Students can Download Tamil Nadu 12th Economics Model Question Paper 3 English Medium Pdf, Tamil Nadu 12th Economics Model Question Papers helps you to revise the complete Tamilnadu State Board New Syllabus and score more marks in your examinations.

TN State Board 12th Economics Model Question Paper 3 English Medium

General Instructions:

- The question paper comprises of four parts.

- You are to attempt all the parts. An internal choice of questions is provided wherever applicable.

- All questions of Part I, II, III and IV are to be attempted separately.

- Question numbers 1 to 20 in Part I are Multiple Choice Questions of one mark each.

These are to be answered by choosing the most suitable answer from the given four alternatives and writing the option code and the corresponding answer - Question numbers 21 to 30 in Part II are two-mark questions. These are to be answered in about one or two sentences.

- Question numbers 31 to 40 in Part III are three-mark questions. These are to be answered in above three to five short sentences.

- Question numbers 41 to 47 in Part IV are five-mark questions. These are to be answered in detail Draw diagrams wherever necessary.

Time: 3.00 Hours

Maximum Marks: 90

PART – I

Choose the correct answer. Answer all the questions: [20 × 1 = 20]

Question 1.

A steady increase in general price level is termed as……….

(a) Wholesale price index

(b) Business Cycle

(c) Inflation

(d) National income

Answer:

(c) Inflation

Question 2.

The word ‘Macro’ is derived from the Greek word………….

(a) Makros

(b) Macros

(c) Macrow

(d) mac

Answer:

(a) Makros

Question 3.

When net factor income from abroad is deducted from NNP, the net value is………..

(a) Gross National Product

(b) Disposable Income

(c) Net Domestic Product

(d) Personal Income

Answer:

(c) Net Domestic Product

Question 4.

Who first introduced the concept of national Income?

(a) Simon Kuznets

(b) Karl Marx

(c) Marshall

(d) Adam Smith

Answer:

(a) Simon Kuznets

![]()

Question 5.

The core of the classical theory of employment is

(a) Law of Diminishing Return

(b) Law of Demand

(c) Law of Markets

(d) Law of Consumption

Answer:

(c) Law of Markets

Question 6.

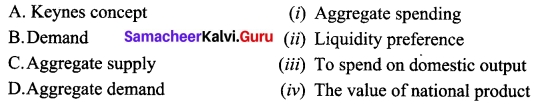

Match the following and choose the correct answer by using codes given below:

(a) A (i) B (ii) C (iii) D (iv)

(b) A (ii) B (i) C (iv) D (iii)

(c) A (iii) B (iv) C (ii) D (i)

(d) A (iv) B (iii) C (i) D (ii)

Answer:

(b) A (ii) B (i) C (iv) D (iii)

Question 7.

An increase in the marginal propensity to consume will:

(a) Lead to consumption function becoming steeper

(b) Shift the consumption function upwards

(c) Shift the consumption function downwards

(d) Shift savings function upwards

Answer:

(a) Lead to consumption function becoming steeper

Question 8.

State whether the statement is true or false.

(a) Keynes propounded the fundamental psychological law of consumption.

(ii) J.M. Keynes has divided factors influencing the consumption function.

(a) Both (i) and (ii) are true

(b) Both (i) and (ii) are false

(c) (i) is true but (ii) is false

(d) (i) is false but (ii) is true

Answer:

(a) Both (i) and (ii) are true

Question 9.

………… inflation results in a serious depreciation of the value of money.

(a) Creeping

(b) Walking

(c) Running

(d) Hyper

Answer:

(d) Hyper

Question 10.

Bank rate is lowered during………….

(a) Inflation

(b) Price

(c) Employment

(d) Deflation

Answer:

(d) Deflation

Question 11.

Bank Rate means………..

(a) Re-discounting the first class securities

(b) Interest rate

(c) Exchange rate

(d) Growth rate

Answer:

(a) Re-discounting the first class securities

Question 12.

Which of the following is not correctly matched:

(a) RBI – Reserve Bank of India

(b) SBI – State Bank of India

(c) IMF – International Monetary Fund

(d) ATM – Any Time Money

Answer:

(d) ATM – Any Time Money

Question 13.

Exchange rates are determined in ……….

(a) money market

(b) foreign exchange market

(c) stock market

(d) capital market

Answer:

(b) foreign exchange market

Question 14.

Foreign Investment mostly takes the form of………….

(a) Indirect investment

(b) Direct investment

(c) IMF investment

(d) World bank investment

Answer:

(b) Direct investment

Question 15.

New Development Bank is associated with…………..

(a) BRICS

(b) WTO

(c) SAARC

(d) ASEAN

Answer:

(a) BRICS

![]()

Question 16.

Assertion (A): SAARC is promote the welfare of the people of South Asia and improve their quality of life.

Reason (R): To strengthen co-operation with other under developing countries.

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

(b) Both ‘A’ and ‘R’ are true but ‘R’ is not the correct explanation to ‘A’

(c) ‘A’ is true but ‘R’ is false

(d) ‘A’ is false but ‘R’ is true

Answer:

(c) ‘A’ is true but ‘R’ is false

Question 17.

Methods of repayment of public debt is…………

(a) Conversion

(b) Sinking fund

(c) Funded debt

(d) All of these

Answer:

(d) All of these

Question 18.

………. means different sources of government income.

(a) Public finance

(b) Public revenue

(c) Public expenditure

(d) Public credit

Answer:

(b) Public revenue

Question 19.

Which of the following is main cause for deforestation?

(a) Timber harvesting industry

(b) Natural afforestation

(c) Soil stabilization

(d) Climate stabilization

Answer:

(a) Timber harvesting industry

Question 20.

M.N. Roy was associated with ………….

(a) Congress Plan

(b) People’s Plan

(c) Bombay Plan

(d) None of the above

Answer:

(b) People’s Plan

PART – II

Answer any seven question in which Question No. 30 is compulsory. [7 × 2 = 14]

Question 21.

Define ‘Economic Model’.

Answer:

- A model is a simplified representation of real situation.

- Economists use models to describe economic activities, their relationships and their behaviour.

- A model is an explanation of how the economy, or part of the economy, works.

- Most economic models are built with mathematics, graphs and equations, and attempt to explain relationships between economic variables.

Question 22.

Define Profit Motive.

Answer:

Profit Motive: Profit is the driving force behind all economic activities in a capitalistic economy. Each individual and organization produce only those goods which ensure high profit. Advance technology, division of labour, and specialisation are followed. The golden rule for a producer under capitalism is ‘to maximize profit.’

Question 23.

Define National Income.

Answer:

National Income means the total money value of all final goods and services produced in a country during a particular period of time (one year).

Question 24.

Define “Capital Gains”.

Answer:

The problem also arises with regard to capital gains. Capital gains arise when a capital asset such as a house, other property, stocks or shares, etc. is sold at higher price than was paid for it at the time of purchase. Capital gains are excluded from national income.

Question 25.

Define full employment.

Answer:

Full employment refers to a situation in which every able bodied person who is willing to work at the prevailing wage rate, is employed. In other words full employment means that persons who are willing to work and able to work must have employment or a job.

Question 26.

What do you mean by propensity to save?

Answer:

- Thus the consumption function measures not only the amount spent on consumption but also the amount saved.

- This is because the propensity to save is merely the propensity not to consume.

- The 45° line may therefore be regarded as a zero-saving line, and the shape and position of the C curve indicate the division of income between consumption and saving.

Question 27.

Define “Ceteris paribus”.

Answer:

Ceteris paribus (constant extraneous variables): The other variables such as income distribution, tastes, habits, social customs, price movements, population growth, etc. do not change and consumption depends on income alone.

Question 28.

Write IMF Functions group.

Answer:

The functions of the IMF are grouped under three heads.

- Financial – Assistance to correct short and medium term deficit in BOP;

- Regulatory – Code of conduct and ‘

- Consultative – Counseling and technical consultancy.

![]()

Question 29.

Define public finance.

Answer:

“Public finance is one of those subjects that lie on the border line between Economics and Politics. It is concerned with income and expenditure of public authorities and with the adjustment of one to the other”. – Huge Dalton

“Public finance is an investigation into the nature and principles of the state revenue and expenditure”. – Adam Smith

Question 30.

State the meaning of environment.

Answer:

Meaning of Environmental Economics is a different branch of economics that recognizes the value of both the environment and economic activity and makes choices based on those values. The goal is to balance the economic activity and the environmental impacts by taking into account all the costs and benefits.

In short, Environmental Economics is an area of economics that studies the financial impact of environmental issues and policies. Environmental Economics involves theoretical and empirical studies of the economic ‘ effects of national or local environmental policies around the world.

PART – III

Answer any seven question in which Question No. 40 is compulsory. [7 × 3 = 21]

Question 31.

Indicate the demerits of socialism.

Answer:

Demerits of Socialism:

- Red Tapism and Bureaucracy: As decision are taken by government agencies, approval of many officials and movement of files from one table to other takes time and leads to red tapism.

- Absence of Incentive: The major limitation of socialism is that this system does not provide any incentive for efficiency. Therefore, productivity also suffers.

- Limited Freedom of Choice: Consumers do not enjoy freedom of choice over the consumption of goods and services.

- Concentration of Power: The State takes all major decisions. The private takes no initiative in making economic decisions. Hence, the State is more powerful and misuse of power can also take place.

Question 32.

Differentiate between personal and disposable income.

Answer:

| Personal income | Disposable income |

| Personal income is the total income received by the individuals of a country from all sources before payment of direct taxes in a year. | Disposable Income is also known as Disposable personal income. It is the individuals income after the payment of income tax. This is the amount available for households for consumption. |

Question 33.

What is the main feature of rural unemployment?

Answer:

- India’s rural economy has both unemployment and underemployment.

- The major feature of rural unemployment is the existence of unemployment in the form of disguised unemployment and seasonal unemployment.

- In agriculture and agro based industries like sugar, production activities are carried out only in some seasons.

Question 34.

Compare the Classical Theory of international trade with Modern Theory of International trade.

Answer:

| S.No. | Classical Theory of International TVade | Modern Theory of International Trade |

| 1. | The classical theory explains the phenomenon of international trade on the basis of labour theory of value. | The modem theory explains the phenomenon of international trade on the basis of general theory of value. |

| 2. | It presents a one factor (labour) model. | It presents a multi – factor (labour and capital) model. |

| 3. | It attributes the differences in the comparative costs to differences in the productive efficiency of workers in the two countries. | It attributes the differences in comparative costs to the differences in factor endowments in the two countries. |

Question 35.

Write the agenda of BRICS Summit, 2018.

Answer:

South Africa hosted the 10th BRICS summit in July 2018. The agenda for BRICS summit 2018 includes Inclusive growth, Trade issues, Global governance, Shared Prosperity, International peace and security.

Question 36.

Write the preparation of the Budget.

Answer:

Preparation of the Budget

The Ministry of Finance prepares the Central Budget every year. At the state level the finance department is responsible for the Annual State Budget. While preparing the budget, the following factors are taken into account.

- The macro economic targets to be achieved within a plan period;

- The basic strategy of the budget;

- The financial requirements of different projects;

- Estimates of the revenue expenditures (includes defence expenditure, subsidy, interest payment on debt etc.)

- Estimates of the capital expenditures (includes development of railways, roadways, irrigations etc.);

- Estimates of revenue receipts from tax and non-tax revenues;

- Estimates of capital receipts from the recovery of loans, disinvestment of public sector units, market borrowings etc.

- Estimates of the gap between revenue receipts and revenue expenditure; and

- Estimates of fiscal deficit, primary deficit and revenue deficit.

![]()

Question 37.

Explain the principles of organic farming.

Answer:

The general principles of organic farming are:

- Protect the environment, minimize soil degradation and erosion, decrease pollution, optimize biological productivity and promote a sound state of health.

- Maintain long-term soil fertility by optimizing conditions for biological activity within the soil.

- Maintain biological diversity within the system.

- Recycle materials and resources to the greatest extent possible within the enterprise.

- Provide attentive care that promotes the health and meets the behavioural needs of livestock.

- Prepare organic products, emphasizing careful processing, and handling methods in order to maintain the organic integrity and vital qualities of the products at all stages of production.

Question 38.

What are the functions of statistics?

Answer:

- Statistics presents facts in a definite form.

- It simplifies mass of figures.

- It facilitates comparison.

- It helps in formulating and testing.

- It helps in prediction.

- It helps in the formulation of suitable policies.

Question 39.

State the concept of super multiplier.

Super Multiplier: (k and β interaction)

Answer:

- The super multiplier is greater than simple multiplier which includes only autonomous investment and no induced investment, while super multiplier includes induced investment.

- In order to measure the total effect of initial investment on income, Hicks has combined the k and β mathematically and given it the name of the Super Multiplier.

- The super multiplier is worked out by combining both induced consumption and induced investment.

Question 40.

What is the main difference between Adam Smith and Ricardo with regard to the emergence of foreign trade?

Answer:

| S.No. | Adam Smith Foreign Trade | Ricardo Foreign Trade |

| 1. | According to Adam Smith the basis of International trade was absolute cost advantage. | Ricardo demonstrates that the basis of trade is the comparative cost difference. |

| 2. | Trade between two countries would be mutually beneficial when one country produces a commodity at an absolute cost advantage. | Trade can take place even if the absolute cost difference is absent but there is comparative cost difference. |

| 3. | Adam Smith argued that all nations can be benefitted when there is free trade and specialisation in terms of their absolute cost advantage. | According to Ricardo a country can gain from trade when it produces at relatively lower costs. |

PART – IV

Answer all the questions. [7 × 5 = 35]

Question 41 (a).

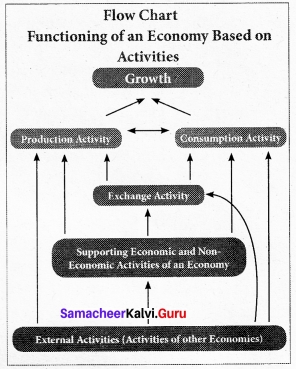

Illustrate the functioning of an economy based on its activities.

Answer:

An economy is referred to any system or area where economic activities are carried out. Each economy has its own character. Accordingly, the functions or activities also vary. The functioning of an economy by its activities is explained in flow chart.

- In an economy, the fundamental economic activities are production and consumption.

- These two activities are supported by several other activities.

- The ultimate aim of these activities is to achieve growth. The ‘exchange activity’ supports the production and consumption activities. These activities are influenced by several economic and non-economic activities.

- The major economic activities include transportation, banking, advertising, planning, government policy and others.

- The major non-economic activities are environment, health, education, entertainment,

governance, regulations etc.

In addition to these supporting activities, external activities from other economies such as import, export, international relations, emigration, immigration, foreign investment, foreign exchange earnings, etc. also influence the entire functioning of the economy.

[OR]

(b) Discuss the importance of social accounting in economic analysis.

Answer:

National Income and Social Accounting:

- National income is also being measured by the social accounting method.

- Under this method, the transactions among various sectors such as firms, households, government, etc., are recorded and their interrelationships traced.

- The social accounting framework is useful for economists as well as policy makers, because it represents the major economic flows and statistical relationships among various sectors of the economic system.

- It becomes possible to forecast the trends of economy more accurately.

Social Accounting and Sector:

Under this method, the economy is divided into several sectors. A sector is a group of individuals or institutions having common interrelated economic transactions. The economy is divided into the following sectors:

- Firms,

- Households,

- Government,

- Rest of the world and

- Capital sector.

1. “Firms” undertake productive activities. Thus, they are all organizations which employ the factors of production to produce goods and services.

2. “Households” are consuming entities and represent the factors of production, who receive payment for services rendered by them to firms. Households consume the goods and services that are produced by the firms.

3. “The Government sector” refers to the economic transactions of public bodies at all levels, centre, state and local. The main function of the government is to provide social goods like defence, public health, education, etc.

4. “Rest of the world sector” relates to international economic transactions of the country. It contains income, export and import transactions, external loan transaction, and allied overseas investment income and payments.

5. “Capital sector” refers to saving and investment activities. It includes the transactions of banks, insurance corporations, financial houses, and other agencies of the money market.

![]()

Question 42 (a).

Explain the following in short:

(i) Seasonal unemployment

(ii) Frictional unemployment

(iii) Educated unemployment Seasonal Unemployment:

Answer:

(i) Seasonal unemployment

- This type of unemployment occurs during certain seasons of the year.

- In agriculture and agro based industries like sugar, production activities are carried out only in some seasons.

- These industries offer employment only during that season in a year. Therefore people may remain unemployed during the off season.

- Seasonal unemployment happens from demand side also; for example ice cream industry,

holiday resorts etc.

(ii) Frictional Unemployment (Temporary Unemployment):

- Frictional unemployment arises due to imbalance between supply of labour and demand for labour.

- This is because of immobility of labour, lack of necessary skills, break down of machinery, shortage of raw materials etc.

- The persons who lose jobs and in search of jobs are also included under frictional unemployment.

(iii) Educated Unemployment:

- Sometimes educated people are underemployed or unemployed when qualification does not match the job.

- Faulty education system, lack of employable skills, mass student turnout and preference for white collar jobs are highly responsible for educated unemployment in India.

[OR]

(b) Describe the types of unemployment.

Answer:

The following are the types of unemployment.

- Cyclical Unemployment

- Seasonal Unemployment

- Frictional Unemployment

- Educated Unemployment

- Technical Unemployment

- Structural Unemployment

- Disguised Unemployment

1. Cyclical Unemployment:

- This unemployment exists during the downturn phase of trade cycle in the economy.

- In a business cycle during the period of recession and depression, income and output fall leading to widespread unemployment.

- It is caused by deficiency of effective demand.

- Cyclical unemployment can be cured by public investment or expansionary monetary policy.

2. Seasonal Unemployment:

- This type of unemployment occurs during certain seasons of the year.

- In agriculture and agro based industries like sugar, production activities are carried out only in some seasons.

- These industries offer employment only during that season in a year. Therefore people may remain unemployed during the off season.

- Seasonal unemployment happens from demand side also; for example ice cream industry, holiday resorts etc.

3. Frictional Unemployment (Temporary Unemployment):

- Frictional unemployment arises due to imbalance between supply of labour and demand for labour.

- This is because of immobility of labour, lack of necessary skills, break down of machinery, shortage of raw materials etc.

- The persons who lose jobs and in search of jobs are also included under frictional unemployment.

4. Educated Unemployment:

- Sometimes educated people are underemployed or unemployed when qualification does not match the job.

- Faulty education system, lack of employable skills, mass student turnout and preference for white collar jobs are highly responsible for educated unemployment in India.

5. Technical Unemployment:

- Modem technology being capital intensive requires less labourers and contributes to technological unemployment.

- Now a days, invention and innovations lead to the adoption of new techniques there by the existing workers are retrenched.

- Labour saving devices are responsible for technological unemployment.

6. Structural Unemployment:

- Structural unemployment is due to drastic change in the structure of the society.

- Lack of demand for the product or shift in demand to other products cause this type of unemployment.

- For example rise in demand for mobile phones has adversely affected the demand for cameras, tape recorders etc.

- So this kind of unemployment results from massive and deep rooted changes in economic structure.

7. Disguised Unemployment:

- Disguised unemployment occurs when more people are than what is actually required.

- Even if some workers are withdrawn, production does not suffer.

- This type of unemployment is found in agriculture.

- A person is said to be disguisedly by unemployed if his contribution to output is less than what he can produce by working for normal hours per day.

- In this situation, marginal productivity of labour is zero or less or negative.

![]()

Question 43 (a).

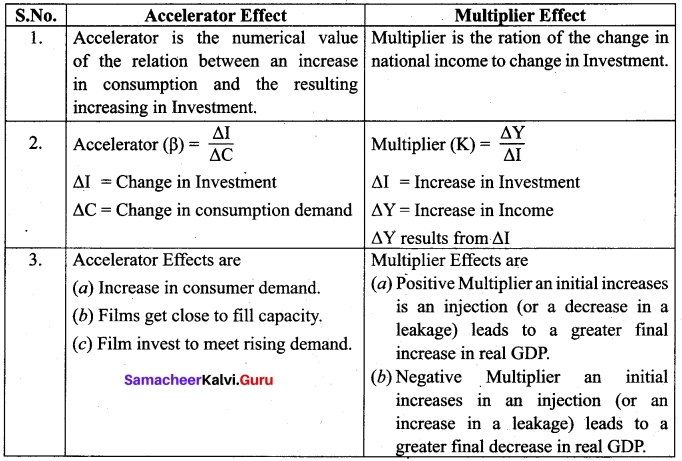

Mention the differences between accelerator and multiplier effect.

Answer:

[OR]

(b) What are the causes of inflation on the economy?

Answer:

Causes of Inflation:

The main causes of inflation in India are as follows:

(i) Increase in Money Supply: Inflation is caused by an increase in the supply of money which leads to increase in aggregate demand. The higher the growth rate of the nominal money supply, the higher is the rate of inflation.

(ii) Increase in Disposable Income: When the disposable income of the people increases, it raises their demand for goods and services. Disposable income may increase with the rise in national income or reduction in taxes or reduction in the saving of the people.

(iii) Increase in Public Expenditure: Government activities have been expanding due to developmental activities and social welfare programmes. This is also a cause for price rise.

(iv) Increase in Consumer Spending: The demand for goods and services increases when they are given credit to buy goods on hire-purchase and installment basis.

(v) Cheap Monetary Policy: Cheap monetary policy or the policy of credit expansion also leads to increase in the money supply which raises the demand for goods and services

in the economy.

(vi) Deficit Financing: In order to meet its mounting expenses, the government resorts to deficit financing by borrowing from the public and even by printing more notes.

(vii) Black Assests, Activities and Money: The existence of black money and black assests due to corruption, tax evasion etc., increase the aggregate demand. People spend such money, lavishly. Black marketing and hoarding reduces the supply of goods.

(viii) Repayment of Public Debt: Whenever the government repays its past internal debt to the public, it leads to increase in the money supply with the public.

(ix) Increase in Exports: When exports are encouraged, domestic supply of goods decline. So prices rise.

Question 44 (a).

Explain the role of Commercial Banks in economic development.

Answer:

Role of Commercial Banks in Economic Development of a Country

(i) Capital Formation:

- Banks play an important role in capital formation, which is essential for the economic development of a country.

- They mobilize the small savings of the people scattered over a wide area through their network of branches all over the country and make it available for productive purposes.

(ii) Creation of Credit:

- Banks create credit for the purpose of providing more funds for development projects.

- Credit creation leads to increased production, employment, sales and prices and thereby they bring about faster economic development.

(iii) Channelizing the Funds towards Productive Investment:

- Banks invest the savings mobilized by them for productive purposes.

- Capital formation is not the only function of commercial banks.

(iv) Encouraging Right Type of Industries:

- Many banks help in the development of the right type of industries by extending loan to right type of persons.

- In this way, they help not only for industrialization of the country but also for the economic development of the country.

- They grant loans and advances to manufacturers whose products are in great demand.

(v) Banks Monetize Debt:

- Commercial banks transform the loan to be repaid after a certain period into cash, which can be immediately used for business activities.

- Manufacturers and wholesale traders cannot increase their sales without selling goods on credit basis.

(vi) Finance to Government:

- Government is acting as the promoter of industries in underdeveloped countries for which finance is needed for it.

- Banks provide long-term credit to Government by investing their funds in Government securities and short-term finance by purchasing Treasury Bills.

(vii) Employment Generation:

- After the nationalization of big banks, banking industry has grown to a great extent.

- Bank’s branches are opened frequently, which leads to the creation of new employment opportunities.

(viii) Banks Promote Entrepreneurship:

In recent days, banks have assumed the role of developing entrepreneurship particularly in developing countries like India by inducing new entrepreneurs to take up the well- formulated projects and provision of counseling services like technical and managerial guidance.

![]()

[OR]

(b) State the objectives of Foreign Direct Investment.

Answer:

Objectives of FDI:

FDI has the following objectives.

- Sales Expansion

- Acquisition of resources

- Diversification

- Minimization of competitive risk.

(i) FDI may help to increase the investment level and thereby the income and employment in the host country.

(ii) Direct foreign investment may facilitate transfer of technology to the recipient country.

(iii) FDI may also bring revenue to the government of host country when it taxes profits of foreign firms or gets royalties from concession agreements.

(iv) A part of profit from direct foreign investment may be ploughed back into the expansion, modernization or development of related industries.

(v) It may kindle a managerial revolution in the recipient country through professional management and sophisticated management techniques.

(vi) Foreign capital may enable the country to increase its exports and reduce import requirements. And thereby ease BOP disequilibrium.

(vii) Foreign investment may also help increase competition and break domestic monopolies.

(viii) If FDI adds more value to output in the recipient country than the return on capital from foreign investment, then the social returns are greater than the private returns on foreign investment.

(ix) By bringing capital and foreign exchange FDI may help in filling the savings gap and the foreign exchange gap in order to achieve the goal of national economic development.

(x) Foreign investments may stimulate domestic enterprise to invest in ancillary industries in collaboration with foreign enterprises.

Question 45 (a).

What are the causes for the increase in government expenditure?

Answer:

The modem state is a welfare state. In a welfare state, the government has to perform several functions viz Social, Economic and political. These activities are the cause for increasing public expenditure.

1. Population Growth

During the past 67 years of planning, the population of India has increased from 36.1 crore in 1951, to 121 Crore in 2011. The growth in population requires massive investment in health and education, law and order, etc. Young population requires increasing expenditure on education and youth services, whereas the aging population requires transfer payments like old age pension, social security and health facilities.

2. Defence Expenditure

There has been enormous increase in defence expenditure in India during planning period. The defence expenditure has been increasing tremendously due to modernisation of defence equipment. The defence expenditure of the government was Rs 10,874 crores in 1990-91 which increased significantly to Rs 2,95,511 crores.

3. Government Subsidies .

The Government of India has been providing subsidies on a number of items such as food, fertilizers, interest on priority sector lending, exports, education, etc. Because of the massive amounts of subsidies, the public expenditure has increased manifold..

The expenditure on subsidies by central government in 1990-91 was Rs 9581 crores which increased significantly to Rs 2,29,715.67 crores in 2018-19. Besides this, the corporate sectors also receive subsidies (incentives) of more than Rs 5 lakh crores.

4. Debt Servicing

The Government has been borrowihg heavily both from the internal and external sources. As a result, the government has to make huge amounts of repayment towards debt servicing.

The interest payment of the central government has increased from Rs 21,500 crores in 1990-91 to Rs 5,75,794 crores in 2018-19.

5. Development Projects

The government has been undertaking various development projects such as irrigation, iron and steel, heavy machinery, power, telecommunications, etc. The development projects involve huge investment.

6. Urbanization

There has been an increase in urbanization. In 1950-51 about 17% of the population was urban based. Now the urban population has increased to about 43%. There are more than 54 cities above one million population. The increase in urbanization requires heavy expenditure on law and order, education and civic amenities.

7. Industrialization

Setting up of basic and heavy industries involves a huge capital and long gestation period. It is the government which starts such industries in a planned economy. The under developed countries need a strong of infrastructure like transport, communication, power, fuel, etc….

8. Increase in grants in aid to state and union territories

There has been tremendous increase in grant – in – aid to state and union territories to meed natural disasters.

![]()

[OR]

(b) Describe the types of exchange rates.

Answer:

Exchange rates are also in the form of (a) Nominal exchange rate (b) Real exchange rate (c) Nominal Effective Exchange Rate (NEER) and (d) Real Effective Exchange Rate (REER).

If 1 US Dollar = Rs 75

Nominal exchange rate = 75/1 = 75.

This is the bilateral nominal exchange rate.

Real Exchange Rate = \(\frac{ep_f}{p}\)

P = Price levels in India

P = Price levels in India

e = nominal exchange rate

If a pen costs Rs 50 in India and it costs 5 USD in the US,

Real Exchange Rate = = \(\frac{75×5}{5}\) = 7.5

If real exchange rate is equal to 1, the currencies are at purchasing power parity.

If the price of the pen in US = 0.66 USD, then,

the real exchange rate = = \(\frac{0.66×75}{50}\)

then it could be said that the USD and Indian Rupee are at purchasing power parity.

Question 46 (a).

Explain the Cambridge approach.

(OR)

Cash Balance approach of Marshall equation.

Answer:

Marshall’s Equation

The Marshall equation is expressed as:

M = KPY

Where

M is the quantity of money

Y is the aggregate real income of the community

P is Purchasing Power of money

K represents the fraction of the real income which the public desires to hold in the form of money

Thus, the price level P = M/KY or the value of money in terms of this equation can be found out by dividing the total quantity of goods which the public desires to holdout of the total income by the total supply of money.

According to Marshall’s equation the value of money is influenced not only by change in M, but also by changes in K.

[OR]

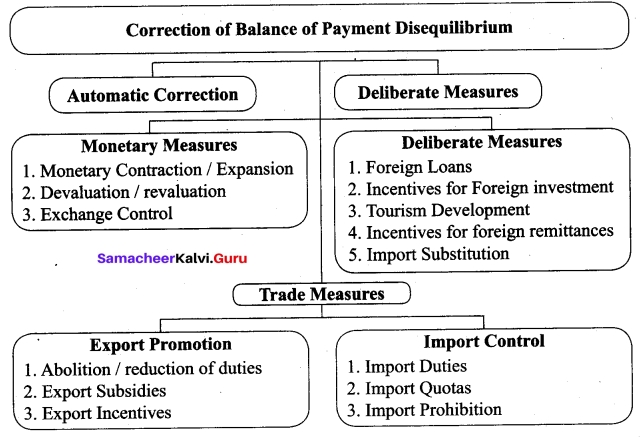

(b) Write the flow chart of correction of balance of payment disequilibrium?

Answer:

Question 47 (a).

Explain the methods of debt redemption.

Answer:

Methods of Redemption of Public Debt:

The process of repaying a public debt is called redemption. The Government sells securities to the public and at the time of maturity, the person who holds the security surrenders it to the Government. The following methods are adopted for debt redemption.

(i) Sinking Fund:

- “Under this method, the Government establishes a separate fund known as “Sinking Fund”.

- The Government credits every year a fixed amount of money to this fund.

- By the time the debt matures, the fund accumulates enough amount to pay off the principal along with interest.

- This method was first introduced in England by Walpol.

(ii) Sinking Fund:

Conversion of loans is another method of redemption of public debt.

- It means that an old loan is converted into a new loan.

- Under this system a high interest public debt is converted into a low interest public debt.

- Dalton felt that debt conversion actually relaxes the debt burden.

(iii) Budgetary Surplus:

- When the Government presents surplus budget, it can be utilised for repaying the debt.

- Surplus occurs when public revenue exceeds the public expenditure.

- However, this method is rarely possible.

(iv) Terminal Annuity:

- In this method, Government pays off the public debt on the basis of terminal annuity in equal annual installments.

- This is the easiest way of paying off the public debt.

(v) Repudiation:

- It is the easiest way for the Government to get rid of the burden of payment of a loan.

- In such cases, the Government does not recognise its obligation to repay the loan.

- It is certainly not paying off a loan but destroying it.

- However, in normal case the Government does not do so; if done it will lose its credibility,

(vi) Reduction in Rate of Interest:

Another method of debt redemption is the compulsory reduction in the rate of interest, during the time of financial crisis.

(vii) Capital Levy:

- When the Government imposes levy on the capital assets owned by an individual or any institution, it is called capital levy.

- This levy is imposed on capital assets above a minimum limit on a progressive scale.

- The fund so collected can be used by the Government for paying off war time debt obligations.

- This is the most controversial method of debt repayment

![]()

[OR]

(b) Differentiate the economic model with econometric model.

Answer:

| S.No. | Economic Model | Econometric Model |

| 1 | Economic model is the theoretical construct that represents the complex economic process. | Econometric model is the statistical concept that represents the numerical estimate of the variables involved in economic process. |

| 2 | Economic model is based on mathematical modeling. | Econometric model is based on statistical modeling. |

| 3 | Economic model is focused on establishing the logical relationships between the variables in the model. | Econometric model is focused on estimating the magnitude and direction of relationship between the variables. |

| 4 | Economic model is applied in stating the theoretical relationship into mathematical equations. | Econometric model is applied in stating the empirical extent of the economic model. |

| 5 | Economic model believes that outcome is certain and exact. So disturbance term is not required. | Econometric modeL Hjelieveg that outcome is certain but not exact. So disturbance term plays the vital role. |

| 6 | Economic model is deterministic in nature. | Econometric model is stochastic in nature. |

| 7 | The Keynesian consumption function: C = a + by is the economic model |

The Keynesian consumption function: C = a + by + μ is the econometric model |