Students can Download Tamil Nadu 12th Accountancy Model Question Paper 3 English Medium Pdf, Tamil Nadu 12th Accountancy Model Question Papers helps you to revise the complete Tamilnadu State Board New Syllabus and score more marks in your examinations.

TN State Board 12th Accountancy Model Question Paper 3 English Medium

General Instructions:

- The question paper comprises of four parts.

- You are to attempt all the parts. An internal choice of questions is provided wherever applicable.

- All questions of Part I, II, III and IV are to be attempted separately.

- Question numbers 1 to 20 in Part I are Multiple Choice Questions of one mark each.

These are to be answered by choosing the most suitable answer from the given four alternatives and writing the option code and the corresponding answer. - Question numbers 21 to 30 in Part II are two-mark questions. These are to be answered in about one or two sentences.

- Question numbers 31 to 40 in Part III are three-mark questions. These are to be answered in above three to five short sentences.

- Question numbers 41 to 47 in Part IV are five-mark questions. These are to be answered in detail Draw diagrams wherever necessary.

Time: 2.30 Hours

Maximum Marks: 90

Part – I

Answer all the questions. Choose the correct answer. [20 × 1 = 20]

Question 1.

Which of the following items relating to bills payable is transferred to total creditors account?

(a) Opening balance of bills payable

(b) Closing balance of bills payable

(c) Bills payable accepted during the year

(d) Cash paid for bills payable

Answer:

(c) Bills payable accepted during the year

Question 2.

The amount of credit sales can be computed from _______.

(a) Total debtors A/c

(b) Total creditors A/c

(c) Bills receivable A/c

(d) Bills payable A/c

Answer:

(a) Total debtors A/c

Question 3.

Income and expenditure account is prepared to find out ________.

(a) Profit or loss

(b) Cash and bank balance

(c) Surplus or deficit

(d) Financial position

Answer:

(c) Surplus or deficit

Question 4.

Which of the following should not be recorded in the income and expenditure account?

(a) Sale of old newspaper

(b) Loss on sale of assets

(c) Honorarium paid to the secretary

(d) Sale proceeds of furniture

Answer:

(d) Sale proceeds of furniture

![]()

Question 5.

When fixed capital method is adopted by a partnership firm, which of the following items will appear in capital account?

(a) Additional capital introduced

(b) Interest on capital

(c) Interest on drawings

(d) Share of profit

Answer:

(a) Additional capital introduced

Question 6.

When a partner withdraws regularly a fixed sum of money at the middle of every month, period for which interest is to be calculated on the drawings as on average is _______.

(a) 5.5 months

(b) 6 months

(c) 12 months

(d) 6.5 months

Answer:

(b) 6 months

Question 7.

When the average profit is ₹ 25,000 and the normal profit is ₹ 15,000, super profit is

(a) ₹ 25,000

(b) ₹ 5,000

(c) ₹ 10,000

(d) ₹ 15,000

Answer:

(c) ₹ 10,000

Question 8.

Book profit of 2017 is ₹ 35,000; Non-recurring income included in the profit is ₹ 1,000; and abnormal loss was ₹ 2,000 then the he adjusted profit is _______.

(a) ₹ 36,000

(b) ₹ 35,000

(c) ₹ 38,000

(d) ₹ 34,000

Answer:

(a) ₹ 36,000

![]()

Question 9.

At the time of admission, the goodwill brought by the new partner may be credited to the capital accounts of _______.

(a) all the partners

(b) the old partners

(c) the new partners

(d) the sacrificing partners

Answer:

(d) the sacrificing partners

Question 10.

Which of the following statements is not true in relation to admission of a partner?

(a) Generally mutual rights of the partners change

(b) The profits and losses of the previous years distributed to the old partners

(c) The firm is reconstituted under a new agreement

(d) The existing agreement does not come to an end

Answer:

(d) The existing agreement does not come to an end

Question 11.

At the time of retirement of a partner, determination of gaining ratio is required ______.

(a) To transfer revaluation profit or loss

(b) To distribute accumulated profits and losses

(c) To adjust goodwill

(d) None of these

Answer:

(c) To adjust goodwill

Question 12.

If the final amount due to a retiring partner is not paid immediately, it is transferred to ________.

(a) Bank A/c

(b) Retiring partner’s capital A/c

(c) Retiring partner’s loan A/c

(d) Other partner’s capital A/c

Answer:

(c) Retiring partner’s loan A/c

Question 13.

The amount received over and above the par value is credited to ________.

(a) Securities premium A/c

(b) Calls-in-advance A/c

(c) Share capital A/c

(d) Forfeited shares A/c

Answer:

(a) Securities premium A/c

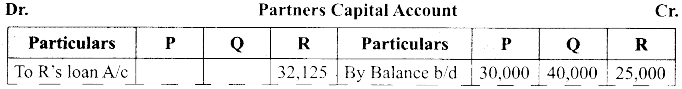

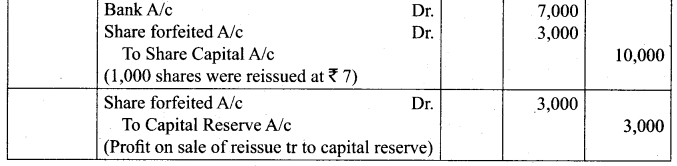

![]()

Question 14.

Which of the following is false?

(a) Issued capital can never be more than the authorized capital

(b) In the case of under subscription, issued capital will be less than the subscribed capital

(c) Reserve capital can be called at the time of winding up

(d) Paid up capital is part of called up capital

Answer:

(b) In the case of under subscription, issued capital will be less than the subscribed capital

Question 15.

Which of the following statement is not a tool of financial statement analysis?

(a) Trend analysis

(b) Common size statement

(c) Comparative statement

(d) Standard costing

Answer:

(d) Standard costing

Question 16.

The term “fund” refers to ______.

(a) Current liabilities

(b) Working capital

(c) Fixed assets

(d) Non – current assets

Answer:

(b) Working capital

Question 17.

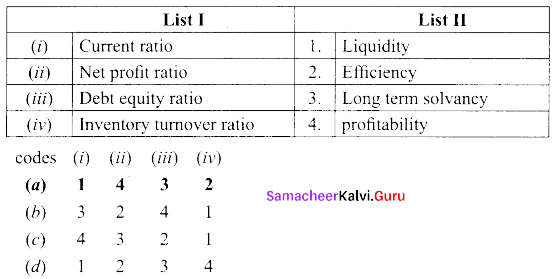

Match list I with list II and select the correct answer:

Answer:

(a) i – 1

(b) ii – 4

(c) iii – 3

(d) iv – 2

![]()

Question 18.

To test the liquidity of a concern, which of the following ratios are useful?

(i) Quick ratio

(ii) Net profit ratio

(iii) Debt-equity ratio

(iv) Current ratio.

Select the correct answer using codes

(a) (i) and (ii)

(b) (i) and (iv)

(c) (ii) and (iii)

(d) (ii) and (iv)

Answer:

(b) (i) and (iv)

Question 19.

Contra voucher is used for ______.

(a) Master entry

(b) Withdrawal of cash from bank for office use

(c) Reports

(d) Credit purchase of assets

Answer:

(b) Withdrawal of cash from bank for office use

Question 20.

Which is not the default group in Tally?

(a) Suspense Account

(b) Outstanding expenses

(c) Sales account

(d) Investment

Answer:

(b) Outstanding expenses

Part – II

Answer any seven questions in which question No. 30 is compulsory. [7 × 2 = 14]

Question 21.

What is a statement of affairs?

Answer:

A statement of affairs is a statement showing the balances of assets and liabilities on a particular date. This method of ascertaining profit is also called as statement of affairs method or networth method or capital comparison method.

![]()

Question 22.

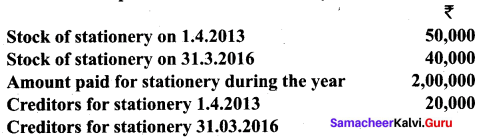

From the following information, calculate the amount of stationery to be shown in income and expenditure account for the year ended 31st March 2016.

Answer:

Question 23.

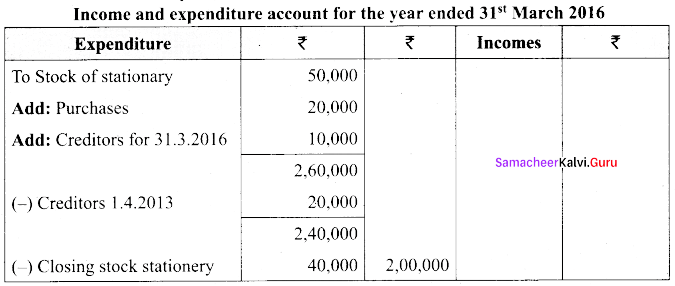

Sundar drew regularly ₹ 2,000 at end of the every month during the year. Calculate interest on drawings @ 10 % p.a.

Answer:

Question 24.

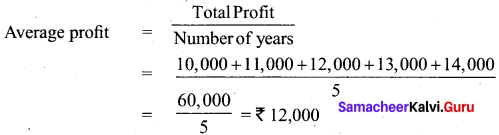

The following are the profits of a firm in the last 5 year :

2014 – ₹ 10,000, 2015 – ₹ 11,000; 2016 – ₹ 12,000; 2017 – ₹ 13,000; and 2018 – ₹ 14,000.

Calculate the value of goodwill at 2 years purchase of average profit of 5 years.

Answer:

Goodwill = Average profit × No. of years of purchase

Goodwill = Average profit × No. of years of purchase

= ₹ 12,000 × 2 = ₹ 24,000

= ₹ 24,000

Question 25.

What is meant by revaluation of assets and liabilities?

Answer:

When a partner is admitted into the partnership, the assets and liabilities are revalued as the current value may differ from the book value. Determination of current values of assets and liabilities is called revaluation of assets and liabilities.

![]()

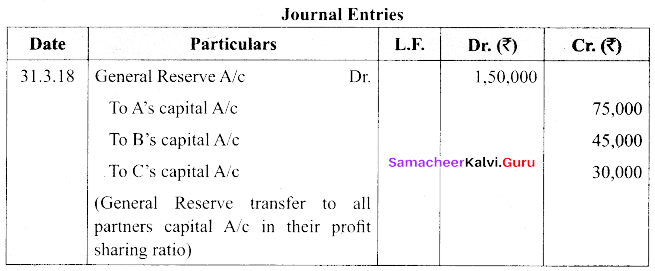

Question 26.

A, B and C are partners sharing profit ratio 5:3:2 on 31.3.2018. A retries on the date of retirement, the books of the firm showed a reserve fund of ₹ 1,50,000. Pass the journal entry to transfer reserve fund.

Answer:

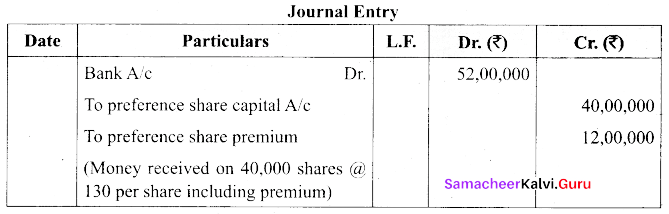

Question 27.

Vinod company Ltd issued ₹ 40000 preference share ₹ 100 each premium of ₹ 30.

Answer:

Question 28.

What is trend analysis?

Answer:

Trend analysis refers to the study of movement of figures over a period. The trend may be increasing trend or decreasing trend or irregular.

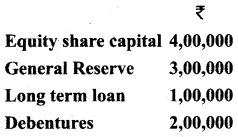

Question 29.

Calculate Debt-equity ratio.

Answer:

Deb-equity ratio = \(\frac{\text { Total long term debts }}{\text { Shareholders fund }}\)

Total long term deb = Debentures + Long term ratio

= 2,00,000 + 1,00,000

= ₹ 3,00,000

Share holders funds = Equity share capital + General Reserve

= 4,00,000 + 3,00,000

= ₹ 7,00,000

∴ Deb equity ratio = \(\frac{3,00,000}{7,00,000}\) = 0.43 : 1

![]()

Question 30.

What are accounting reports?

Answer:

Accounting report is a compilation of accounting information that are derived from the . accounting records of a business concern. Accounting reports may be classified as routine reports and special purpose reports.

Part – III

Answer any seven questions in which question No. 40 is compulsory. [7 × 3 = 21]

Question 31.

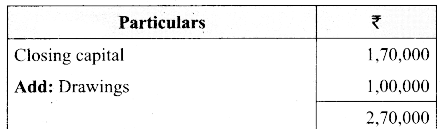

From the following details, calculate the missing figure.

| Particulars | ₹ |

| Drawings | 1,00,000 |

| Additional capital | 20,000 |

| Opening capital | 2,00,000 |

| Profit made during the year | 50,000 |

Answer:

Question 32.

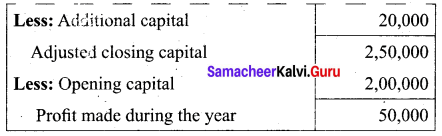

How will the following items appear in the final accounts of the club for the year ending 31st March 2017. Received subscription of ₹ 80,000 during the year 2016-17. This includes ₹ 10,000 for 2015-16, and ₹ 6,000 for the year 2017-18. Subscription of ₹ 2,000 is still outstanding for the year 2016-17.

Answer:

![]()

Question 33.

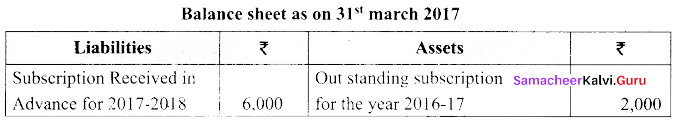

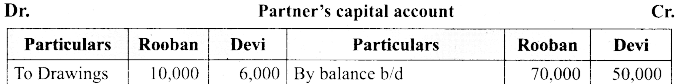

From the following information, prepare the capital account of partners Rooban and Devi when their capitals are fluctuating.

Answer:

Question 34.

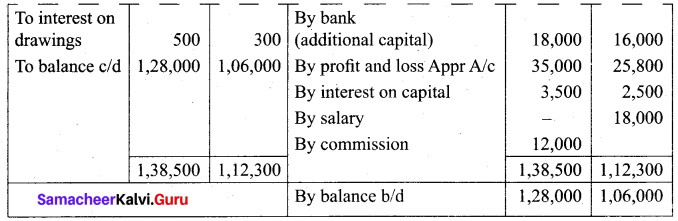

From the following information relating to Sridevi enterprises, calculate the value of goodwill on the basis of 4 years purchase of the average profits of 3 year.

a) Profits for the year ending 31st Dec 2016, 2017 and 2018 were ₹ 1,75,000, ₹ 1,50,001; raid ₹ 2,00,000 respectively.

b) A non-recurring income of ₹ 45,000 is included in the profit of the year 2016.

c) The closing stock of the year 2017 was overvalued by ₹ 30.000.

Answer:

Goodwill = Average profit × Number of years of purchase

= 1,60,000 × 4

= ₹ 6,40,000

Question 35.

Seenu and Siva are partners sharing profits in the ratio of 5:3. In the view of Kowsalya admission, they decided,

a) To increase the value of building by ₹ 80,000.

b) To bring into record investment @ ₹ 20,000; so far not recorded.

c) To decrease the value of machinery by ₹ 28,000; and furniture by ₹ 24,000.

d) To write off sundry creditors by ₹ 32,000. Pass entries and prepare revaluation account.

Answer:

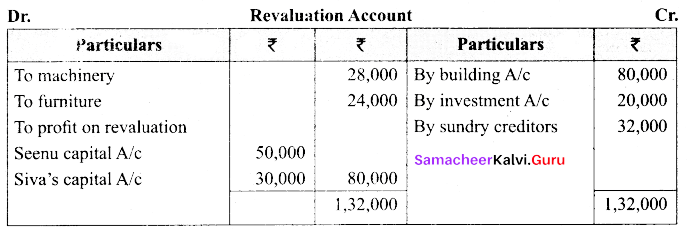

![]()

Question 36.

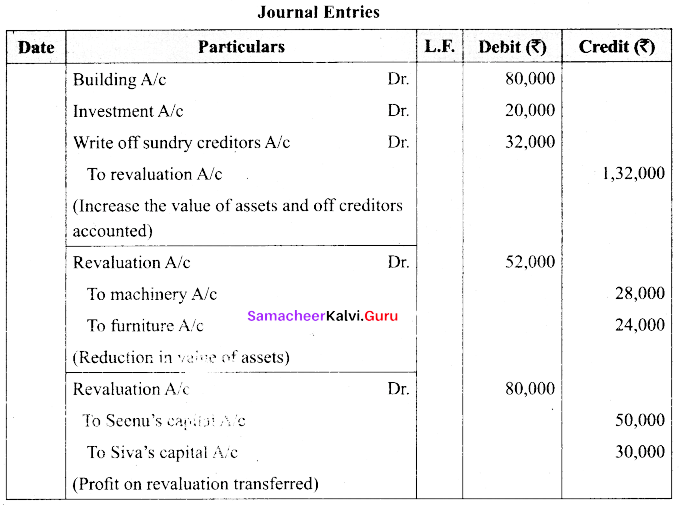

Kevin, Madhan and Ranjith are partners sharing of profit ratio 4:3:3. Kevin retires from the firm on 31st Dec 2018. On the date of retirement his capital account shows a credit balance of ₹ 1,50,000. pass the journal entries of,

(a) The amount due is paid of immediately

(b) The amount due is not paid immediately

(c) ₹ 1,00,000 is paid balance in future

Answer:

Question 37.

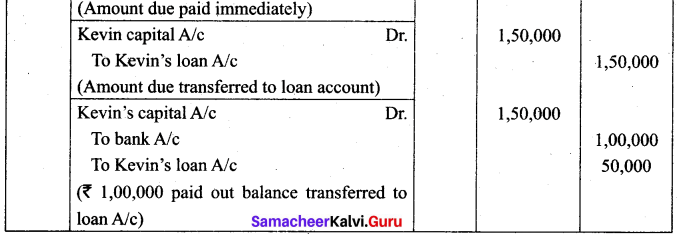

Sara company issues 10,000 equity shares of ₹ 10 each payable fully on application.

Pass journal entry if the shares are issued.

(i) At par,

(ii) At a premium of 2/- per share

Answer:

Question 38.

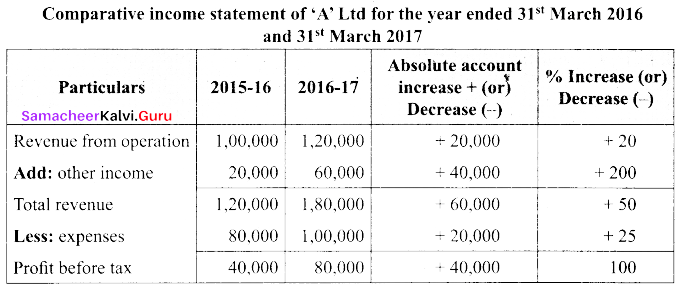

From the following particulars, Prepare comparative income statement of A Ltd.

Answer:

Question 39.

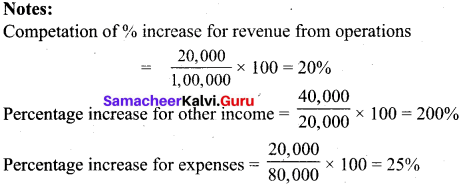

Calculate operating profit ratio under the following cases

Case 1: Revenue from operations ₹ 16,00,000 operation profit ₹ 4,00,000

Case 2: Revenue from operations ₹ 40,00,000 operating cost ₹ 28,00,000

Case 3: Revenue from operations ₹ 20,00,000 Gross profit 25% on revenue from operations; operating expenses ₹ 2,00,000.

Answer:

Operating profit = Gross profit – Operating expenses

Gross profit = 25% of 20,00,000 = ₹ 5,00,000

Operating profit = 5,00,000 – 2,00,000 = ₹ 3,00,000

∴ Operating profit ratio = \(\frac{3,00,000}{20,00,000}\) x 100 = 15%

![]()

Question 40.

Mention the commonly used voucher types in Tally ERP. 9.

Answer:

The following are some of the major accounting voucher used in an organisation.

- Receipt voucher

- Payment voucher

- Contra voucher

- Purchase voucher

- Sales voucher

- Journal voucher

Part – IV

Answer all the questions. [7 × 5 = 35]

Question 41.

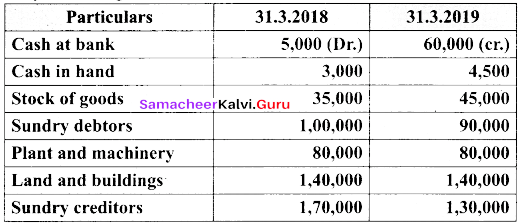

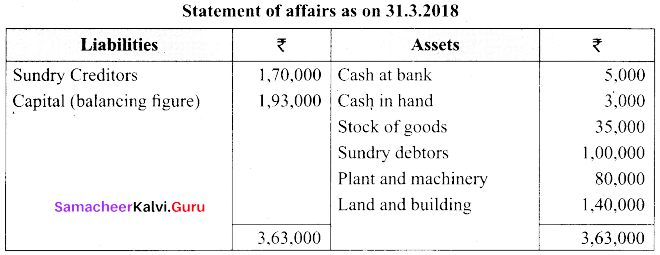

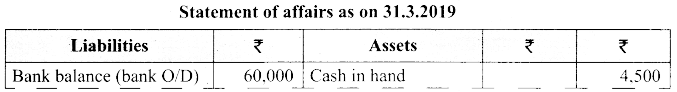

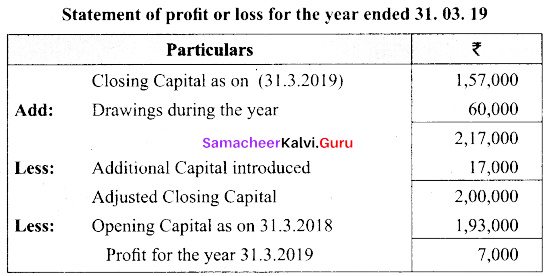

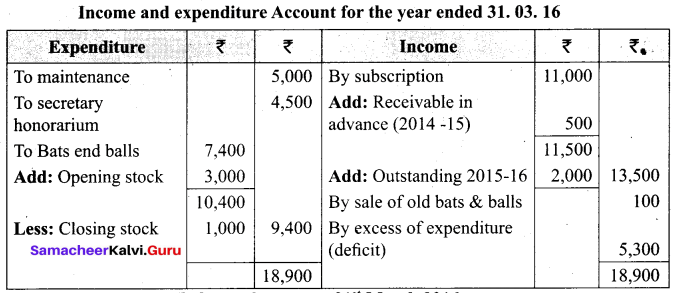

(a) Ananth does not keep his books under system. Find the profit or loss made by him for the year ending 31st March 2019.

Ananth had withdrawn ₹ 60,000 for his personal use. He had introduced ₹ 1,70,000 as capital for expansion of his business. Create a provision of 5% on debtor. Plant and machinery is to be depreciated at 10%.

Answer:

Calculation of opening capital:

Calculation of closing capital:

[OR]

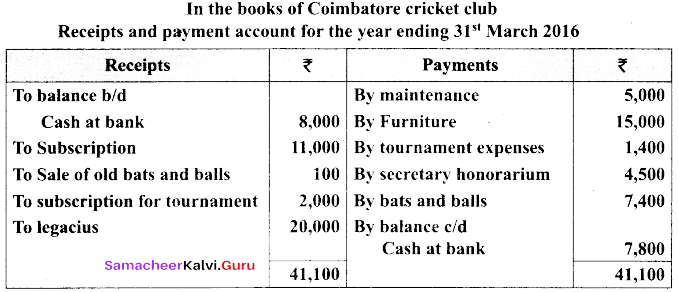

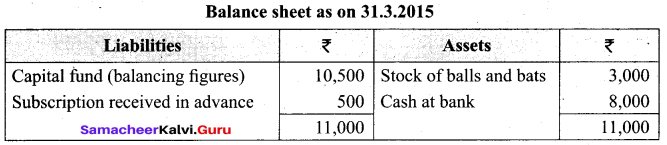

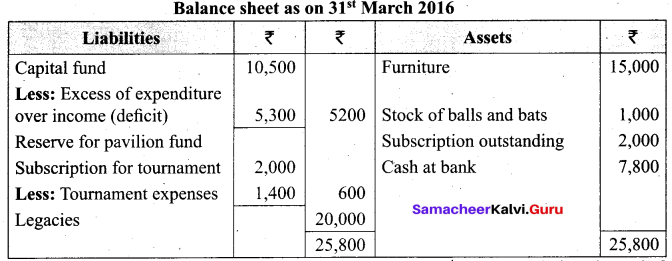

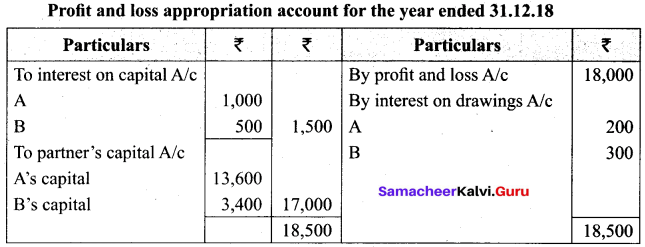

(b) From the following Receipts and payments account of Coimbatore cricket club for the year ending 31st March 2016. Prepare income and expenditure account for the year ending 31st March 2016 and a balance sheet as on that date.

Answer:

Additional information:

On 1st April 2015, the club had stock of balls and bats of ₹ 3,000 and an advance subscription of ₹ 500 surplus on account of tournaments should be kept in reserve for permanent pavilion. Subscription due on 31.3.2016 was ₹ 2,000; stock of bats and balls on 31.3.2016 was ₹ 1,000.

Answer:

Calculation of capital fund:

![]()

Question 42.

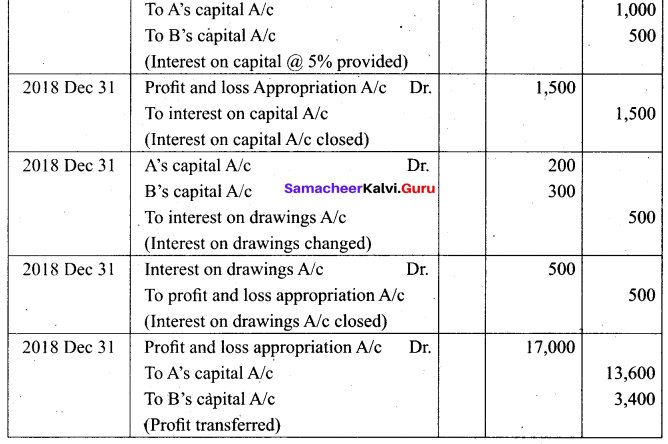

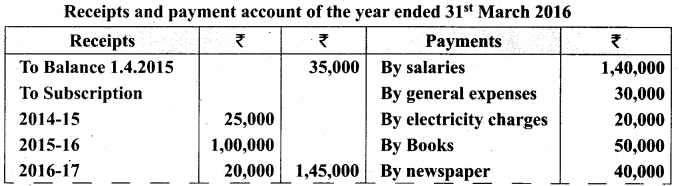

(a) A and B are partners in a firm sharing ratio at 4:1. On 1st January 2018, their capitals were ₹ 20,000 and ₹ 10,000, respectively. The partnership deed specifies the following

(a) Interest capital is to be allowed at 5% p. a.

(b) Interest on drawings charged to A and B are ₹ 200 : 300

(c) The net profit of the firm before considering interest on capital and interest on drawings amounted ₹ 18,000.

Give necessary journal entries and prepare profit and loss appropriation account for the year ended 31.12.2018. Assume that capitals are fluctuating.

Answer:

[OR]

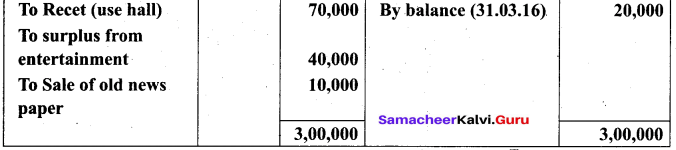

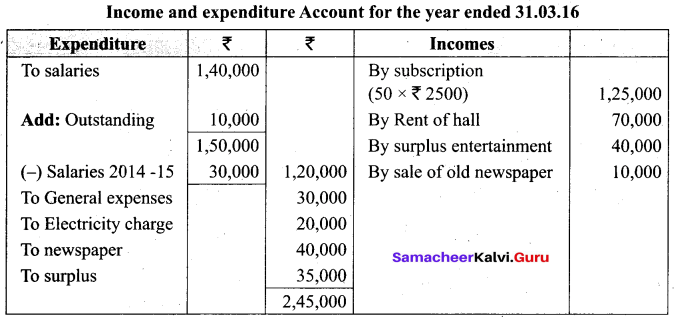

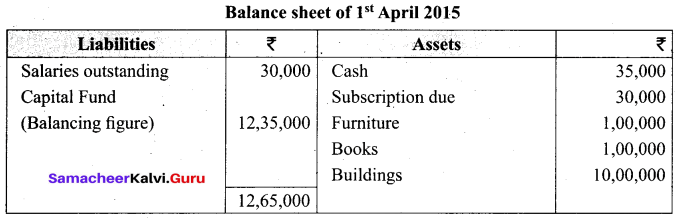

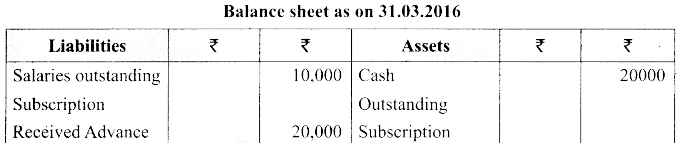

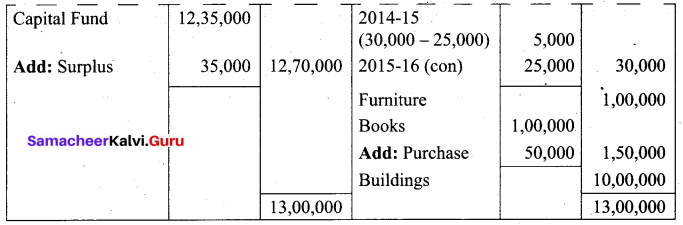

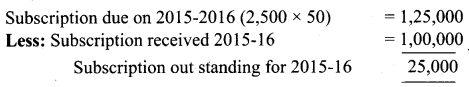

(b) From the following receipts and payments A/c of defence club and from the information, prepare income and expenditure account for the year ended 31st March 2016 and balance sheet.

(i) The club has 50 members each paying annual subscription of ₹ 2,500, subscription outstanding on 31st March 2015 were to extent ₹ 30,000.

(ii) On 31st March 2016, salaries outstanding amounted to ₹ 10,000; salaries paid in 2015-16 included ₹ 30,000 for the year 2014-15.

(iii) On 1st April 2015, the club owned buildings valued at ₹ 10,00,000. Furniture ₹ 1,00,000 and books ₹ 1,00,000.

Answer:

Working note:

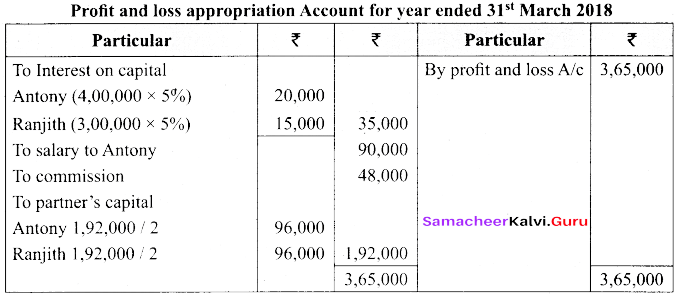

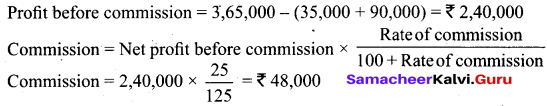

Question 43.

(a) Antony and Ranjith started a business on 1.4.2018 with capitals of ₹ 4,00,000 and ₹ 3,00,000. According to the deed, Antony is to get salary of ₹ 90,000 p. a. Ranjith is to get 25% commission on profit after allowing salary to Antony and interest on capital @ 5% p. a. but after charging such commission. Partners are equal. Profit earned by firm is ₹ 3,65,000. Prepare profit and loss Appropriation account.

Answer:

[OR]

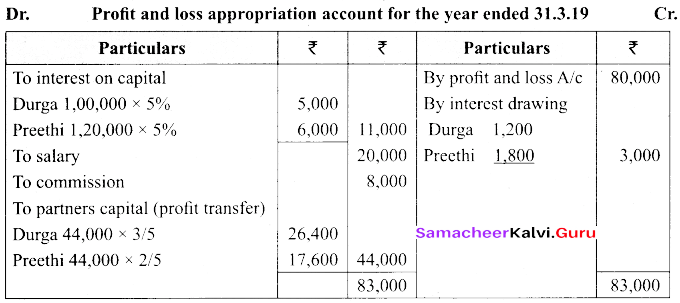

(b) Durga and Preethi entered into a partnership agreement on 1st April 2018. Durga contributing ₹ 1,00,000 and preethi ₹ 1,20,000.

(a) Profit and losses to be shared in the ratio 3:2 as between Durga and Preethi

(b) Partners to be entitled to interest on capital @ 5% p.a.

(c) Interest on drawings to be charged for Durga ₹ 1200. Preethi ₹ 1800

(d) Durga to receive salary of ₹ 20,000 for the year and

(e) Preethi to receive a commission of ₹ 8,000.

During the year, the firm made a profit of ₹ 80,000 before adjustment of interest, salary and commission, prepare Profit and Loss Appropriation A/c.

Answer:

![]()

Question 44.

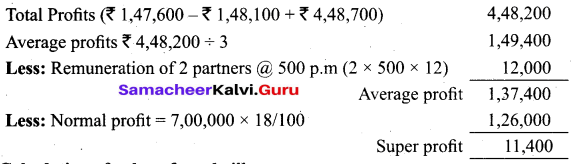

(a) From the following information, calculate the value of goodwill of the firm of Chander and Gupta.

(a) At least 3 years purchase of average profits

(b) At least 3 years purchase of super profits

(c) On the basis of capitalisation of super profits

(d) On the basis of capitalisation of average profits

(i) Average capital employed in the business ₹ 7,00,000

(ii) Net trading results of past year, 2014 – 147600 (profit) loss 2015 – ₹ 148100; profit 2016 – ₹ 4,48,700

(iii) Rate of interest expected from capital having regard risk 18% remuneration to each partner his service Rs 500 per month.

Answer:

(i) Calculation of average maintainable profits and super profits

(ii) Calculation of value of goodwill:

(a) At 3 years purchase of average profit:

Average maintainable profits × No. of years purchase

= 1,37,400 × 3 = ₹ 4,12,200

(b) At 3 years purchase of super profits

Super profits × No. of years purchase

= ₹ 11,400 × 3 = ₹ 34,000

(c) On the basis of capitalisation of super profits

(d) On the basis of capitalisation of average profits:

[OR]

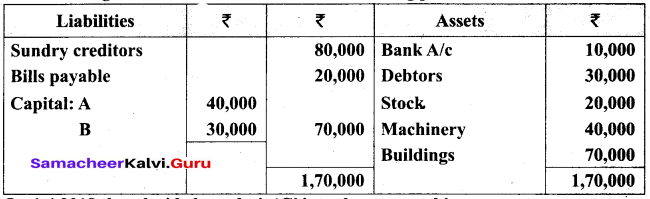

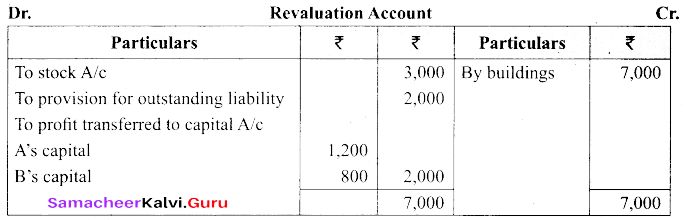

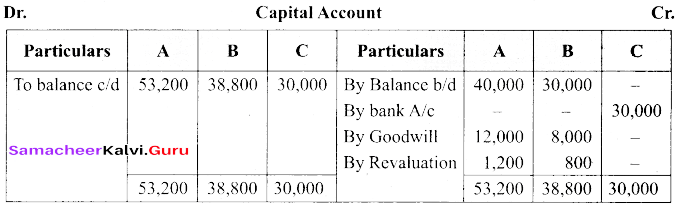

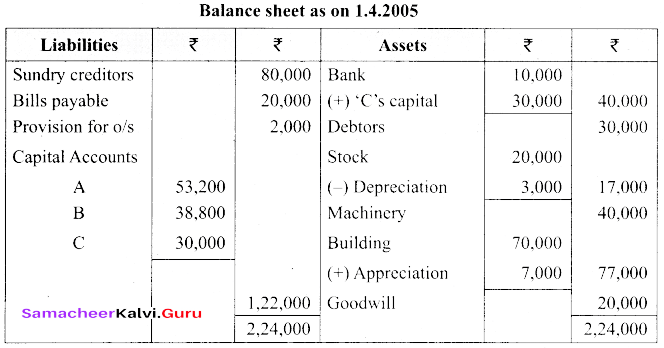

(b) The following is the balance sheet of A and B sharing profits 3:2 as on 31.3.2018

On 1.4.2018 they decided to admit ‘C’ into the partnership

(a) ‘C’ Shall bring in a capital of ₹ 30,000.

(b) Goodwill of the firm being valued at ₹ 20,000.

(c) Buildings be appreciated by 10%.

(d) Stock be depreciated by ₹ 3,000 and provision for outstanding liability be created at ₹ 2,000.

Prepare Revaluation, capital A/c and balance sheet.

Answer:

Question 45.

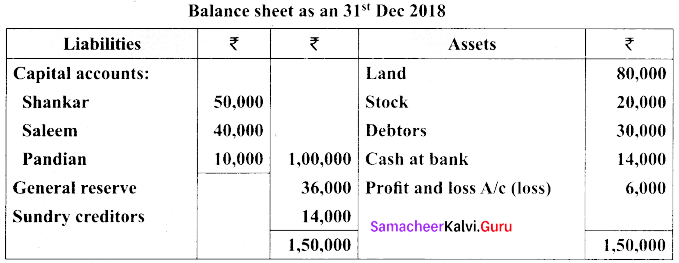

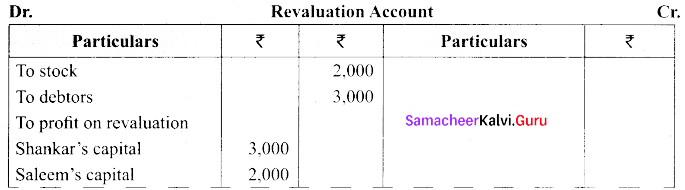

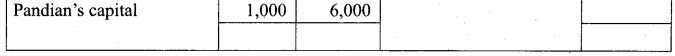

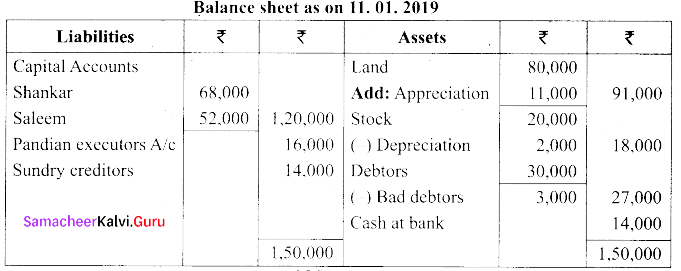

(a) Shankar, Saleem and Pandian are partners with ratio of 3:2:1. Their balance as follows 31.12. 2018.

Answer:

On 1.1.2019, Pandian died and on his death following arrangements were made

(i) Stock to be depreciated by 10%.

(ii) Land is to appreciated by Rs 11,000.

(iii) To provide ₹ 3,000 for bad debtors.

(iv) The final amount due to Pandian was not paid.

Prepare revaluation A/c partner’s capital A/c and Balance sheet of the firm after death.

[OR]

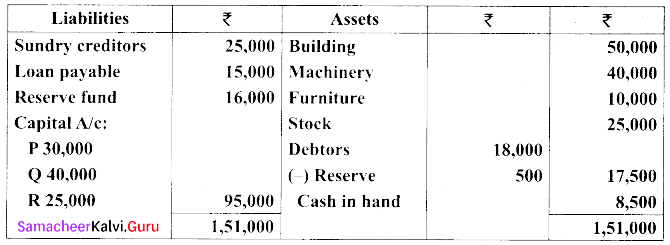

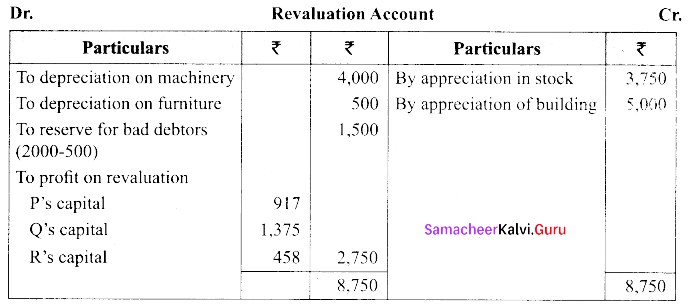

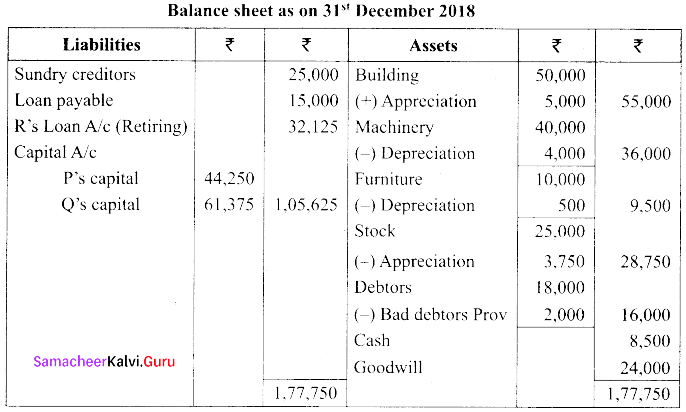

(b) P, Q and R are partners sharing losses 2:3:1. Their balance sheet on 31st Dec 2018 was as follows.

R retires on 31st Dec 2018. Subject to following canditions,

(а) A goodwill account is created in the books at ₹ 24,000.

(b) Machinery to be depreciated by 10%

(c) Furniture to be depreciated by 5%

(d) Stock to be appreciated by 15% and factory building by 10%

(e) Reserve for doubtful debtors to be raised to ₹ 2,000.

Prepare necessary ledger accounts and show the balance sheet.

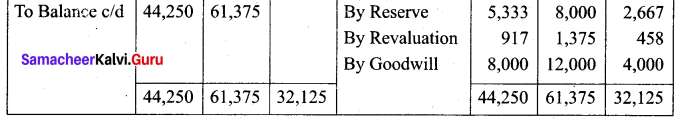

Answer:

![]()

Question 46.

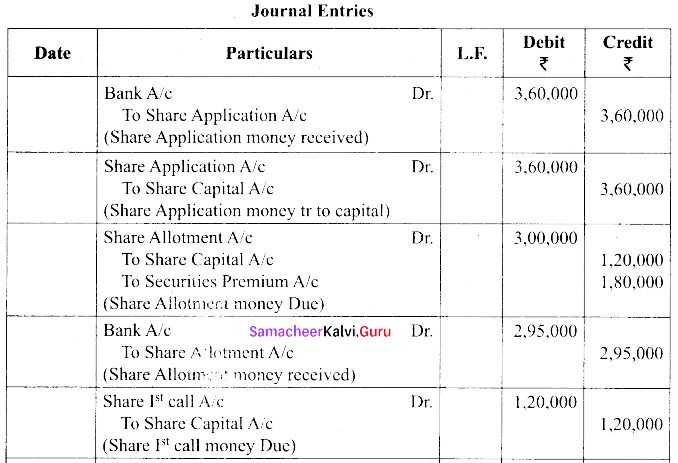

(a) Vairam Ltd. issued 60,000 shares @ 10% each premium of Rs 3/- per share payable as follows: On application ₹ 6/- on Allotment ₹ 5/- (including premium) on first and final call ₹ 2. Issue was fully subscribed and the amounts due were received except Saritha to whom 1,000 shares were allotted who failed to pay the allotment money and first and final call money. Here shares were forfeited. All the forfeited shares were reissued to Parimala @ ₹ 7/- per share. Pass journal entries.

Answer:

[OR]

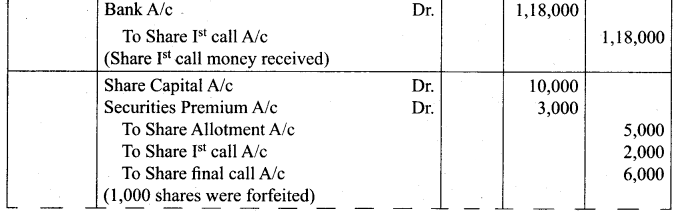

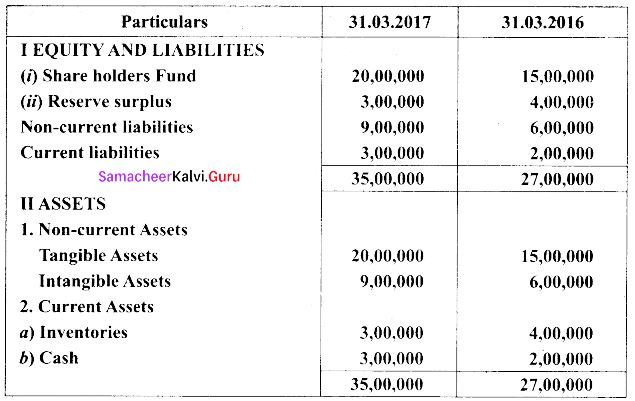

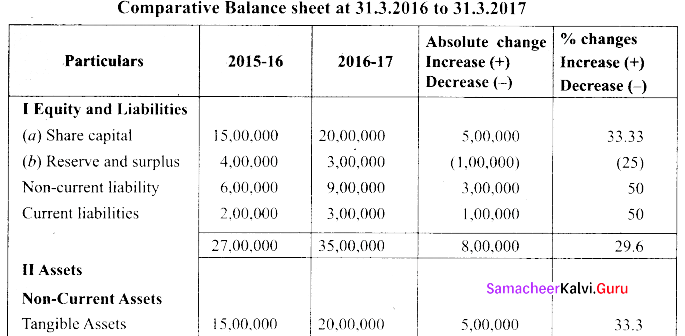

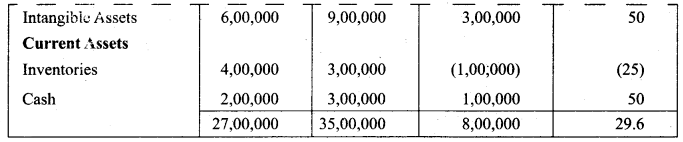

(b) From the followings balance sheet of Universe Ltd as on 31st March 2016 and 2017 Prepare comparative balance sheet.

Answer:

![]()

Question 47.

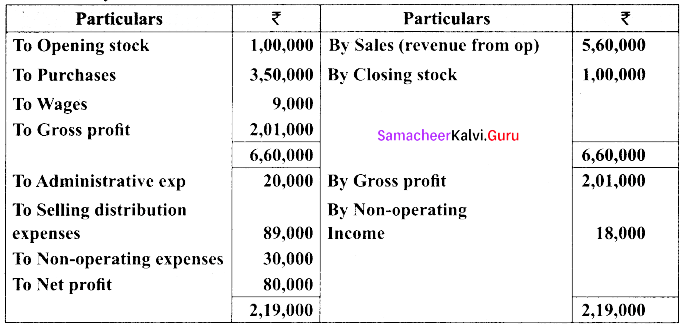

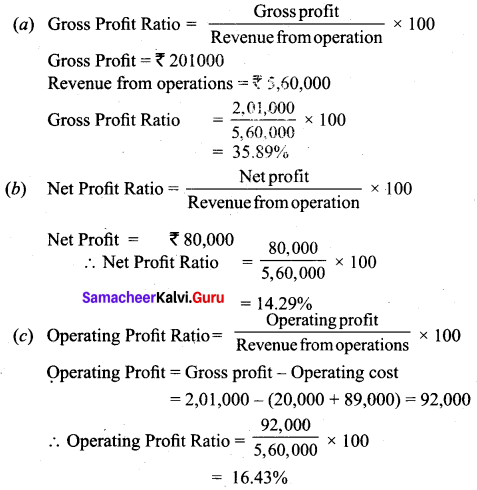

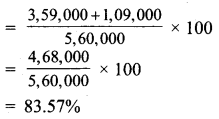

(a) Following is the trading and profit and loss Account of a company. Calculate profitability ratio for the year ended 31.3.2018

Answer:

(d) Operating cost ratio = \(\frac{\text { Operation cost }}{\text { Revenue from operation }}\) × 100

Operating Cost = Cost of revenue from Operation + Operating expenses

Cost of revenue from operation = Revenue from Operation – Gross profit

= ₹ 5,60,000 -2,01,000

= ₹ 3,59,000

Operating expenses = Selling and distribution expenses + administrative expenses

= 20,000 + 89,000 = ₹ 1,09,000

Note:

Operating Cost Ratio = 100% – Operating Profit Ratio

= 100% – 16.43

= 83.57%

[OR]

(b) What are the applications of computerised accounting system?

Answer:

Computerised accounting system refers to the system of maintaining accounts using computer. It involves the processing of accounting transactions through the use of computer in order to maintain and produce accounting records and reports.

The applications of computerised accounting system are as follows:

(i) Maintaining accounting records:

In computerised accounting system, accounting records can be maintained easily and efficiently for long time period. It does not require a large amount of physical space. It facilitates fast and accurate retrieval of data and information.

(ii) Inventory management:

Computerised accounting system facilitates efficient management of inventory, fast moving, slow moving and obsolete inventory can be identified. Updated information about availability of inventory, Level of inventory etc, can be obtained instantly.

(iii) Payroll Preparation:

Payroll involves the calculation of amount due to an employee. Pay of an employee may be calculated based on hours/days worked or units produced.

(iv) Report generation:

Computerised accounting system helps to generate various routine and special purpose reports.

(v) Data import/export:

Accounting data and information can be imported from or exported to other users within the organisation as well as outside the organisation.

(vi) Taxation:

Computerised accounting system helps to compute various taxes and to deduct these and deposit the same to the Government account.