respectively. Their partnership deed provides for the following.

(i) Interest on capital @8%

(ii) Interest on drawings @ 6%

(iii) Shanthi to get a salary of ₹ 1,000 P.m.

(iv) Shanthi to get a commission of 10% an the net profit after changing such commission. The profit of the firm for the year ended 31.03.2005 before making the above adjustments was ₹ 75,000.

Drawings of the partners during the year were Nirmala ₹ 15,000 and shanthi ₹ 10,000.

Show the profit and loss appropriation Account of firm.

Answer:

Question 44.

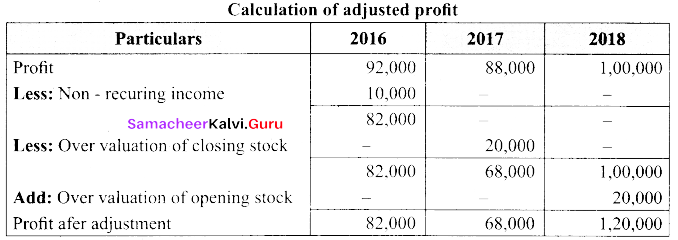

(a) From the following information relating to Arul enterprises calculate value of goodwill as the basis of 2 year purchase of the average profit of 3 year.

(0 Profit for the year ending 31st December 2016, 2017, 2018 were ₹ 92,000; ₹ 88,000; and ₹ 1,00,000 respectively.

(ii) A non – recurring income of ₹ 10,000 is included in the profit of 2016.

(iii) The closing stock of the year 2017 was over valued by 20,000.

Answer:

Goodwill = Average profit × Number of years of purchase

= ₹ 90,000 × 2 = ₹ 1,80,000

[OR]

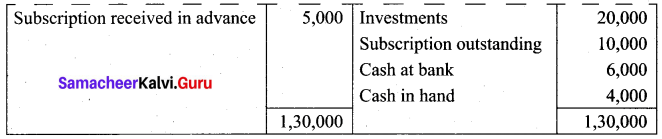

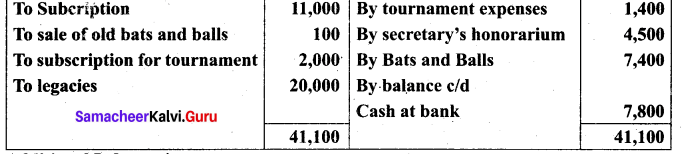

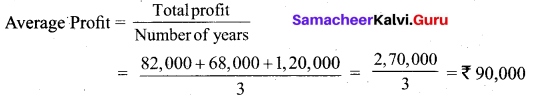

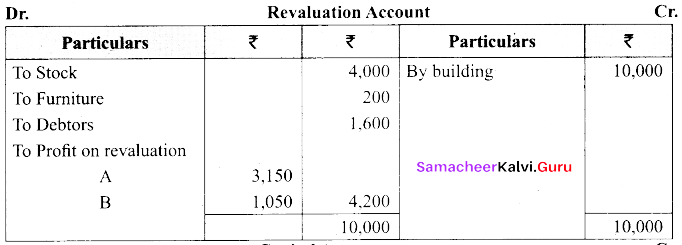

(b) A and B are partners profit & losses ratio of 3:1. Their balance sheet of 31st March 2017 as under.

On 1.4.2017 they admit ‘C’ as a new partner of the following arrangements.

(i) ‘C’ brings ₹ 20000 as capital for 1/5 share of profit

(ii) Stock and furniture is to be reduced by 10% a reserve of 5% on debtors for doubtful debtor.

(iii) Appreciate building by 20%

Prepare revaluation a/c & partners capital account and the balance sheet of the firm admission.

Answer:

![]()

Question 45.

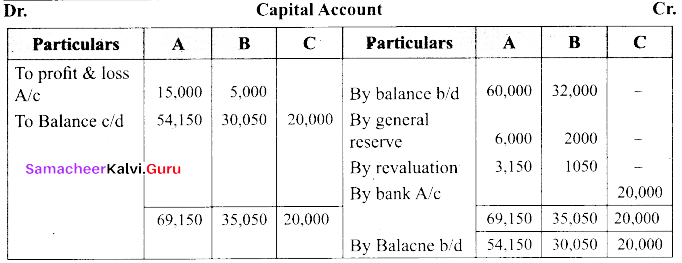

(a) ‘A’, ‘B’ and ‘C’ are partners profit and losses are equally. Their balance sheet as on 31.3.2018 is balance sheet.

Answer:

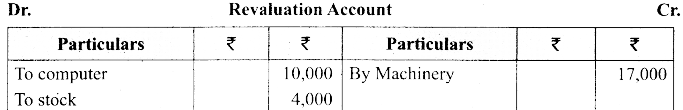

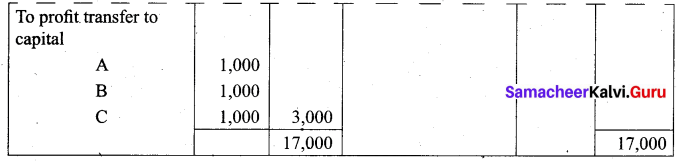

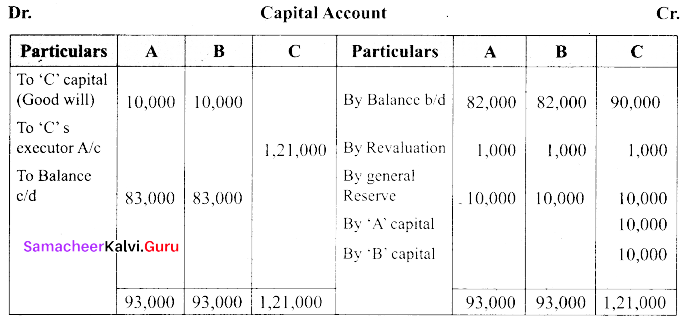

‘C’ died on 1st April 2018. The following agreement was to be put into effect.

(i) Goodwill was valued at 60000; ‘C’ was to be credited with his share.

(ii) Assets were revalued; Machinery ₹ 1,17,000; computer to ₹ 46,000; Stock to ₹ 15,000.

(iii) ₹ 21,000 was to be paid away to the ‘C’s executor on 1st April.

Prepare the revaluation, capital A/c & Balance sheet of new firm.

Answer:

[OR]

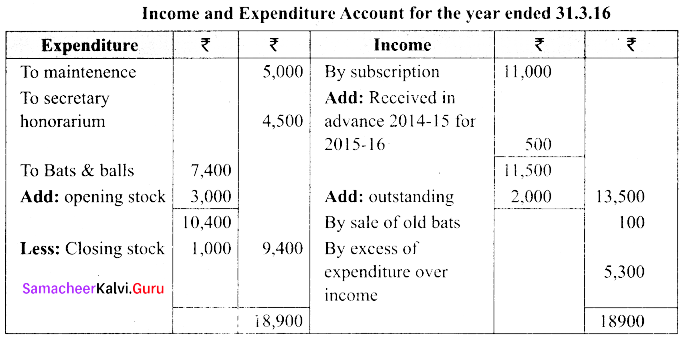

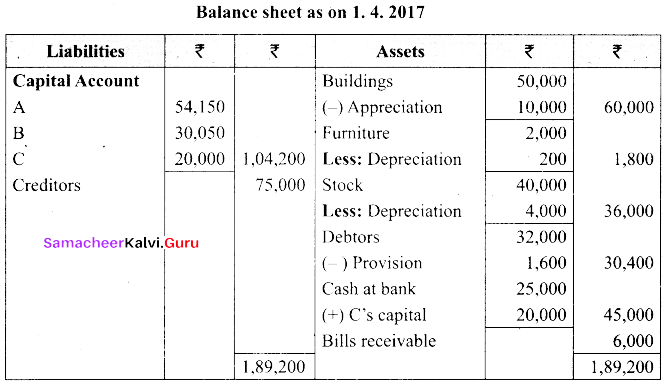

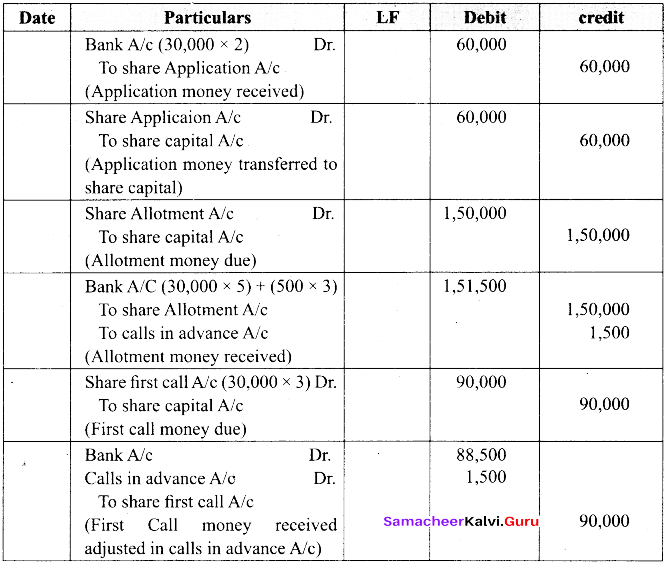

(b) Anjali Flour Ltd with a registered capital ₹ 4,00,000 in equity share of ₹ 10 each issued 30,000 of such shares payable 2/- per share an application. ₹ 5/- per share an allotment and ₹ 3/- per share on first call. The issue was duly subscribed.

All the money payable was duly received but on allotment share holder paid the entire balance on his holding of 500 shares. Give journal entries to record the transactions.

Answer:

![]()

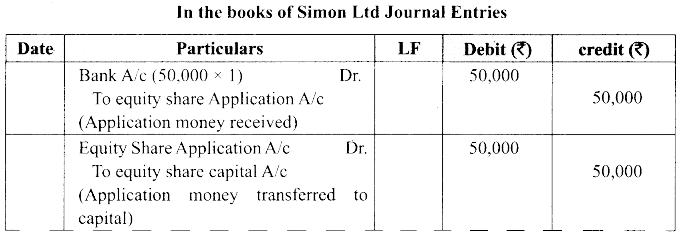

Question 46.

(a) Simon Ltd issued 50,000 equity shares of ₹ 10/- each at per payable an application ₹ 1 per share on, allotment ₹ 5/- per share on first call ₹ 2/- per share and on second & final calls ₹ 2/- per share. The issue was fully subscribed and all the amount were duty received with the exception of 2,000 shares held by Chezhian. who failed to pay the second & final call. Journalise the above transaction.

Answer:

[OR]

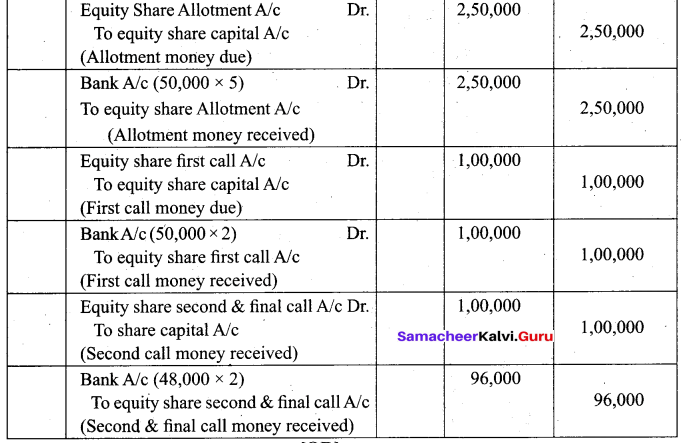

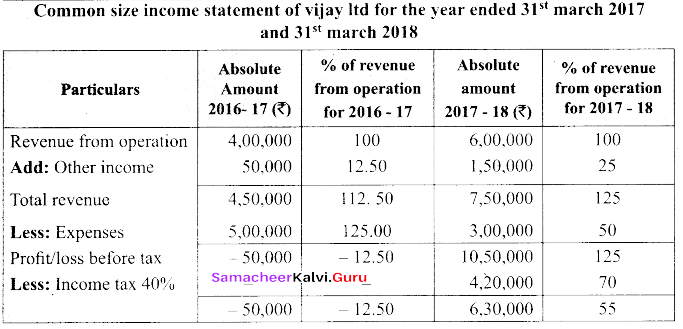

(b) From the following particulars of vijay Ltd prepare common size income statement for the year ended 31st march 2017 and 31st march 2018.

Answer:

Question 47.

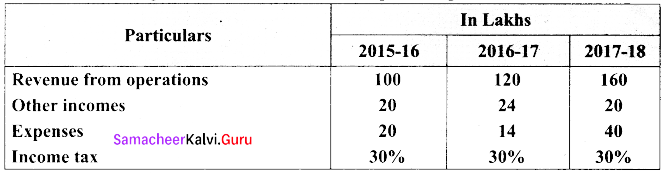

(a) From the following information calculate trend percentage for Malar Ltd.

Answer:

[OR]

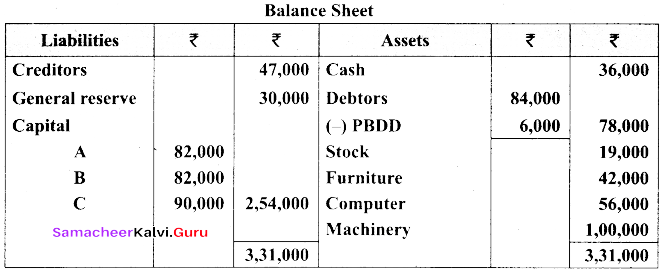

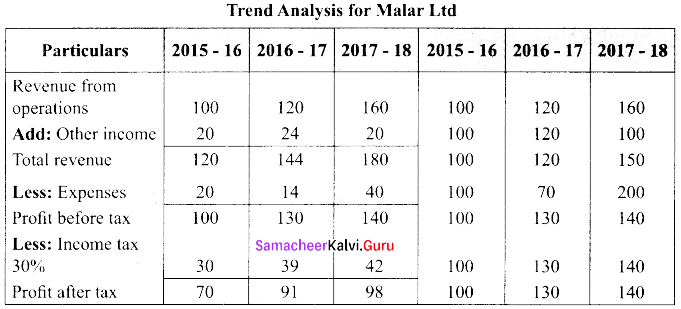

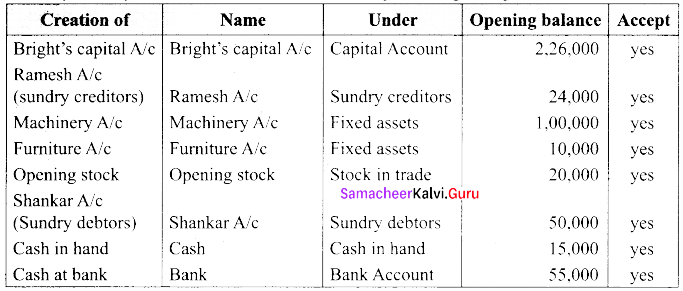

(b) The following balance sheet has been prepared from the books of bright on 1.4.2018

During the year the following transaction took place,

- Wages paid by cash ₹ 2,000

- Rent paid by cheque ₹ 5,000

- Cash purchases made for ₹ 3,000

- Good purchased on credit from Senthamarai ₹ 15,000

- Good sold in credit to Pushparaj ₹ 25,000

- Payment made to Santhamarai by cheque ₹ 5,000

- Cash received from Shankar ₹ 30,000

- Cash sales made for ₹ 6,000

- Depreciate machinery at 10%

- Closing stock on 31.03.2019 ₹ 15,000

You are required to prepare trading and profit and loss A/c for the year ended 31.03.2019 and balance sheet using Tally.

Answer:

Following steps are to be followed to outer the transaction in tally ERP.9

1. To create company Company info > Create company

Type the name as briget and keep all other fields as they are and choose “yes” to accept.

2. To maintain accounts only

Gateway of Tally > F11 Accounting features > General > maintain accounts only: yes > accept yes

3. To create ledger accounts with opening balances

Gateway of Tally > Masters > Accounts info > Ledgers > single ledger > create

Note:

Cash account need not be created as it is default ledger only the opening balance has to be recorded by altering the cash account.

To record the opening balance of cash

Gateway of Tally > Masters > Accounts info > Ledger > single Ledger > Alter.